Why invest in Bitcoin?

Everyone has heard about Bitcoin by now, if only in passing reference. But is it worth your attention?

Is the cryptocurrency another high-tech rabbit hole too deep to bother with?

Is Bitcoin an investment worth even considering, let alone ploughing some hard earned money into it?

How can you do so safely and conveniently?

What is the fair value of a Bitcoin?

It’s time to get some answers.

Unfortunately, it takes time to understand Bitcoin. If you want to really know Bitcoin you’ll have to trawl through opinions and information that seems designed to confuse and contradict.

The thing is, you don’t need to know Bitcoin back to front to benefit from it. It’s not like you know how Visa or Mastercard processes your transactions now.

A basic understanding is enough to illuminate the power of Bitcoin and how you can benefit from it.

Whether you’re an investor or want to embrace the power of Bitcoin by becoming a user, Bitcoin should play a role in your life.

What is Bitcoin?

Bitcoin is different things to different people.

Its strongest supporters argue amongst each other just as much as with detractors. Because there is nothing similar to Bitcoin, it’s so hard to explain.

Bitcoin itself isn’t the key to understanding what Bitcoin is really about. To really understand the pound you need to understand the financial system that makes it our currency.

But let’s take a first step into explaining Bitcoin just enough so you can see how you might benefit from it.

Bitcoin is an electronic currency. Just as every bank note has a serial number on it, so does every Bitcoin. It’s just that the serial number isn’t written on a banknote.

It’s just electronic. You could write down the Bitcoin’s identifier on a piece of paper if you wanted though.

You can transfer Bitcoin to anyone with a Bitcoin wallet, buy wine in Chamonix, pay for bedsheets in Australia and do many other things with it. But there are several key differences to other currencies, especially when you use them electronically.

Decentralisation: No government is in control of Bitcoin

There is no entity that can make decisions about how many Bitcoins are created.

There is no intermediary needed to move Bitcoins from one person to another. As Bitcoin’s founder put it, Bitcoin is a Peer to Peer currency for electronic transactions without needing to rely on trust.

Many of these characteristics make Bitcoin comparable with gold. In the past, gold was used for the same types of reasons as Bitcoin. But Bitcoin has several advantages and disadvantages compared to gold.

Bitcoin uses technological and mathematical solutions of various types to overcome the problems other currencies have, instead of relying on tens of thousands of back office bank employees, police forces, courts, economists, central bankers and accountants to get the job done.

For example, the speed at which new Bitcoins are created is a mathematical equation. Bitcoins are created, or mined, by solving an extremely difficult mathematical puzzle.

You need lots of computing power to solve the equation, just as Alan Turing needed a lot of computing power to crack the German Enigma code to win World War 2. So he invented the computer to do it.

Whoever solves the equation gets the new Bitcoins.

If the equation is being solved too often too quickly, it automatically becomes more difficult. By doing this automatically, the number of Bitcoins increases at the predictable rate predetermined by the creators of Bitcoin. But the total number is capped and we’ll reach the cap eventually.

This system can’t be altered, unless by a consensus of more than 51% of the owners of Bitcoin.

Another way Bitcoin uses maths is to solve the problem of security and identification. Bitcoin is a cryptocurrency because it uses cryptography to make its user anonymous and their transactions secure.

Bitcoin’s genius is Blockchain Technology

There is one more concept you need to understand a little to understand Bitcoin’s benefits and potential. Blockchain technology is what makes Bitcoin so powerful and new.

Instead of having a place to keep the record of who owns which Bitcoin, just as we have the bank’s accounts for money and Her Majesty’s Land Registry Office for property, Bitcoin maintains a record of every transaction ever in a blockchain.

Think of it as a ledger. Each time a transaction occurs, it’s added to the end of the blockchain. That blockchain is kept on every Bitcoin using computer, not in one single place, where it would be at risk.

A new block is only accepted onto the blockchain if it’s in accordance with at least 51% of the other records. So you can’t sell a Bitcoin you don’t have because it would conflict with the existing blockchain’s record.

That’s why Bitcoin is so safe.

You’d have to control 51% of the Bitcoin network to falsify a transaction. Otherwise your dodgy block would simply be ignored by the blockchain. The true owner of the Bitcoin would be unaffected.

Because of the blockchain technology, there is no intermediary or arbitrator over Bitcoin. There is no human error, government risk or cost to a Bitcoin transaction.

The History of Bitcoin

Nobody knows who created Bitcoin.

His pseudonym is Satoshi Nakamoto. He might be more than one person. He might be dead. There are many theories and false usurpers. But the fact that it doesn’t really matter is indicative of Bitcoin’s independence from any authority or group.

At first Bitcoin was a geeky academic project. Some students had thousands of them on their laptops, which would now be worth more than a million dollars. Today it’s an incredibly powerful currency used by arms dealers and café patrons alike.

In 2008 Satoshi Nakamoto submitted his academic article suggesting the Bitcoin and blockchain system. In 2009 the network began operating and someone paid 10,000 Bitcoin for two Pizzas, including delivery.

Bitcoin then came into the spotlight because it’s resistant to government control and can be used anonymously. Wikileaks asked for donations in Bitcoin and drug dealers were able to use Bitcoin to sell drugs over the internet. But some more credible organisations now accept Bitcoin, including the Swiss railways.

Still, Bitcoin’s use is mostly in countries where people are trying to avoid government crackdowns. In Venezuela people use Bitcoin to buy basic necessities which are then smuggled into the country. Most transactions are in China, where the government restricts many international transfers. I met an Australian intelligence agent who had been shot in the knee by an AK-47 bought with Bitcoin.

Does Bitcoin and Blockchain technology live up to its promises?

There is a huge furore about whether Bitcoin can actually live up to the many promises it makes. For example, one key feature of Bitcoin is that you don’t need an intermediary to make a transaction. Transferring other currencies requires your banks and Visa or Mastercard to all be up and running. No intermediary means less cost and more security for Bitcoin.

But practically speaking, almost everyone uses Bitcoin intermediaries to make life easier. And one of those already went bust in a big scandal that cost users a lot of money. Bitcoin is still quite new, so who knows what flaws might be lurking in the computer codes.

What is the value of Bitcoin?

The supply of Bitcoin is known because it’s mathematically determined and self-correcting whenever the equation becomes too difficult or easy for Bitcoin miners to solve. It’s the demand that’s the key.

The more currency chaos there is in the world, the more governments crack down on international transactions and your right to buy goods and services, the more Bitcoin will be needed. That means Bitcoin is a bet on the instability of the world. Remember, the price is global, so the instability can surge anywhere and Bitcoin benefits.

On the other hand, if drugs continue to be legalised and governments don’t do anything stupid, the Bitcoin price could lag.

Even if you’re not an investor into Bitcoin, you may reap enormous rewards from it. Banks can adopt Bitcoin’s blockchain technology to make normal pound transactions just as fast and secure.

This means a huge improvement in your quality of life. Transactions would be instant and safe. The fees involved could disappear. Banks would suddenly no longer need hundreds of thousands of employees, freeing up workers to produce something else and allowing banks to pass on these savings to customers and investors.

How to invest in Bitcoin

The obvious easy way to invest in Bitcoin is to get a Bitcoin wallet, sign up to a Bitcoin exchange, transfer your money in and then buy Bitcoin.

It’s the next step that was the downfall of Bitcoin investors who used the Mount Gox exchange. If you keep your Bitcoins in an exchange’s accounts, you are relying on the exchange to be run properly.

If you transfer the Bitcoins out of the exchange and into your wallet on your computer or USB drive, it is far safer.

A few Bitcoin ETF are in the works in the US, but there are many bumps in the road. Keep in mind that investing in a Bitcoin ETF is contradictory. If you’re making a bet on financial instability, but relying on the financial stability of the financial sector, you could be caught out.

Should I Invest in Bitcoin?

Like all innovations, Bitcoin was dragged into the investment world.

It turned curious university students into multi-millionaires by surprise. It ruined investors caught up in the craze when the price crashed on many occasions. There’s no question Bitcoin regularly goes from being doomed to re-emerging as a fad again.

The price is spectacularly volatile. That means it’s a great trading opportunity. Buy when it has crashed and sell when it recovers.

For longer term investors, Bitcoin’s future is uncertain. The number of Bitcoins is capped, so it is scarce. While central banks around the world print money like madmen, Bitcoin increases steadily, slowly and predictably.

But there’s a far more important reason to believe in Bitcoin: more and more people believe in it.

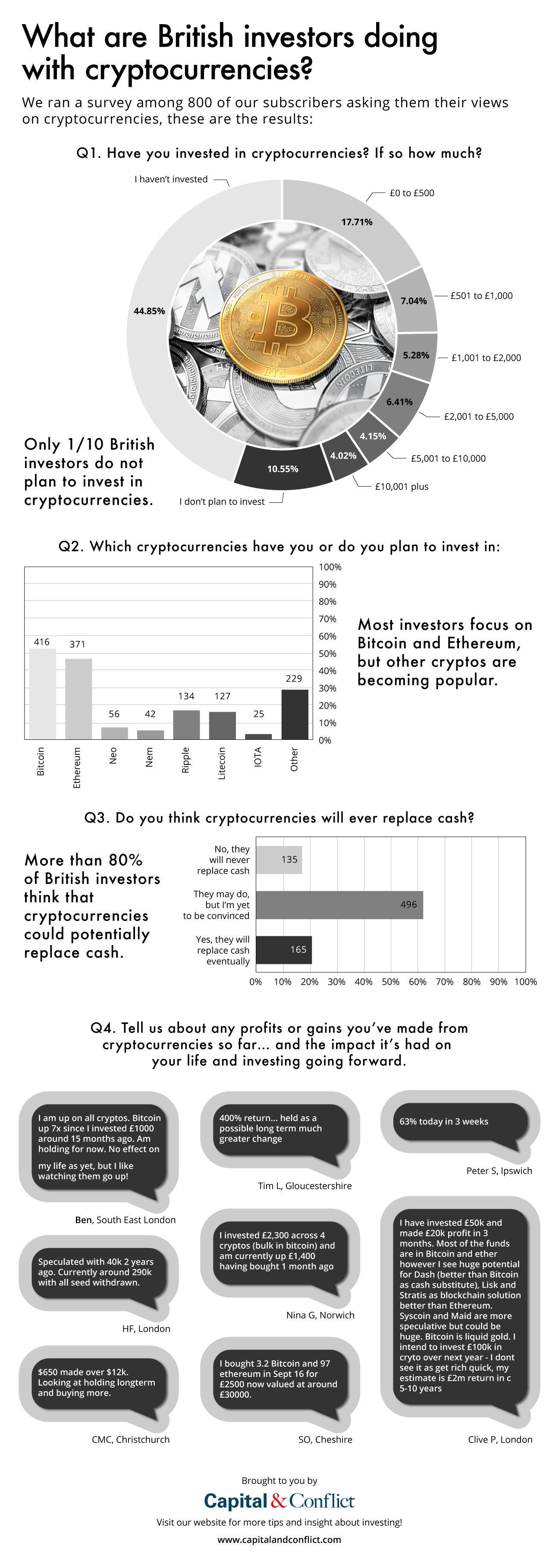

To find out what are British investors doing with bitcoin, we ran a massive survey amongst 800 of our subscribers, the results are astonishing:

Get started with Bitcoin

So what’s the step by step process to getting started with Bitcoin?

Well, below you have a quick summary, but if you want further information, visit this link to see our Beginner’s Guide to Investing in Cryptos.

Forget mining them – these days it takes industrial quantities of computing power to do this. Let’s instead look at how to buy them.

- The first thing you need to do is get a wallet. Your wallet is a bit like your email address – it’s where you keep your Bitcoins. Go to coinbase.com, or blockchain.info, type in your email address and a password, and you’ll have a wallet. You’ll then be given a wallet address. Make a note of it.

- Go to bittylicious.com. Paste your wallet address where it says “bitcoin address”, then deposit some money – say £20 – either via debit card or bank transfer. Get a friend to do the same.

- Once you and your friend are set up, practise sending each other small amounts of money.

- Go to a trendy café in Shoreditch or somewhere that accepts Bitcoins, and buy yourself a cup of coffee and a croissant as your reward. Congratulations. You’re part of the financial revolution.

Another buying option is available through localbitcoins.com. You can even buy them in cash this way. In some cases, the vendor might come to you and probably even help you to get set up.

Many bitcoiners are happy to help the uninitiated where they can. As explained, the more it’s used, the more valuable it becomes. So don’t forget to share the knowledge you’ve gained from this introduction to Bitcoin.

But be careful. One of the biggest advantages of cryptocurrencies like Bitcoin is their relative anonymity. Don’t publish your Bitcoin wallet’s address in connection with anything that could identify you personally.

Who know what governments will ban in the future?

|

“How you could make your first million buying and holding cryptocurrencies!” Claim your copy of this new book by crypto expert Sam Volkering now. Find out:

Click here now and claim your copy! Capital at risk. Forecasts are not a reliable indicator of future results. A regulated product issued by Southbank Investment Research Ltd. |