It’s time to appreciate the sunset as this year draws to a close, and reflect on what 2018 really meant for financial markets. What’s past is prologue; let’s see what we can arm ourselves with from the last 12 months as we approach 2019.

To my mind, markets this year were moulded by the events that occurred in early February, when something snapped. The tranquillity that had surrounded risky assets was abruptly shattered by a financial explosion that sent ripples far and wide across both assets and countries. There was plenty of collateral damage, which we’ll examine in a second.

Crucially, the heat of the blast revealed (for just a moment) that a failsafe mechanism which investors have relied upon for decades is not functioning properly, and cannot be relied upon in a crisis. When you consider that investors have used this failsafe to justify taking more risk, and entire investing careers have taken place where this failsafe worked time and again, the repercussions are huge.

Ground zero

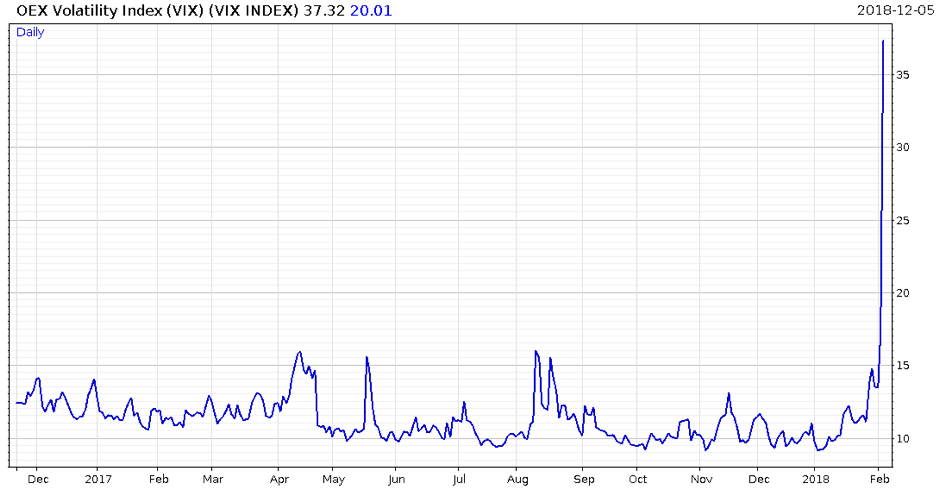

Back to the scene of the crime. It began with the VIX index, an esoteric measure of investor sentiment. It illustrates the cost of options on the S&P 500, or more simply how expensive it is to insure against a move up or down in US stocks.

Because stock prices had just kept smoothly going up, it had become very profitable to sell insurance against a downward movement in stocks, as nobody ever claimed on it. More and more people joined in, making the insurance cheaper, and the VIX went down. In pursuit of higher returns, investors then bet that the VIX itself would go down, by selling VIX futures, or buying an investment product that sold them for you.

Then this happened:

So many people were betting on the VIX staying low that it only required a small upward movement in the VIX to create a short squeeze, as everybody selling insurance switched to buying it.

This created a selloff in stocks, as the VIX was signalling extreme fear in the stockmarket (skyrocketing insurance prices).

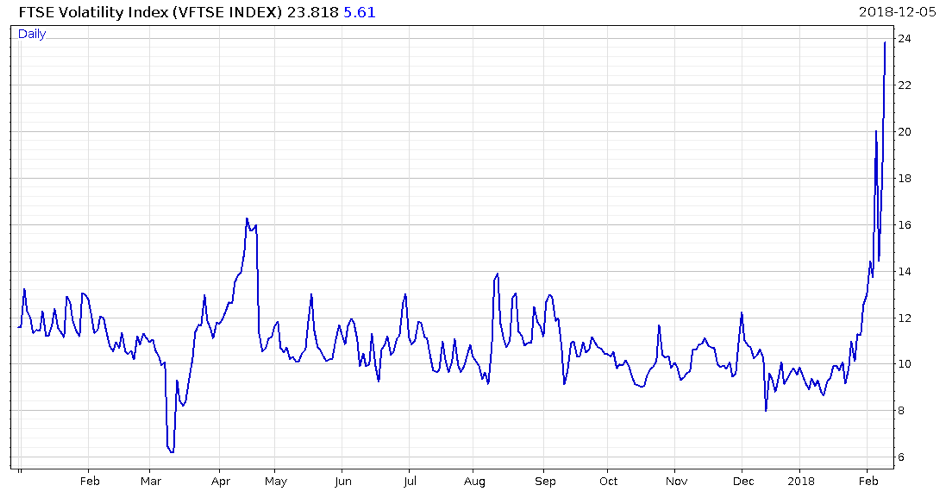

You may wonder why we focus on the US so much when we’re a UK-based research group. To illustrate just how interconnected financial markets are, take a look at the ripples this sudden explosion in American volatility created here at home…

