Sterling had quite a day yesterday.

At 9:30am, it gapped up by $0.02 – about 1.5% – against the dollar, jumping from $1.52 to $1.54. Remember we are talking currencies, so 1.5% is no small matter.

The move came on the back of yesterday’s better-than-feared GDP figure, which showed that Britain’s economy grew by 0.3% in the first quarter.

It’s quite a change from the overwhelmingly bearish sentiment we saw two months ago.

So what’s next for sterling?

Nature hates a vacuum – and so do the forex markets

In late February Britain had just been downgraded by credit rating agency Moody’s.

The Bank of England’s inflation report was awful, its outlook for GDP growth was pessimistic, the appointment of Mark Carney pointed to yet more loose monetary policy ahead and sterling had been falling heavily against the US dollar since the beginning of the year.

The financial media was, unsurprisingly, heavy with anti-sterling sentiment.

Since early- to mid-March, however, the pound has enjoyed a rally, bouncing from a low against the US dollar of about $1.48 to $1.54 about a fortnight ago. It is re-testing that $1.54 level now.

The bears have been hushed. Not only has price reversed, but so has sentiment. So what’s next for the pound? Is it yet time to look at going short again? Or can we expect more of a bounce?

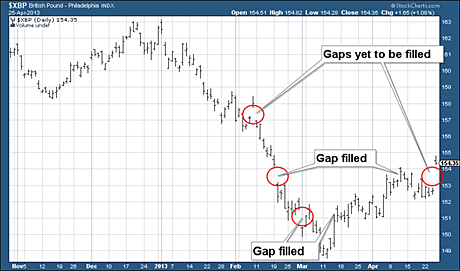

Let’s take a look at the charts. ‘Nature abhors a vacuum’ – horror vacui – is the old saying (attributed to Aristotle).

Many believe markets are no different. When a market ‘leaves a gap’ – when it suddenly trades at a price significantly higher or lower than its previous price – sooner or later that gap will get ‘filled’. In other words, the price will move back into the area where the gap was left.

Like everything to do with markets, you have to take this idea with a pinch of salt. Waiting for a market to ‘fill the gap’ can mean you miss out on large moves or trends. But that said, it’s amazing how often markets – be they currencies, commodities, stock indices or individual companies – do ‘back and fill’.

In late February, with sterling at $1.51, and bearish sentiment in full flow, I noted that sterling had left a gap between $1.54 and $1.53 – and that at some stage it would probably back and fill.

A few days later it gapped down another cent from $1.515 to $1.505. Both those gaps have now been filled.

Sterling left another gap yesterday between $1.52 and $1.54. So that becomes one target on the downside. But it has also left a gap much higher up at $1.57-$1.58. That is another target.

The chart below shows ‘cable’ (sterling vs US dollar) over the last six months, I have circled the gaps which have been left, as well as noting those that have been filled.

The next chart below, shows the three-year range that the pound has been trading in versus the dollar. The red band marks the upper end of the range – resistance – in the $1.63-$1.64 area. (It broke briefly above in the first half of 2011).

The amber band – from about $1.52 to $1.54 – marks the area that was acting as support. You can see that it held through six tests. On the seventh it failed, support was broken – and that first gap was left (I’ve marked it with the first red circle).

It fell to just below $1.49 by early- to mid-March. That amber line of support might have been expected to become resistance, but we have now broken back through.

A temporary reprieve for the pound?

That means that for now the trend is up. If you’re a short-term trader, I would expect that gap at $1.52 to be filled fairly soon (so the pound would have to fall). So for day traders, that could be a target.

But in the slightly longer term, I can see us moving higher to the $1.57-$1.58 area to close that other gap, although there is quite a bit of resistance at $1.55.

We might even make it to the old resistance at $1.63 on this run if it continues for a few months. But I’m not convinced.

In the longer run, I’m bearish on sterling. And my longer-term target remains about $1.40 – the green area in this long-term chart below.

At present I’m detecting a feeling of general dissatisfaction with politicians, be they left or right wing. Of course, it’s apparent across Europe, but it’s very clear in the UK.

Many are frustrated with the coalition government for all sorts of different reasons. The cuts are too fierce, or the cuts aren’t fierce enough. The LibDems have betrayed their election promises. David Cameron is too soft on Europe, he’s a social democrat in Tory clothing. And so on.

But neither Ed Milliband nor the Labour party are getting the correspondingly high approval ratings you might expect in opposition to a government that is so unpopular.

If there’s one thing a currency doesn’t like, it’s political instability. We have the local elections coming up shortly. In the days following the drama of the Eastleigh by-election the pound went from $1.50 almost to $1.52 then to $1.48.

If, as I expect, voters express their discontent and we get some surprise results in the local elections, we might see yet more tension and friction in Westminster. That might be the spark sterling needs to get its downward slide going once again.

Category: Market updates