I was wrong.

Bitcoin did not hit $10,000 by midnight on Friday.

I was too bullish by 40 minutes: BTC reclaimed the $10k territory at twenty to one on Saturday morning.

But once it hit the $10k handle, it was off to the races – riding a rollercoaster to $11k, before retreating back to $10,800 where it stands at the time of writing.

If you’ve been reading Capital & Conflict in recent days, you’ll know what I think is behind the current boom. In my view, the recent surges are a product of wealthy Chinese using BTC as a vehicle to smuggle their wealth out of the country.

This will be bolstered (if it hasn’t already) by the prospect of further interest rate cuts and asset purchases by global central banks. This will force investors to venture ever further into the risky markets – like crypto – into which they can now invest thanks to increased custodial infrastructure.

In short: China lights a fire under the crypto market, and the Federal Reserve turns it into a raging inferno.

But there is another somewhat conspiratorial theory as to why bitcoin is booming. Some claim the crypto market is being pumped higher by a central bank printing money to buy BTC. But this is not a central bank you’ll likely have heard of.

The Tetheral Reserve

Long-time readers of this letter may recall a cryptocurrency by the name of Tether, which featured in this letter in late 2017.

Tether is a cryptocurrency, but is designed as a US dollar derivative, with a value pegged to the dollar. 1 US dollar should always equal 1 Tether, or USDT (it also provides euro and yen Tethers), and you can purchase such Tethers directly from them via its website.

The group behind Tether claims that every single Tether it’s created is backed by dollars or other assets of the same value. From its website:

Every tether is always 100% backed by our reserves, which include traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities (collectively, “reserves”). Every tether is also 1-to-1 pegged to the dollar, so 1 USD₮ is always valued by Tether at 1 USD.

As Tether is a cryptocurrency it is not regulated by the US banking system, even though it aims to mimic the dollar as closely as it can. This means that crypto exchanges not wanting to comply with US banking regulations can just accept Tethers instead of dollars and not bother with any of it.

USDTs are traded and valued just like dollars, and few people redeem them for the real thing – there are substantial fees and they’ll only do $100,000 at a time.

This belief that 1USDT=1USD raises some troubling questions, as the those in charge are notoriously shady when it comes to proving that every Tether is “100% backed” as they claim.

If everybody believes a Tether is worth a dollar and will accept it as such… the “Tetheral Reserve” could embark on its very own quantitative easing programme, printing Tethers to buy bitcoin, bidding up its price, and lifting the market as a whole. As one crypto enthusiast jests on Twitter: “Central Banks refused to buy Bitcoin, so we did it ourselves.”

The last time I wrote about Tether – December 2017 – there were 814 million USDTs in circulation. Today, that figure now stands at an incredible £3.5 billion.

