“Realise your youth while you have it. Don’t squander the gold of your days, listening to the tedious, trying to improve the hopeless failure, or giving away your life to the ignorant, the common, and the vulgar. These are the sickly aims, the false ideals, of our age. Live! Live the wonderful life that is in you! Let nothing be lost upon you. Be always searching for new sensations. Be afraid of nothing.”

– Lord Henry, The Picture of Dorian Gray (Oscar Wilde, 1890)

“Be afraid of nothing”… Not even investment losses?

Youth comes with plenty of advantages. The future is wide open for adventure, and you’ve a body that can sustain plenty of punishment to explore it with. Your metabolism is faster, you recover from injuries more rapidly, and you have the confidence that comes with not being beaten over the head with life yet. You feel indestructible.

But we only refer to “the optimism of youth” because it inevitably hits the cold wall of reality in adulthood sooner or later. The experience that comes with age has a price – all of the benefits previously listed, and generally a fair amount of money lost from not knowing any better.

As Oscar Wilde wrote in a magazine column a few years before The Picture of Dorian Gray,

… the young are always ready to give to those who are older than themselves the full benefits of their inexperience.

The optimism that comes with youth has been on full display during the crash in stocks in March, and the disembowelment of oil over the last couple of weeks. After a decade of “buy the dip” being ingrained in market participants, the fastest bear market ever experienced led to a similarly swift buying impulse from market participants expecting such action to be rewarded, like Pavlov’s dog slavering with the anticipation of receiving food.

One of the problems with “the optimism of youth” is perceiving value when none exists – seeing the price of something going down and assuming that now makes it a bargain. Nowhere is this phenomenon clearer than with a stock called $USO.

The purpose of USO, the United States Oil Fund, is to track the price of US oil prices. It does this by buying futures contracts for West Texas Intermediate oil, and buying new futures contracts when the old ones expire. In this way, it never owns physical oil, just a constant promise of future physical oil which it never lays hands upon, but which are normally worth roughly the same as the US oil price.

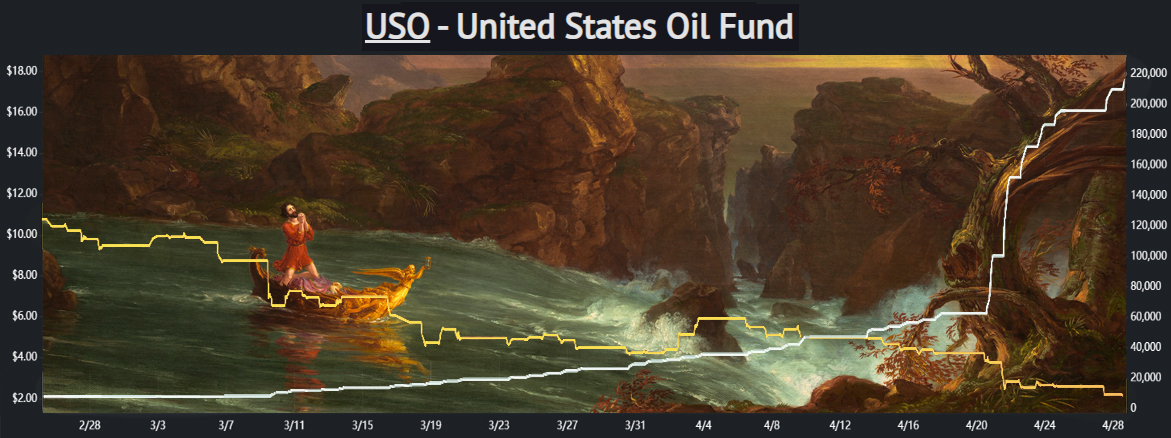

With the US oil futures – that promise of future oil – being worth less than zero last week, this put USO in a very precarious situation, and its price suffered very heavily as a result. But what makes the situation incredibly revealing is the chart of “da yoof” buying it while this has happened.

Reverse Robin Hood economics

Robinhood is a trading app, wildly popular in the US and which will soon be released here in the UK. Its main appeal is that it charges zero commissions – you do not need to pay the firm any money to buy stocks on its platform. This makes the app incredibly popular amongst youngsters wanting to get a start in the stockmarket.

The way the company makes money is following that Wilde quote from earlier, about young folks giving older folks the “benefit of their inexperience”: Robinhood sells its order flow – what its users are buying and selling – to hedge funds, who take advantage of that information however they like.

The price of USO since late February is illustrated below (yellow line, left scale). The number of Robinhood users buying this derivative of a derivative of the US oil price is illustrated in white above it:

The optimism of youth: millennials buy oil hand over fist while the broader market dumps it to hell. Source: me, on Twitter with the help of RobinTrack.net

The optimism of youth: millennials buy oil hand over fist while the broader market dumps it to hell. Source: me, on Twitter with the help of RobinTrack.net

As USO has collapsed, the number of millennials buying it has exploded, at an almost exactly opposite pace. This is a scenario where I think the optimism of youth is going to hit a brick wall – at least in the near term…

Just as millennials have been trying to buy the dip in oil, they’ve also been trying to buy the dip in the broader stockmarket, allocating plenty to the big FANG names through the Robinhood app. But will “buying the dip” really pay off this time? Will Pavlov’s dog actually get fed?

The latest from Robin Griffiths and Rashpal Sohan over at Dynamic Investment Trends Alert doesn’t paint a happy picture. And while I’ve been poking fun at my fellow millennials in this piece, the broader market has been full of baby boomers buying the dip expecting yet another central bank-stimulated resuscitation.

Robin and Rashpal have more decades of market experience between the two of them than many investors have been alive, and I’m not just talking about the youngsters. Robin and Rashpal know a bear market rally when they see one, and they’re standing well clear of the recent jump in stocks. From their latest update to subscribers:

… it remains clear to us that we are in a bear [market] which will be big bad and brutal. It has already started by falling faster than what happened back in 1929. If that does not make you nervous, we will repeat it regularly until the message sinks in.

It is true that the number of people infected with the covid-19 disease will turn a corner soon, but that will not end the problem. Severe damage has been inflicted to the economy and can and will get worse. We will have to behave differently in many ways from now on…

Be prudent thrifty and shrewd. If you find yourself feeling optimistic any time soon, well go take a walk in the fresh air until you feel better.

…The bottom line is that all investors should be cognizant that we are now in an equity bear market. It will be big – make that very big. We believe this will be the biggest bear in our lifetimes, including all the ones we have heard or read about elsewhere. It will change the way we live and invest and will eventually create some special buying chances of huge value for the future. The challenge now is to survive and get through to that moment in good shape…

Big, bad, and brutal. The biggest bear market of our lifetimes. It’s not a tune the average investor, millennial or boomer wants to hear right now. But if you’re reading this, I think you should be paying close attention. If the pair of them are right – and they certainly know what they’re talking about – the investment losses of the market darlings of the last ten years will be extreme.

That’s all for today. I’ve received some interesting feedback from readers regarding the future of oil and gas, which I’ll share tomorrow. I always welcome your feedback on subjects that you find interesting, and my mailbox is always open: boaz@southbankresearch.com.

There have been quite a few suggestions of additions to the Capital & Conflict beer list too – I’m looking forward to trying all of these…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates