Today we make no attempt whatsoever to time the market.

Instead we think with a longer time horizon, and offer what we think is the trade of the lustrum!

But what on earth is a lustrum?

You won’t regret this purchase in five years’ time

It’s often said that you shouldn’t try to time the market. Many believe it can’t be done consistently over time. Value investors certainly think so.

I believe it can be done. And that belief has led to one of my biggest failings as an investor.

I’m so intent on micromanaging the timing of a trade and catching the exact low or the exact high, that if I don’t nail it, I either don’t place the trade or I get stopped out, and I often end up missing out on the bigger trend – which is how you make the most money.

A lustrum, by the way, is a five-year period. I bet you didn’t know that. I know I didn’t. I just looked it up.

And the trade of the lustrum is oil.

I’m aware that, even although the price has stabilised over the past few weeks, in the intermediate and long term, oil is very much in a downtrend. I’m aware there is a so-called glut of supply.

And I’m aware it is a political commodity and as such vulnerable to all sorts of games behind the scenes. For example, one current theory is that the Saudis deliberately increased production in order to put North American shale producers out of business.

There’s not a lot that I, from my little desk in London, can do about any of that. I just know that oil, to use a value investor’s term, is cheap.

Oil looks really cheap compared to gold

West Texas Intermediate (WTIC) is at $33 a barrel as I write. It’s not as cheap as it was a fortnight ago when it hit $26. It’s already more than 20% off its lows. But it’s still historically cheap.

Brent is at $36. Interestingly Brent’s February low was higher than the one it made in January, while WTIC’s was lower. There is some divergence, and Brent is leading.

Both could, I guess, go back to the low $20s, at which point just about every oil producer in the world will be operating at a loss. But we must be closer to lows than we are to highs.

I suspect that, after what they have been through, if oil goes back to the $40s, many oil producers will sell a shed load of production forward in order to hedge themselves. That will put a cap on future gains.

But oil is trading at the same price it was in the early 1980s. How many dollars have been printed since then? It’s trading below its crash lows of 2008. That’s a claim few – other than Deutsche Bank – can make.

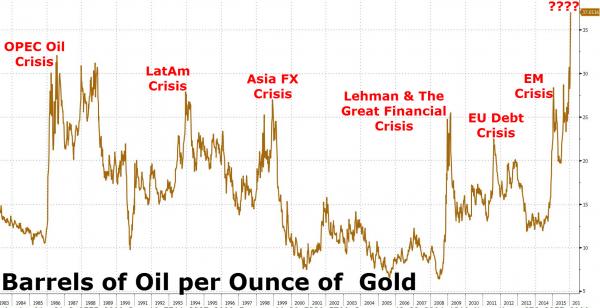

I was struck by this chart that blogger Michael Snyder put together, showing the ratio of oil to gold. Using gold (which has not enjoyed the same levels of production as the US dollar) as a measure, you see how cheap oil looks on a relative basis – and also how expensive gold is.

We are at a point of unusual extremity.

We may go lower, but I’m confident that in three or five years from now we will be looking back and wondering how oil got to be so cheap and why we didn’t buy barrels and barrels of the stuff.

The best ways to bet on an oil rebound

So. How do you invest? Buying oil is not simple.

I don’t like the oil exchange-traded funds (ETFs). There are all sorts of goings-on with the rolling over of futures contracts – backwardation and contango and all that malarkey – with the result that when oil goes on one of its runs, you don’t seem to benefit.

I’m also not crazy about BP. Tempting dividend aside, BP seems to trade vaguely in the direction of oil, but it doesn’t track it quite as closely as you might expect. The same goes for Royal Dutch Shell. I don’t like its financial position, and I think BG is a rotten purchase.

There’s no shortage of other FTSE and Aim oil plays, but I’m going to single out a company better known for something else. That’s mining giant BHP Billiton (LSE: BLT). It may be the one of the world’s largest iron ore producers, but something like 22% of its revenue and 34% of its earnings come from petroleum. And if you plot a chart of BHP over WTIC, you’ll see that one tracks the other quite beautifully – in fact, if anything, BHP leads.

At just over 700p, the likelihood that the company will lower its next dividend is already priced in. I suggest, over the next lustrum – don’t you just love that word – it’s a buy.

If you want a more geared play then Tullow Oil (LSE: TLW) at 170p is worth thinking about. Like most oil producers, Tullow has problems, but not so long ago this was a 1,600p stock. There is plenty of rebound potential. If Brent can get to $50 – a 30% rally from here – Tullow could double. But if the oil price stays low, Tullow, like most producers will struggle.

Category: Market updates