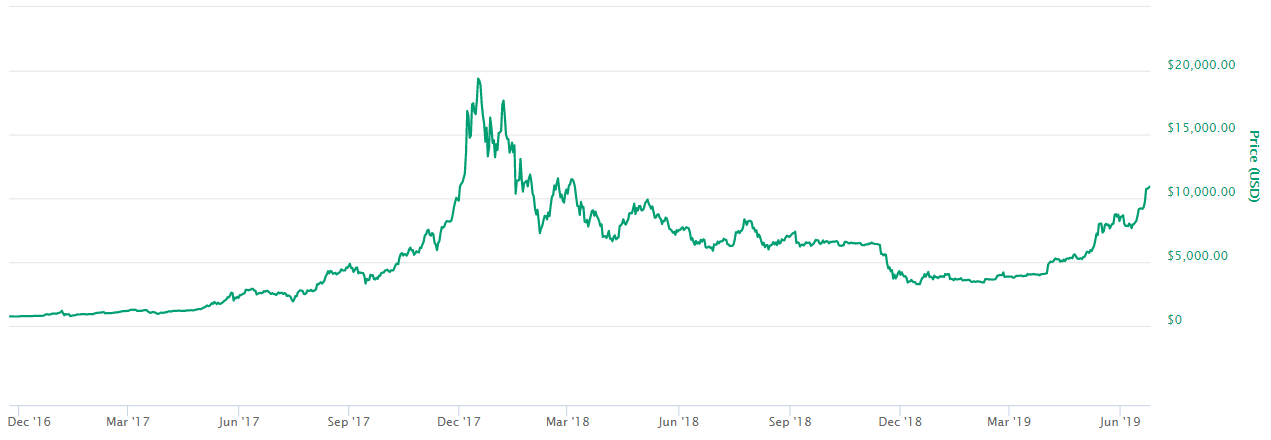

And as you can see, a rising number of Tethers correlates closely with the bitcoin price, especially over the last few months:

Tethers in circulation (top, blue) and the bitcoin price (bottom, green). Source: CoinMarketCap

Tethers in circulation (top, blue) and the bitcoin price (bottom, green). Source: CoinMarketCap

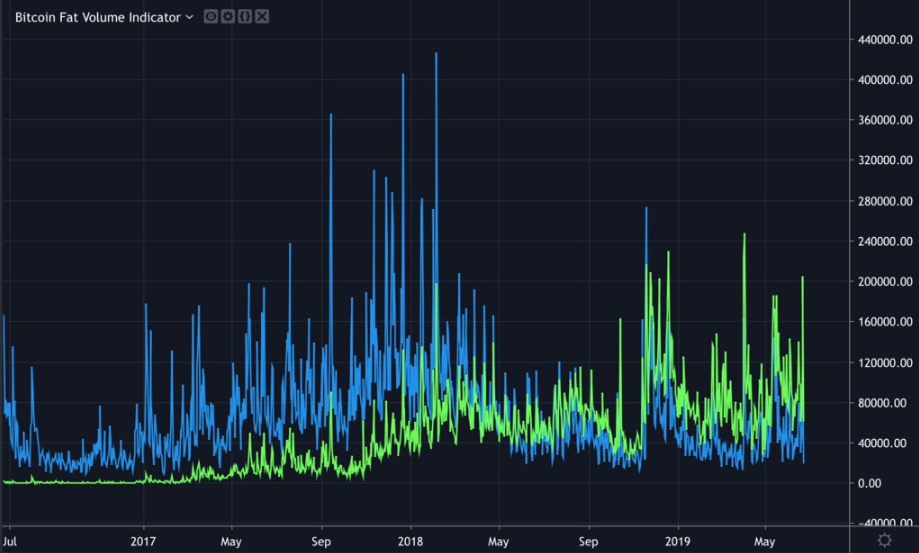

Furthermore, USDT has now overtaken USD in bitcoin trading volume – traders are buying and selling more BTC in Tether than they are in real dollars. As you can see below, since the beginning of this year, Tether now dominates BTC trading volume:

Bitcoin volume in USD (blue) compared to bitcoin volume in Tether (green)

Bitcoin volume in USD (blue) compared to bitcoin volume in Tether (green)

Source: Silver Watchdog, on Twitter

Some claim that due to Tether’s dominance, bitcoin is no longer really being priced in dollars, but in Tethers. And as the true value of a Tether could be much lower (if it’s been running the printing press without real dollar backing), the market value for a bitcoin in real dollars may actually be much lower.

If this is the case, this sudden crypto rally could all be one massive fraud, a sword of Damocles hanging above the entire market. Now, I’ve no doubt that the Tetheral Reserve has plenty to hide, like many other shady characters lurking in this Wild West of a market. But I’m not entirely sold on the idea that it’s just thin air behind all these new Tethers. I expect all the new cash that’s poured into Tether is from the wealthy Chinese folks trying to get their cash into bitcoin, and heaven knows where else afterwards.

Such individuals of course do not want to be identified or linked to the funds in any way, which could explain both the sudden printing of Tethers this year (as Cold War II ramps up), and Tether’s opaque accounting practices.

I’m maintaining my thesis on BTC for the time being, but those that ignore the risk of a Tether unravelling – though it has lingered for years – do so at their peril.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates