An old buddy of mine contacted me yesterday asking what stocks he should buy now that the market has turned down.

This very same friend contacted me at the very end of the crypto bull market to tell me he had invested heavily in an altcoin called Litecoin, a month or so before the market collapsed in 2018.

“Surely”, he asked me, “if you buy stocks now and hold them for a year, you’re going to make some great returns, right?”

Something tells me we’ve nowhere near the bottom of this bear market yet…

Our editors here at Southbank Investment Research who specialise in cycles, Rashpal Sohan and Robin Griffiths over at Dynamic Investment Trends Alert and Akhil Patel over at Cycles, Trends & Forecasts, have all predicted that we’ve a long time to wait until we see an end to the stockmarket pain.

Akhil, who accurately expected a stockmarket panic this year back in December, expects stocks to bottom in 2021. Robin said we’re on the cusp of “a grand supercycle correction”, a brutal economic turndown like a force of nature which no intervention will be able to stop.

I’ll be speaking to Robin and Rashpal later today to discuss their views and predictions further. By the time you read this, it’ll be available for you to listen to –

An increasingly clear “bear (market) necessity” right now is gold – if you don’t have it yet, you’re late to the party. Gold in pounds hit a new all-time high yesterday – £1,371 (but good luck getting it at that price if you want physical…).

Silver is what’s going cheap right now – and as I’ve written in the past in this letter, I believe the corona-shock will produce the buying opportunity of the decade for silver, just as it did after 2008. But silver is also suffering a serious shortage across the world as the everyman has also twigged on to the fact that serious currency debasement is on the way. In the latest The Fleet Street Letter Monthly Alert I outlined a manner in which subscribers could not only access physical silver, but do so without VAT and at a discount to the spot price

But those are just my views – I’ve nothing like the insight that Robin and Rashpal bring to the table, with well over half a century’s worth of financial experience between them. Hear what they have to , and if you want their regular investment recommendations sent straight to your inbox every fortnight, you should consider a subscription to Dynamic Investment Trends Alert.

The economy getting pounded is a good thing

In yesterday’s note, I said that the UK is unique as we are the largest developed economy in the world with our own currency. This is a crucial but overlooked aspect of the UK which Nickolai Hubble pointed out recently.

Some folks favour fixed exchange rates and currency pegs for the illusion of stability this creates. But these inevitably lead to distortions, some very dangerous, which can only be solved through massive government intervention, and then only temporarily.

In reality, ditching fixed exchange rates and allowing the currency to float against others would rectify those problems, with a strong or weak currency changing the incentives of market participants to behave in line with whatever the economy needs.

(This is provided government corruption/socialism isn’t an issue of course. Venezuela has one of the weakest currencies in the world, but you’d need to be mentally defective to try and take advantage of its weak currency by setting up a manufacturing plant there.)

The free exchange of the pound acts for our economy like a keel does for a ship, or as I described yesterday, like a gyroscope, maintaining position and orientation whatever the forces surrounding it.

Economic uncertainty and turmoil weaken the pound, making the UK more attractive for foreign investors and making UK goods and services more competitive internationally. A booming Britain and a stronger pound discourages foreign investors, but incentivises British investors to buy assets abroad, weakening the pound and reining in excess within the UK.

Adam Smith’s “invisible hand” is at the wheel of the currency, and does not require guidance from the government.

However, this beautifully simple system that has been a font of prosperity is rejected by other countries – it runs contrary to the grand strategies or international alliances maintained by some national governments. For example, the Chinese Communist Party (CCP) wanting to keep Chinese goods and services cheap to embed itself within the global economy, and Saudi Arabia needing to stay cosy with Washington.

This puts the UK at a serious advantage, and it’s something we should remember during these volatile times for the world: the pound will do what our economy requires of it – be it strengthen or weaken. I don’t know what it will do, but I don’t have to.

Let’s continue where we left off yesterday with the “traitor currencies” of other major economies which the pound is in competition with. We looked at the US and Japan’s traitor currencies yesterday – both the dollar and the yen move contrary to the health of their respective economies – but the euro is in a class of its own when it comes to creating and maintaining stability across the euro bloc.

Traitor currency #3: the German and French (and Finnish, and Irish, and Spanish, and Italian and Greek, etc) euro

Having the wrong exchange rate out of sync for one country is dangerous enough as it is. Now imagine if 19 of them all share the wrong one.

This prevents struggling countries from recovering economically by devaluation, once a pressure release valve for the Greeks and Italians which is now impossible for them to access.

The other side of this is that the shared currency creates an unmitigated export boom in Germany. The euro is staying low thanks to Italy and Greece, propping up German exporters’ prospects.

German tourists no longer dominate deckchairs around the world thanks to their strong currency. German export firms dominate trade instead, thanks to the artificially weak euro. The key difference is that there is no rebalancing mechanism. There can be no rally in the German exchange rate to bring the trade surplus back into line. The export boom will continue until some sort of crisis puts an end to it.

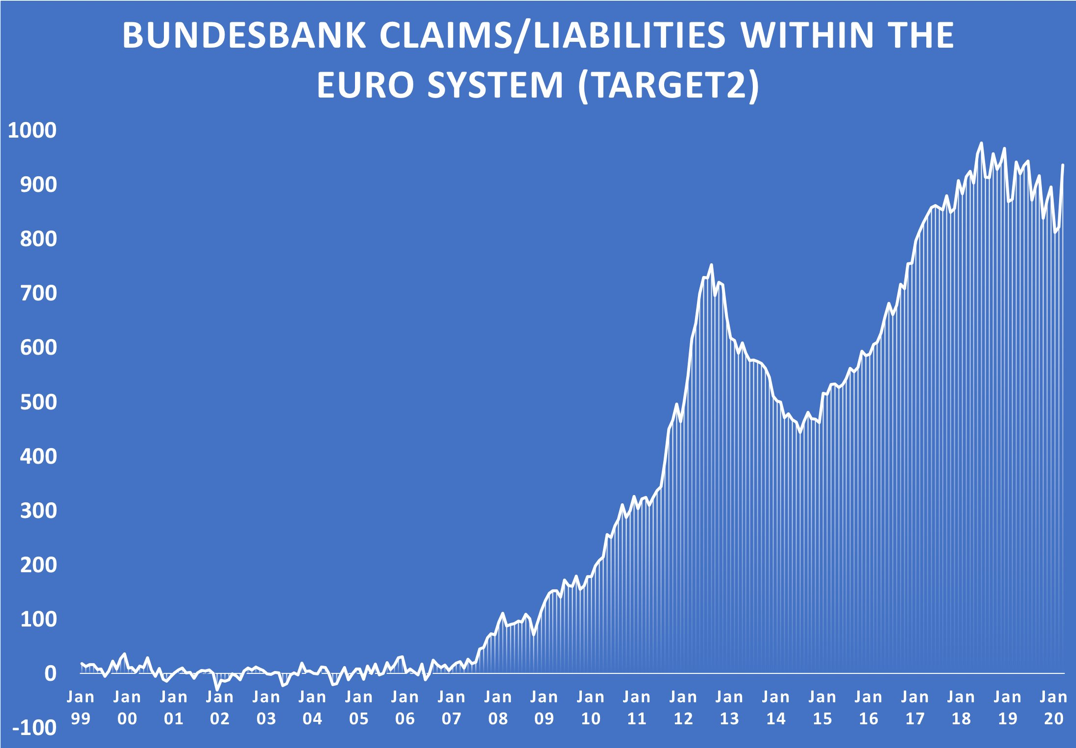

The closest there is to a rebalacing mechanism is the obscure Target2 system within the European Central Bank (ECB), which reveals where flows of currency within the eurozone banking system are going. Elsewhere in the world, flows out from one country’s banks and into another would weaken the former’s currency, while strengthening the latter, and create economic equilibrium. In the eurozone, the currency can move, but a euro is a euro and no such change takes place.

In times of fear, euros pour from the southern European zones (which would normally devalue their currency) into the less indebted Germany. This is revealed in Target2 as the amount of deficits (called “claims”) which southern European countries have in the system, and the number of surpluses (called “liabilities”) which countries like Germany have in the system.

(These are called claims and liabilities as the ECB gives the central banks of the southern European countries (formerly sovereign central banks now enslaved to the ECB) a “claim” to the cash which has left the country, which goes on their balance sheet to make up for the lack of cash. Correspondingly, the German central bank is given a “liability” to constrain its lending by the amount of cash that has just flooded in over the border. If this did not occur, lending conditions in southern Europe would become incredibly tight, while lending in Germany would become incredibly easy, and the role of the ECB is to ensure they remain the same, creating Target2 for that very purpose.)

The corona-panic has caused cash to flood into Germany again, as expressed in the liabilities pooling at the German node of the ECB, the Bundesbank:

Source: @Schuldensuehner on Twitter

Source: @Schuldensuehner on Twitter

I’ve said it before and I’ll say it again – if Italy doesn’t leave the euro now, it won’t be able to in the future of its own volition. Its incredibly weak banking system, stuffed with non-performing loans, is about to take another major hit and the technocrats in charge are about to seize a lot more power. It’s now or never…

Traitor currency #4: the Chinese yuan

The yuan doesn’t perfectly qualify for this list as we’re comparing major developed economies, and China is not a developed economy, it is only major. However, as the second largest economy in the world, it merits inclusion.

The value of the yuan is pegged and manipulated by the CCP, and you would imagine that the CCP would have at least some interest in keeping its economy stable. But the thing with currency pegs is that while you may be able to keep the value of your currency in line with that of another… to do so means you have to import all their monetary policy. Monetary policy that was not intended for your country in the first place.

This gets even messier as the Chinese yuan isn’t just pegged to one currency, it’s pegged to a basket of all the world’s major currencies, meaning it effectively imports everybody else’s currency problems. The largest proportion of that basket is held by the US dollar, but as we explored yesterday, the US dollar is not just the US’s currency due to its use in global trade, and its interest rates are forced to reflect that. So China imports its interest rates from abroad, much of which were meant to be tailored for the US but have been forced lower by the US’s role everywhere else. If this sounds strange, it is.

Using a currency peg is a bit like tailgating somebody ahead of you to get a bit more speed. Helps the fuel efficiency, but you can’t really see where you’re going. And if they crash, you’re toast. Similarly, if you don’t watch yourself, you can crash into them.

When you consider that this is being done by the two largest economies in the world, which have now entered a Cold War against one another, you can start to imagine just a few of the “bumps in the road” we might encounter as the 2020s unfold.

Thankfully, we are somewhat sheltered from the fallout as we are the largest developed economy with our own currency. It will fluctuate in line with what our economy needs, rain or shine.

And in the fullness of time, we won’t be the only ones to appreciate this. In fact, the UK may actually become a safe haven for capital as a result of this (sure to drive the europhiles insane), and maybe even drive the pound to become a safe haven currency. Of course, safe haven status comes with plenty of drawbacks, as we explored yesterday… but we’re a way off there yet.

For now, take comfort in the fact that the pound is not constrained and distorted like everyone else’s currency. This will protect the UK economy – whatever comes of the current crisis.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates