Well, I’m back home after a month at the Edinburgh Festival, and what an absolute blast I had. How fantastic a city Edinburgh is!

You associate Edinburgh with late night drinking and such, and I had the odd pint, of course, but I haven’t felt so healthy in yonks. I think it’s all that fresh air blowing in off the North Sea. Much more pleasant than the viscous London stuff.

Anyway, thanks to all those who came to see my show. But now it’s back to business.

Today we’re talking stockmarkets…

If you sold in May, should you be looking to return now?

In May you always seem to read articles – some of them by yours truly – discussing whether we should sell in May and go away.

Well, the second half of that maxim often gets forgotten: “come back on St Leger day” – or, if you’re American, Labor Day.

The idea is that traders start to leave for their annual holidays in May, and markets are quiet until they come back in September, when things get going again. (There are lots of other equally unconvincing theories for the “sell in May” effect.)

Well, America’s Labor Day is next week, as is the St Leger Stakes. Should we be buying the stockmarket?

I must say I’m cautiously optimistic.

Looking first at the S&P 500, it hasn’t gone anywhere for six weeks now. Volatility is low and volumes have been too. Yet, at 2,172, it’s just a few points off its all-time high of 2,193.

I was reading a report from Institutional Advisors, the Vancouver research firm, and it contained the following observation from Ross Clark: “The history of the S&P shows that when the market has corrected by 10% from a high and then takes out that high with low volatility, it has a good chance of staging a prolonged advance”.

The S&P 500 made its high at 2,134 in May 2015. We then got two 10% corrections, one last August and another in January. In July we took out the old high – with low volatility.

According to Clark, this is the 13th time this has happened since 1928. All but two of these saw prices continue higher for another ten months.

It’s an interesting observation. But my view is rather more basic. It’s a bull market.

It’s a bull market that’s mature, sure, and many prices, it could be argued, are a little stretched. But I don’t think it’s over. If this were a football match, perhaps we’d be in the 75th minute.

The best stockmarket to buy now

There’s still plenty of money on the sidelines that can push the S&P 500 higher. The US is by no means fully invested. It’s September and many funds will be positioning themselves for the period between now and Christmas.

A rate rise from Janet Yellen may puncture things, but I don’t think she’s ready to go on that just yet. And in the US elections, Clinton is ahead, which the markets will like. But even if Trump wins, I think it’s fair to say he’s business friendly. It won’t necessarily mean the end of the S&P world, even if he does break a bit of metaphorical china.

Turning to the UK, I’m a bit more cautious. UK markets have had a terrific run since Brexit, up about 14%. The issue for me is the pound. I’m of the mind that it is undervalued. Somewhere nearer €1.30 or $1.50, I’d suggest is fairer value, as opposed to €1.15 or $1.30, where, give or take, we are today.

Every time sterling looks like it is starting on a recovery run, Bank of England boss Mark Carney has made some kind of statement that has killed the rally stone dead. But if Carney can keep his trap shut – and perhaps even if he doesn’t – the next run should be more meaningful.

Much of the run that UK stocks have enjoyed – particularly if you’re looking at the FTSE All Share index – can be attributed to sterling weakness. It’s made UK products cheap. That arbitrage will no longer be the case if sterling rallies, so it may be that other markets do better.

Anyhow, a simple, cheap way to track the FTSE All Share, if you disagree with my view, is via the SPDR FTSE UK All Share UCITS ETF (LSE: FTAL).

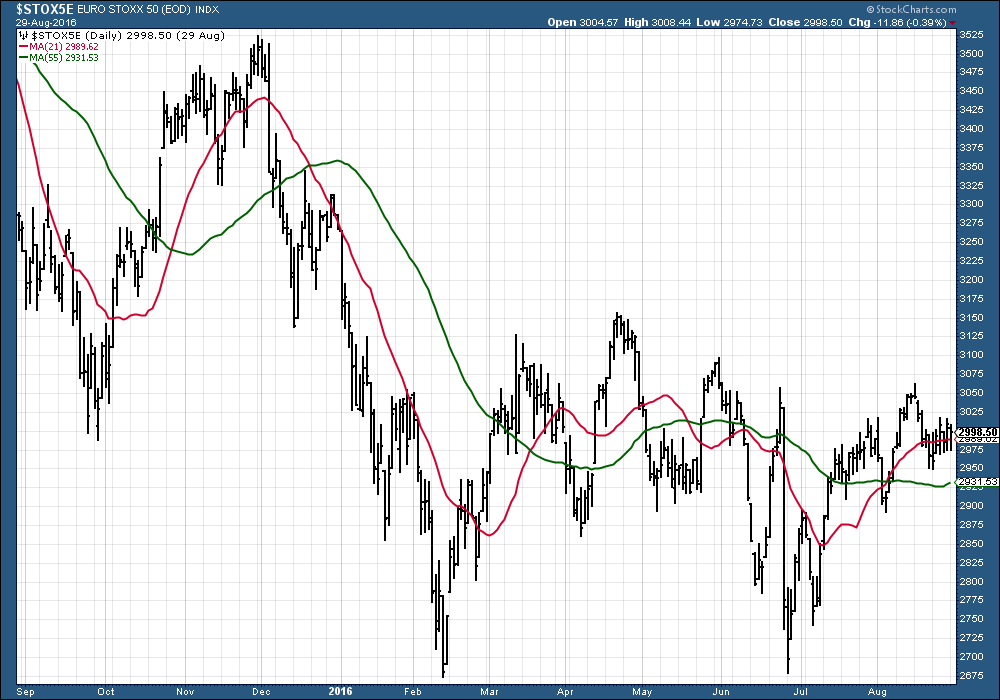

I must say, looking at it from a chart point of view, I’m rather more tempted to buy Europe and track the Eurostoxx 50. That looks to me like an index with a nice firm low in place at 2,675. The low’s been successfully re-tested. Now the medium-term moving averages (green and red lines) are lining up. A couple of weeks and this’ll be ready to go.

Don’t ask me for any kind of rationale as to why we should buy Europe when the EU seems intent on administering the continent into poverty. I can’t provide any. I just like the way the chart is setting up.

There are all sorts of ETFs and funds which track the Eurostoxx. But if I’m right about sterling picking up, it might be an idea to go for one that is currency hedged.

Category: Market updates