Yesterday we took a look at who it might be that’s bidding up bitcoin. In today’s note, I’d like to zoom out a bit, and put the blooming of BTC in the context of the global macroeconomic garden.

For regardless of who bought bitcoin in bulk last weekend (probably a Chinese capital smuggler), the conditions for crypto to grow strong are upon us anyway. The weather’s getting just right, and the monetary fertiliser is on the way…

Bitcoin was born in the depths of the last financial crisis, with the very first block in bitcoin’s blockchain (known as the genesis block) containing a reference to it. Satoshi Nakamoto, the pseudonymous creator of BTC, thought it fitting to include in the foundation of his creation a Times headline, adding “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks“.

While born in the financial crisis, bitcoin boomed from the central banks extreme monetary reaction to it. They forced investors to take more risks by reducing the returns you could be found in safe assets (like government bonds). By removing the shelter of risk-free returns, they hoped that investors would take measured risks in businesses that would be successful and would lead to a resumption of economic growth.

They pursued this goal through zero and negative interest rate policies (ZIRP and NIRP) and asset purchase programmes (quantitative easing) which all drove both short-term and long-term interest rates.

When you lower the rate of interest, the value of future cash flows increases. This is why growth stocks (companies with bold ambitions to grow their business and revenues quickly) and junk bonds (which pay higher interest) went through the roof and most remain at nosebleed valuations. It’s also why companies which are unprofitable, and don’t even expect to be in the future (see: Uber), can raise vast quantities of capital and gain multibillion-dollar valuations. The fact that they are cash-flow negative and destroy capital year on year doesn’t matter.

By reducing risk-free returns, investors have turned to ever wilder methods of extracting any returns at all. By reducing the return on bonds (there’s $10 trillion in negative yielding government bonds out there today), investors turned to stocks that pay high dividends as a replacement. When they all piled into those stocks, the price of the stock was so high that the dividend earned was significantly lower. And so investors turned to the peculiar and exotic orchids in the garden, the alternative investments. It’s here that things go a bit nuts.

Investors began selling stockmarket insurance (and hoping it’s never claimed on), leasing old airliners, providing bridge loans to fast food franchises, and buying music royalties from the estates of dead rockstars, all in an attempt to extract income from a low interest rate environment. Chasing returns has led to a speculative boom in fine art, classic cars, vintage watches, and gemstones.

Central Banks had crowded out the interest-bearing assets considered safe, and pushed investors further and further out along the risk curve. But they should be careful what they wish for – for at the end of the risk/return curve, lie cryptocurrencies.

In a low interest rate environment, turning to crypto was only one step removed from buying small cap tech stocks for small investors. And though it took quite a lot of crazy monetary policy before they turned to bitcoin, turn to it they did, which lead to the grand BTC boom of 2017.

But by that point, the Federal Reserve in the US had begun pulling away from its post-crisis measures. Raising interest rates, and selling the bonds it bought. In other words, interest rates were rising once more, and such crazy risk taking was no longer required to make returns. In other words, investors no longer needed to go so far along the risk curve to make money.