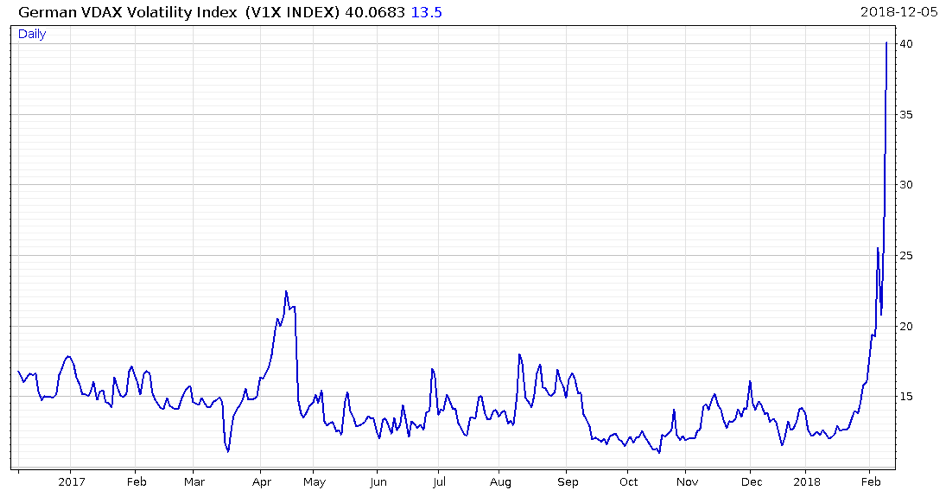

It sparked a volatility explosion in Germany, too…

And in Japan…

And in Hong Kong…

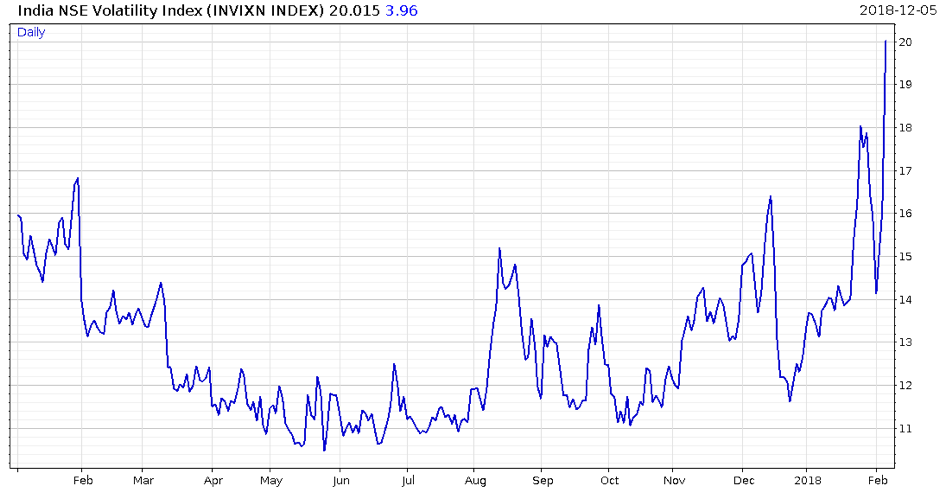

And India, too:

But as stocks sold off in the flash crash, bonds sold off too. Investors rely on bonds, specifically government bonds, to be a safe haven in a crash, but this time they weren’t.

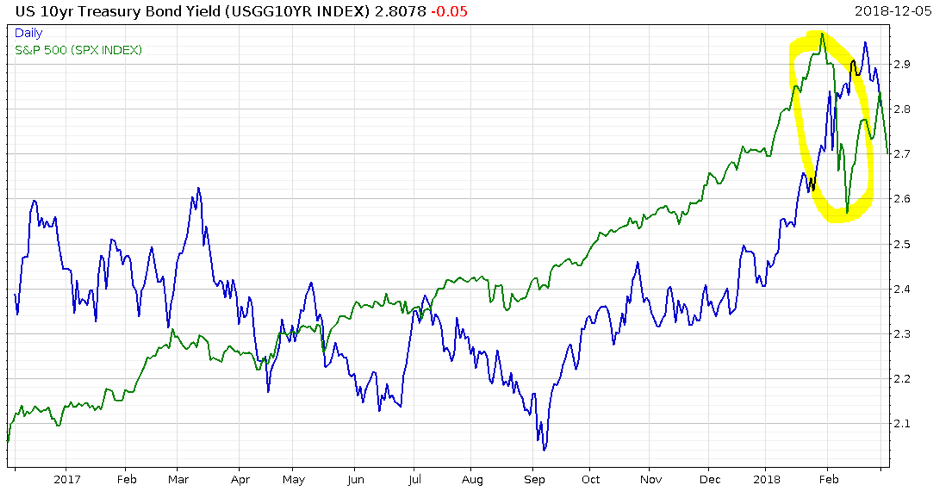

The cherished ten-year US Treasury bond which investors have flocked to time and again over the last few decades, was abandoned with stocks amid the “volmageddon”, as you can see below.

Bond yields (blue) should go down as investors buy them when stocks crash (green). In other words, they should be anti-correlated, and that’s the reason why many investors own bonds in the first place.

But this anti-correlation didn’t appear in early February, when there was a flash crash that ripped across the world – ie, when that anti-correlation really matters. If bonds can’t be relied upon as a safe haven when calamity strikes, then all the investors out there who own bonds as a hedge will get wrecked. The 60:40 stocks/bonds split endorsed by many portfolio managers and financial advisers will have brutal consequences.

We’ll explore this further tomorrow. In the meantime, remember: the safety is off.

All the best,

Boaz Shoshan

Editor, Southbank Investment Research

Category: Market updates