Happy new year!

Hang on. It’s a little late for all that isn’t it? The celebrations are over, the resolutions have been made and broken and remade again. In fact we’re 19 days into 2016. So how is this the first time I’ve written to you this year?

The simple answer – and for this I must apologise – is that I’ve been busy beavering away on my new project. It’s something that I think you’ll be interested in, purely because it’s unlike anything else we do here. It’s certainly almost the exact opposite of what we do here at C&C.

I’ll tell you a little bit more about it in just a second. But first, I have a challenge for you…

The financial singularity is here

Your goal is to make $1bn. And you have to do it as quickly as you possibly can. The winner is whoever can come up with a good enough idea, build a company and infrastructure around it and grow that company to a $1bn market cap in the shortest possible time.

Just a word of warning: if you’re going to come out on top, you’re going to have to beat some of the world’s most innovative and inventive tech entrepreneurs.

That’s what today’s piece is all about. Speed. Specifically, the breathtaking speed of change in the technology industry, as reflected by the period of time it’s taking businesses to go from inception to a $1bn market cap. It’s one of the most important financial trends in the tech world today.

Today, I’m going to show you a) why that is, b) why it matters to us as investors, and then c) make a prediction about where all this is going.

Let’s dive straight in.

First off, it’s worth pointing out that for any company, growing from zero to $1bn is an epically tough task. If you’ve ever started your own company you’ll know this already. Most companies never manage it. Most never even get close. When you’re at zero, growing to ten or even a hundred million valuation feels like a lifetime of work.

So making it to a billion is a distant goal. It’s a dream. It’s like boarding a flight to Paris and hoping you’ll end up in Neverland.

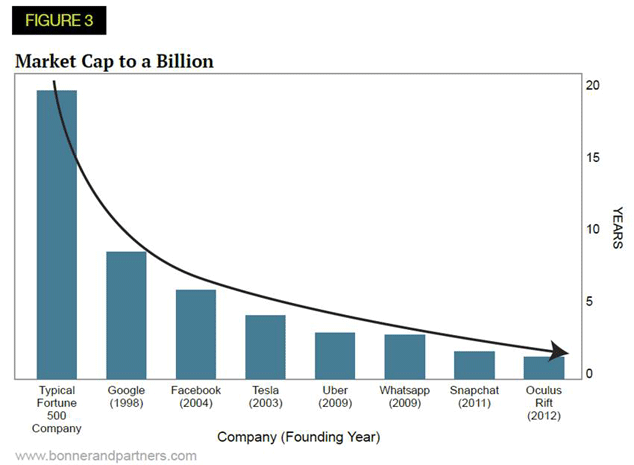

So for those companies that do manage it… it takes a long time. My colleagues at Bonner and Partners did some research into this subject. They found that the typical Fortune 500 company takes just under 20 years to reach $1bn. I’d say that’s pretty good going.

But one thing that’s certainly always been true of tech companies – and in particular, software companies who don’t have to manufacture tonnes of hardware and other expensive stuff – is that they grow much quicker than “typical” companies. A company like Google took less than ten years to reach $1bn. Facebook took just over five.

But here’s the thing: tech companies might grow faster than typical companies. That’s obvious. But the interesting thing is… this trend is accelerating over time.

More and more companies are shooting from zero to $1bn at an ever faster rate. This chart tells the story:

There are several important financial implications to this. We’ll get to them in a second. But first, let’s answer the important question. Why is this happening? What force is powering this sort of rapid growth?

I sat down and spoke to journalist and author Robert Colvile about this topic a couple of weeks ago. Robert’s written a book called The Great Acceleration. The book isn’t published until this April, so I won’t give too much away now (I recorded our chat and I’ll be putting it out as a podcast next week, by the way). But at its core, the book is about how lots of different aspects of life are speeding up – from the speed a news story breaks online to the speed companies grow. It’s all speeding up.

Two examples to demonstrate my point. One from the past, and one from the present. Both have huge benefits and major risks attached – the road to developing nuclear weapons, and the quest to develop artificial intelligence (AI).

Developing nuclear weapons – which obviously happened before the internet was around – involved small numbers of people working in secret at disparate jobs. Many people involved didn’t even know they were helping develop nuclear weapons. The whole process happened away from the public eye. It was a top secret project. As such, the number of connected activities or ancillary technologies that could spin out of it were restricted.

Now take the quest to develop AI.

You may well have heard of the Open AI project, announced at the end of last year. It involved many top tech companies pledging $1bn in research funding over the next ten years. But the really interesting thing is, it’s an open source project. Huge numbers of people all over the globe can take part. The computer programmer in Tokyo and the developer in Paris can work together, almost as if they were in the same room.

Multiply those connections a thousand times in hundreds of different cities all over the world over the next ten years and the number of new innovations will be staggering. The speed of innovation, and the speed new ideas are spread, is exponentially faster than it was even 20 years ago.

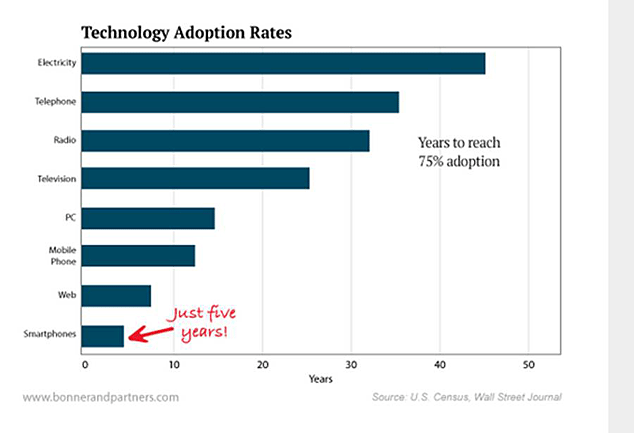

The acceleration of new ideas and innovations also shows up in something called the “adoption rate” of new technologies. That means the speed a new piece of technology takes to go from inception to widespread us. Again, this chart tells the story:

It’s the same idea again. The rate at which new technology is spreading around the world is accelerating.

When you boil it down, this is all just an extension of an idea Ray Kurzweil came up with over a decade ago. It’s called the Law of Accelerating Returns. It’s based on the idea of exponential growth, and the way it warps our perception of what’s happening.

In simple terms it means that the pace of change in the world is growing so quickly that we’re able to pack previous centuries’ worth of innovation into a very short period of time. As Kurzweil explains it:

The paradigm shift rate (ie, the overall rate of technical progress) is currently doubling (approximately) every decade; that is, paradigm shift times are halving every decade (and the rate of acceleration is itself growing exponentially).

So, the technological progress in the 21st century will be equivalent to what would require (in the linear view) on the order of 200 centuries. In contrast, the 20th century saw only about 25 years of progress (again at today’s rate of progress) since we have been speeding up to current rates.

So the 21st century will see almost a thousand times greater technological change than its predecessor.

Or to put it another way, the world of today isn’t just faster than the world of yesterday. The world of tomorrow will be many times faster than the world of today.

That’s what’s driving the accelerating pace of change.

And of course, if you’re a software company and your product is a load of computer code and an app, flourishing in this environment is even easier. That’s why a large percentage of the companies shooting to $1bn status are software businesses.

Take Square, for instance. It was founded by Twitter cofounder Jack Dorsey. Essentially it’s a piece of kit that enables businesses to accept mobile payments (so it’s mostly software with a little bit of new hardware mixed in there). It took 2.93 years to reach a $1bn market cap.

Or take Didi Kuadi. It’s known as the “Uber of China”. It took under two and a half years to hit the $1bn mark.

I could go on, but I’d just be repeating myself and substituting different company names in. I’ll spare you that.

So why does all this matter to us as investors?

Because growth matters. It drives investment returns. And there’s a direct correlation between the speed a company is growing at and the kind of returns you can expect to make on your money.

At least, that’s what a report published last year by McKinsey and Company found. It studied the growth rates of 3,000 tech, online and software companies between 1982 and 2012. Here’s what it learnt (emphasis mine):

Growth trumps all. Three pieces of evidence attest to the paramount important of growth.

First, growth yields greater returns. High-growth companies offer a return to shareholders five times greater than medium-growth companies.

Second, growth predicts long-term success. “Super growers”— companies whose growth was greater than 60 percent when they reached $100 million in revenues—were eight times more likely to reach $1 billion in revenues than those growing less than 20 percent.

Additionally, growth matters more than margin or cost structure. Increases in revenue growth rates drive twice as much market-capitalization gain as margin improvements for companies with less than $4 billion in revenues. Further, we observed no correlation between cost structure and growth rates.

Like I said, growth matters.

It matters to the companies themselves. And it matters to the investors who want to see a high return on their capital. The fact that high-growth companies return five times more than medium-growth companies cannot be ignored.

And on top of that, the study found that a high growth rate was actually predictive of success in the future. Back to the report: “Perhaps even more important, our research revealed that higher growth rates portend sustained success. In fact, super growers were eight times more likely than stallers to grow from $100 million to $1 billion and three times more likely to do so than growers.”

Where does this leave us?

Well, we know three things: the world is speeding up; tech companies are riding this wave to grow faster than ever before; and high growth correlates with return on capital.

Follow this trend to its logical conclusion and not only do you see a world where social, technological and medical advancements sweep the planet at a rate that will shock people… it’ll also be possible to make more money, more quickly, than at any other point in investment history.

Here’s my prediction. It’s a two for the price of one situation. I think very soon, we’ll either see companies going from zero to $1bn even more quickly – say, within a financial quarter. Or the entire paradigm will shift up a gear and we’ll see firms hitting five or ten billion in the same time today’s firms take to hit £1bn.

Perhaps both will come true.

So, how is this relevant to you today?

That part, at least, is simple. I’ve spent the last six months researching and investigating stories exactly like this. Not just what’s happening, but how you can make money from it. And I’ll be writing about it, every single day, in my new e-letter, Exponential Investor.

In these daily letters, we’re going to be showing you just how close the world is to an epoch of absolutely astonishing change and progress. Some of what we share with you will seem unbelievable. For instance, the idea that we could access unlimited sources of new energy, add decades of good life to the average lifespan, create super-intelligent beings and develop new ways of sharing the fruits of these innovations with the entire world may seem crazy right now.

Over the course of the coming weeks and months, we’re going to be taking a look at some of the biggest, and potentially most profitable, technological innovations around right now. I’ll also be introducing you to a handful of extremely knowledgeable experts from all over the world.

Specifically, if you’re interested in learning more about – and investing in – solar and battery technology, innovative medical and biotech firms, the blockchain or machine learning, then sign up right away. You won’t be disappointed.

Oh – and there’s one other theme we’ll be covering in detail – the London tech start-up scheme. You’ll hear from some of the most interesting entrepreneurs on the scene on the regular basis. We’ll also show you how to go about investing in some of them (through crowdfunding platforms, mostly).

The financial singularity is coming.

The first place you’ll hear about it is in Exponential Investor.

Category: Investing in Technology