There were long and winding queues at the ticket machines for the metro in Hong Kong yesterday. The Hongkongers, who’d normally use their plastic “Octopus” cards to pay for public transport (similar to Oyster cards in London), instead wanted paper tickets.

They were protesting an extradition bill that would allow the Chinese Communist Party (CCP) to extract dissidents from the island. And they were afraid that the record of their travel to areas where there were protests, recorded through their Octopus card, could be used by the CCP to find them in the future.

The Hong Kong protests (which also occurred to a smaller degree in Australia) have produced some revealing insights into how technology originally marketed to make life easier can be turned on a whim into Machiavellian tools of control.

You’ll hear proposals in the future from think tanks, academics, central banks and the government to abolish physical cash, who’ll describe the benefits of a cashless, or less-cash society. The ease of everyday purchases, the supposed reductions it’ll have on crime.

When you hear those proposals in the future – and you will hear them – remember those Hongkongers thronging for a paper train ticket for fear of being “disappeared” overnight by an authoritarian government.

How successful the protestors will be in avoiding the eye of the state remains to be seen – facial recognition may thwart any attempt at anonymity. But they appear to be damn organised – I’ve never seen a group of protestors collaboratively extinguish tear gas grenades with water bottles before.

They say people divorce more often than they switch banks, but that doesn’t mean the relationship with the bank. Hongkongers have been withdrawing cash to the tune of $100 million from the Bank of China (BoC) in protest. This is likely a drop in the bucket for the BoC, but one month interbank lending in Hong Kong (known as HIBOR, the Hong Kong Inter Bank Offered Rate) has jumped to October 2008 levels since the protests began.

The protests have at least produced some amusing content, like this from ardent China bear Kyle Bass:

Scrolling through the responses below, however, reflected the insidious degree of CCP influence within Twitter:

The US government will only tolerate this for so long. As Cold War II ramps up, expect the US to try and bend Twitter and the other social media giants to their will – possibly even into propaganda outlets of their own…

Capitalism with Chinese characteristics – bullish for the big ₿

We wrote yesterday how the rise of financial authoritarianism, while growing in the UK, has not trickled into public consciousness.

Off course, this is not the case in China, and the change in behaviour by Chinese citizens fearing government theft of their wealth has had a global impact, especially upon investors. As “capitalism with Chinese characteristics” becomes ever more prevalent in the UK, investors would be wise to witness the results it has wrought in its birthplace.

As noted yesterday, Chinese citizens have flooded foreign markets with their capital, creating grand surges in the price of gemstones, art, prime real estate, and more.

I believe the recent surge in bitcoin, a tried and tested vehicle for Chinese capital flight, is a result of further Chinese capital flight. The arrival of hundreds of thousands (some say over a million) Hongkongers taking to the streets may well have exacerbated this, with bitcoin at the time of writing grazing $8.1k once more.

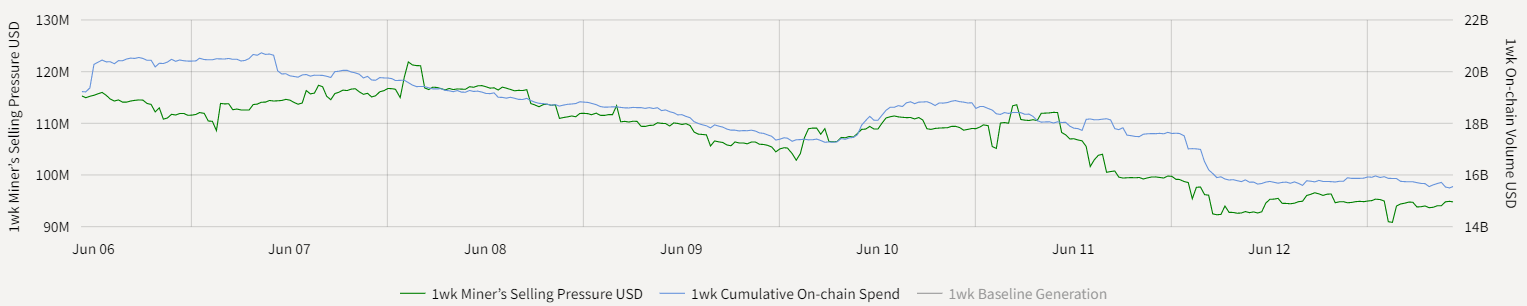

The miners are holding back their selling, putting fuel on the fire – but notably this is all occurring while a key fundamental of bitcoin has been in decline: the network “spend”, or value of money being transferred between the bitcoin network itself, has been falling all week.

Miner selling pressure in green, network spend in blue

Miner selling pressure in green, network spend in blue

Source: ByteTree

Charlie Morris over at The Fleet Street Letter believes this a key “fundamental” for bitcoin, with a declining spend indicating a lower intrinsic value for BTC, and vice versa.

But some buyers are less price sensitive – like those evacuating their wealth from the country.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates