Not a good day to be a camel – even if it is hump day.

The Australians, faced with drought and wanting to do their bit for the planet, have settled on a strange solution: the camels have to go.

From The Australian:

Professional shooters will take to the air from Wednesday to kill up to 10,000 camels as the federal government faces renewed calls to create a carbon credit market for culling to provide an economic incentive to take out the methane emitters.

The decision by leaders in the Anangu Pitjantjatjara Yankunytjatjara Lands, in the state’s far northwest, to launch the mass kill came up against hesitation in some Christian Aboriginal communities, where camels are regarded as sacred because of their biblical link to the Nativity.

“It was on camels that three wise men came to see baby Jesus,” Tim Moore, chief executive of carbon farming specialists RegenCo, said…

APY wants to use camel control operations to create economic opportunities, and is backing calls for the federal government to amend legislation to award carbon credits for getting rid of feral camels as a way to cut greenhouse gas emissions.

“One million feral camels emitting the effect of a tonne of CO2 per year is the equivalent of having an additional 400,000 cars on the road,” Dr Moore said.

It’ll be an interesting twist to the climate change story if the culling of wild animals ends up being endorsed by the green crowd. Want a carbon credit to offset your emissions? Shoot a wild animal! Though the name “Extinction Rebellion” might need a rebrand…

All joking aside, the Australians are no strangers to wars on animals perceived as be hostile. One of Australia’s most famous military escapades was the Great Emu War of 1932, in which the military were given machine guns to shoot hordes of emus which were destroying crops. Despite the heavy firepower, the emus were victorious.

The Major in charge of the operation later lamented: “If we had a military division with the bullet-carrying capacity of these birds it would face any army in the world … They can face machine guns with the invulnerability of tanks.” (I’m not making this up – that did actually happen.)

The best kind of battle is doubtlessly one in which nobody dies. Following Iran’s launch missiles at an Iraqi military base with the intent of killing American forces last night, both Iraq and the US have claimed there were no casualties. This may sound too good to be true – but to this market, that’s good enough.

While oil, gold, and volatility surged on news of the event and stocks fell on news of the attack… almost all of that movement was reversed.

US stocks sold off at first… then composed themselves.

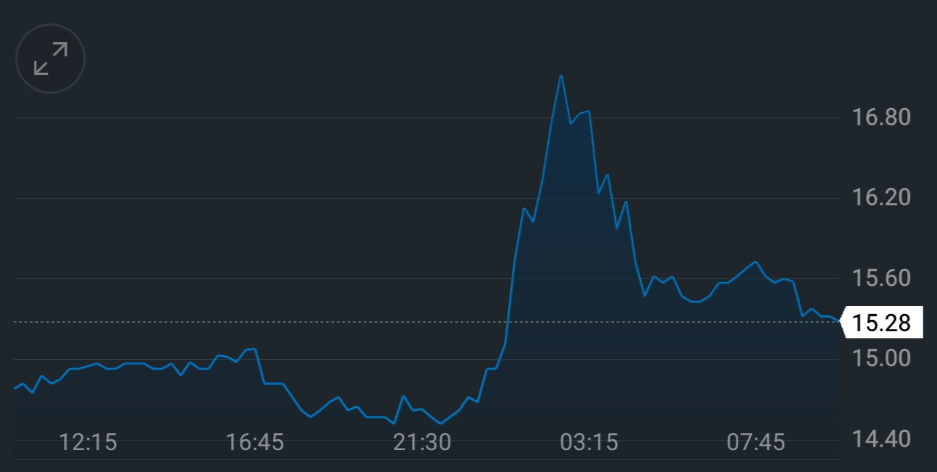

The oil market spiked up… then cooled:

Volatility returned… and then left again:

And it should be noted that all of these moves higher were pretty marginal. They only look like large spikes because they’re 24hr charts.

Perhaps the market knows that nobody was killed, is incredibly convinced that the US/Iran confrontation will have a happy ending, or like we argued yesterday, is so insulated from conflict in the Middle East thanks to shale oil that it doesn’t think Iran could do much to rock the global economic boat.

One thing’s for sure – right now, nothing can rock this market. To use a boxing term, it has an “iron jaw”, and can take missile strikes straight to the chin without flinching.

If this is how it reacts to bad news – just imagine how it’ll react to good news. I’ve said it before and I’ll say it again – the melt-up is upon us, for better or for worse.

But that brings us to a question. What might a superpower like the US do if it was confident that nothing it ever did abroad would have domestic consequences, in markets or otherwise?

Worse, what if the US has actually evolved from a country which benefits from international stability… to one which benefits from international chaos?

That and more, tomorrow.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates