My affinity with Long John Silver continues apace. A colleague tells me during a video conference call that I’m turning not grey, but ginger. And my trusty Holland & Holland baseball cap, extra-large to accommodate my dome, no longer fits thanks to the massive mullet I’m growing.

Receding hairlines are no match for the WuFlu. This bull market in hair, a “supply glut” if ever there was one, cannot be trimmed by any interest or tax cut. The scissors look ever friendlier…

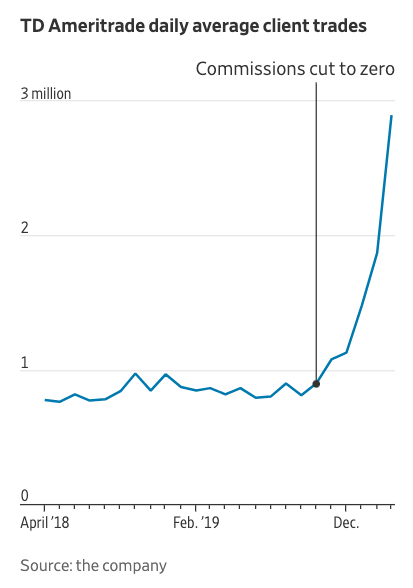

Urban isolation has driven many to distraction – or worse, to the classic vice of many a pirate: gambling. On my recent voyages into Twitter, I was struck by a chart of what happened when investment brokerage TD Ameritrade cut the cost of trading on its platform to zero late last year, right on time for WuFlu to send their clients into a boredom-driven trading frenzy:

Today’s note concerns the most speculative of assets that brings gamblers and investors ever closer together.

I spoke to my father over the phone the other day, who gave me an update on how things are going in Aberdeen. He asked me what I was planning on writing about this week. I said I’d likely be taking a look at bitcoin, as the price had gone nuts recently. Interestingly, he disagreed with me on that last point, saying that he had checked the price recently (I gave him some for his birthday many years ago), and that the price was only £7,000 per coin.

That the bitcoin price had been less than half that not eight weeks ago, didn’t seem to count as “going nuts”, as I had put it. That a >100% price increase in less than two months didn’t pass the “nuts” test goes to show the level of volatility that those casually interested in the space expect from it. In his defence of course, the >100% rally had occurred from the pits of the market crash in March, when virtually all investment assets – and certainly all risky ones – fell dramatically in price.

In this context, bitcoin just bounced from the lows like plenty of risky assets did, and with the usual vigour that accompanies its movements in any direction. And of course, £7k is a hell of a long way from the £15k BTC hit in late 2017.

… or is it?

After all, that’s “only” a >114% increase in price…

This is the quandary we’ll be dancing around over the next couple of days. Can bitcoin actually rally from here? Can it really glow during these gloomy times, and outshine all the flashy internet stocks that have done so well out of the lockdown? Or is it just a hockey puck for jittery investors to kick around now that they’re starved of social interaction, a casino chip which millennials can apply their ADHD to trading all night, lacking any inherent value but the agony and ecstasy that comes with clutching it..?

Is it a gamble, or is it gold?

Don’t expect any solid answers, dear reader. We don’t actually know what’s going to happen. Nobody does. But having watched this particular asset for many years now, we do have some ideas as to what may come next.

And one should bear in mind that while one can dismiss bitcoin as the crutch of the degenerate gambler, degenerate gambling now occupies an increasingly significant aspect of investing thanks to the wonder of negative interest rates.

As macro trader Kevin Muir wrote a while back on the fascinating phenomenon of Investors paying to lend money to the German government for ten years, in the hopes that another investor will buy that loan off them for a higher price (specifically, buying bunds in the anticipation that they shall yield an ever more deeply negative interest rate):

It’s tough for me to even begin to describe the absurdity of this anomaly. It’s like Dumb & Dumber were put in charge of bond pricing. Don’t even get me started on the CNBC-portfolio-managers who this summer somehow advocated buying bunds on the belief that they could go even more negative! Yeah sure, it could happen. But at that point you are no longer a portfolio manager. You are just a degenerate river-boat-gambler. There is zero fundamental argument for locking in negative nominal rates (and even greater negative real rates) for ten years.

This “degenerate river boat gambling” is becoming ever more de rigueur as the phenomenon of negative interest rates spread throughout financial markets. And investors inevitably turn to other means of making returns – the more trapped they are, the more imaginative they become. And that’s where assets like bitcoin start looking like gambles that aren’t all that bad compared to everything else.

Thankfully, here at Southbank Investment Research we have a fund manager who treats bitcoin as anything but a gamble – in fact he treats valuing it almost as a science. While the bitcoin space has schizophrenically floundered up and down over the last couple of years, Charlie Morris over at The Fleet Street Letter Wealth Builder has bided his time before he told his readers it was time to buy BTC.

He was waiting for the right signs of life, the “vitals” within the bitcoin payment network itself, before he struck. And when he did finally say “buy” it was a remarkably bold move – for he did it right in the middle of the March crash, when the stockmarket was in the midst of its fastest crash in history.

Here’s when Charlie sent out his alert to his subscribers:

And here’s a snippet of what he said at the time, back on 20 March:

It should come as no surprise that bitcoin has been caught in the storm. Being a virtual asset, many believed bitcoin should be detached from the real world, and perhaps they are right to think so. But you can’t escape that bitcoin’s owners come from the real world, and therein lies the link. If they start to panic about asset prices, they sell everything, as we have seen…

What is apparent is the $20,000 test in 2017 was a bubble. The cooling off phase is behind us and it’s onwards and upwards.

Just as the internet will come out of this episode stronger, so will bitcoin. More people will question the financial system and look for alternatives. The bitcoin ecosystem will continue to grow, and new applications will thrive. An asset that can withstand a shock of this magnitude will emerge with more respect and credibility.

Bitcoin used to have 90% corrections: much worse than general asset prices. In those days, it was regarded as a rarely used asset, that was highly speculative but with potential. Whenever the music stopped, liquidity dried up and the price collapsed. Things have changed. As we have just seen, the corrections are much smaller than they were, the market remains liquid and its value is underpinned by a vibrant network…

I won’t say what Charlie has advised his subscribers since then… but we’ll be taking a closer look “under the hood” at his methods of analysing bitcoin tomorrow – that, and the 50% supply shock that’s due in a week’s time…

Until then,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Uncategorised