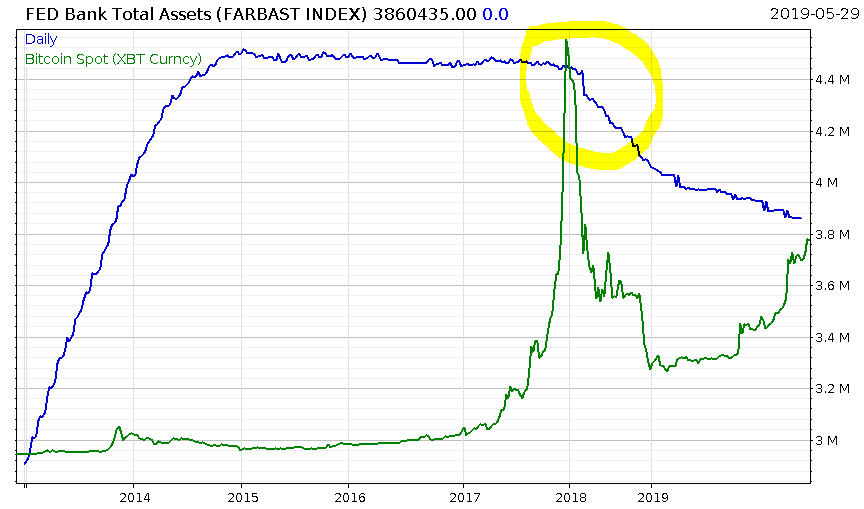

Interestingly, bitcoin peaked just before the Fed started reducing its balance sheet:

The rise and fall of American QE: the balance sheet of the Federal Reserve (blue), BTC (green)

The rise and fall of American QE: the balance sheet of the Federal Reserve (blue), BTC (green)

And the continuous contraction of the balance sheet did not bode well for BTC, which collapsed.

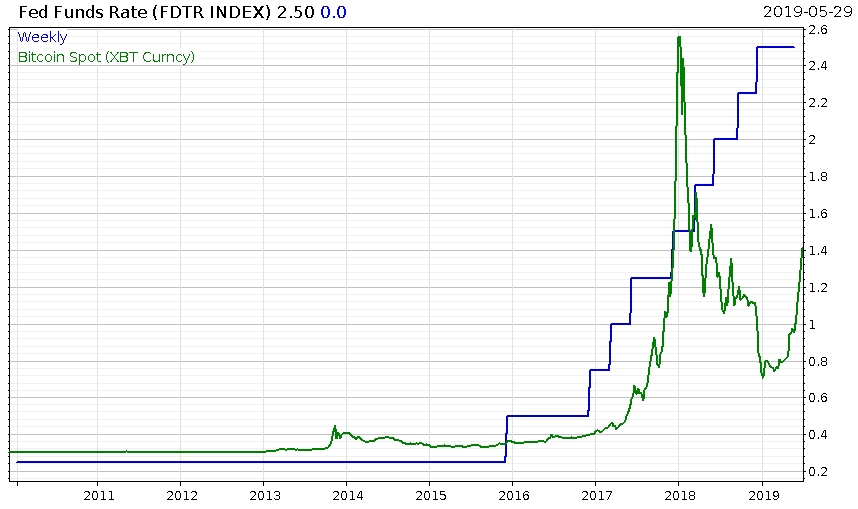

BTC, which had built momentum for years in a low and negative interest rate environment, and had boomed high even as rates slowly rose, eventually couldn’t keep up. Crypto is one of the riskiest games around, and when you can actually earn a decent return at low risk back in the ordinary financial system, some investors chose not to play:

Interest rates at the Fed (Blue), versus BTC (green)

Interest rates at the Fed (Blue), versus BTC (green)

But what will happen to BTC if the blue line in the first chart goes up again… and the blue line in the second goes down? By which I mean, what if the Fed begins buying assets once again (under QE or another acronym), and lowers interest rates?

In my view, the bitcoin boom was the product of central banks forcing investors to find returns elsewhere. It has unique qualities, certainly, but the grand flow of money into BTC was a result of a decade of low interest rate policies, which drove investors into the wild in search of returns.

I reckon this is going to happen again, though the exact timing is hard to judge. There are signs that we are getting close to the end of Fed’s hiking cycle – the futures market is now pricing in two rate cuts by January. On top of that, the Fed has declared that it will cease its balance sheet reduction programme in September, and are discussing using it (buying assets to reduce the returns investors can earn from them) as a more regular tool in their operations.

All in all, it’s looking like investors will shortly be pushed down the risk curve once again. But investors are now much knowledgeable of this wild, crypto section of the macro garden. And this time around, they won’t be nearly so fearful to tread there…

More on that tomorrow, where we’ll explore how things have changed between the last boom and now, and how the capital highways to crypto have been expanded to carry a lot more traffic.

Don’t go away!

Until then,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates