After oil, it’s the most widely traded commodity in the world by volume.

Global consumption is growing at a rate of 2-3% a year. But in China it’s growing by 40% a year, according to some analysts.

It’s produced in hot countries, but in chilly Scandinavia, they drink about three times as much of it as anyone else.

In 2010-11 the price more than doubled. In 2011-12 it halved.

In case you haven’t already guessed, coffee is the subject of today’s Money Morning…

China – a nation of potential coffee converts

Some 2.25 billion cups of coffee are drunk daily. With a global population of nearly seven billion, that’s almost one cup for every three people.

The average Brit drinks about 2.8kg a year. And we’re only 45th in the consumption league. The average American drinks about 4.2kg (more than 18 gallons) a year, which still only puts the US in 26th place. Top place goes to Finland, where some 12kg of coffee (over four times as much per person as in the UK) per head is consumed each year. Second-placed Iceland only manages 9kg per head.

But the real growth story for coffee is not in the developed world, where consumption has remained fairly steady over the past decade. For growth, we have to look to emerging markets, and China in particular.

At present, China doesn’t even make the top 50, in terms of coffee consumption per head. Yet this traditionally tea-drinking nation is catching the coffee bug. Starbucks now has more than 90 outlets in Beijing alone, and 600 across 48 Chinese cities. The target is 1,500 by 2015. You can see why the company is keen – in the US, Starbucks’ operating profit margin is about 22%. In China, it’s 35%. It’s 22% in the US.

I’ve seen different projections for Chinese coffee consumption growth to 2015, ranging from 15% a year to 40% a year. Whichever estimate you take, it’s big. Why such huge numbers? Simply put, there’s lots of room for growth.

“China’s average coffee consumption is three cups per person per year, while the world’s average is 240 cups,” as Ji Ming, chief of the Beijing Coffee Industry Association, said in 2011. And at 120,000 tons last year, China’s coffee consumption was only 6% that of the US. Meanwhile, about a million tons of tea was consumed in China last year.

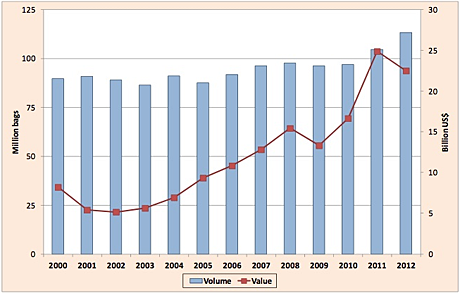

There is a similar dynamic occurring in India, though not quite so breath-taking. In short, there is no shortage of demand for coffee. Globally, consumption has grown rapidly over the last couple of years, as the chart below from the International Coffee Organisation (ICO) shows.

2011-12 saw a large spike in price, as we’ll see shortly, which explains the decline in the value consumed.

Volume & value of world coffee exports 2000-2012

So what about the supply side?

Brazil is the largest coffee exporter, with 32% of global production. Vietnam, the second largest, has 18%. Indonesia had a 6.4% share in 2011/12. And Colombia slipped from 3rd to 4th place, on 5.7%, after being hit by bad weather and disease problems.

South American production fell by 6.4% in 2011-13 to 58.9 million bags, or 44% of global production. Production in Asia and Oceania grew by 13% to 41 million bags, or 30% of global production.

There are, for our purposes, two types of bean: Arabica and Robusta. Arabica, which accounts for about 60% of world production, is harder to grow, but its flavour is considered richer. It’s the premium bean and the benchmark for coffee prices. Robusta is less expensive, easier to grow and less flavoursome.

The biggest driver of coffee prices – as with many ‘soft’ commodities – is the weather. Coffee needs quite specific conditions: a warm climate and about 70 inches of rain per year, ideally towards the start of the growing season. As a result, extreme weather can send the price soaring, as in 2010-11.

Geopolitics has also hit prices in the past. For example, in 1994, when the US lifted its embargo against Vietnam – the world’s second-largest producer – prices quickly fell with the increased supply.

However, (and please correct me if I’m wrong in the comment section below), the only country in the table below (from the ICO), where I see any significant short-term geopolitical risk, is Guatemala.

And maybe I’m biased against it because of the various problems in mining that have gone on there of late. And how much is 2.9% of world supply going to affect things anyway?

Ten leading producing countries in crop year 2011-12

| Production | % share of world total | |

|---|---|---|

| Brazil | 43,484 | 32.4 |

| Vietnam | 24,058 | 17.9 |

| Indonesia | 8,620 | 6.4 |

| Colombia | 7,653 | 5.7 |

| Ethiopia | 6,008 | 4.5 |

| Honduras | 5,705 | 4.2 |

| Peru | 5,581 | 4.2 |

| India | 5,233 | 3.9 |

| Mexico | 4,546 | 3.4 |

| Guatemala | 3,840 | 2.9 |

So while a couple of those countries might raise eyebrows, I don’t see geopolitical risk as a major factor in the coffee price in the short-term.

A higher oil price, however, would have an effect, because of the impact on both production and transportation costs. You can read more about my thoughts on oil here. On top of that, other input costs such as labour and fertilizer, are not getting any cheaper.

Why now could be a good time to bet on coffee

The chart below shows the coffee price since 2002, which is when its bull market began. You can see the huge spike it enjoyed in 2010-11, when adverse weather hit production. (It’s small wonder investment and trading houses are prepared to spend such fortunes on accurate weather forecasting. If you fancy a punt on the weather, coffee futures are one way to do it).

But all those gains have been given back now and coffee is back in the support zone, which I have drawn in red. The dotted blue line shows another line of support.

Zooming into a short-term chart, you can see the inexorable decline that has taken place over the last two years. The trend is very much down.

Now, it’s well said that you should “never catch a falling knife” and all that. But the descent of that knife appears to be flattening out. Perhaps it is starting to make a low.

Demand, as we have seen, is strong. So for this market to move much lower from here, there needs to be a rise in supply. Much depends on the weather of course, but with input costs up and prices down 50%, producers are not exactly incentivized to dramatically increase production as in 2010-11. There could be a huge fall in discretionary income, of course, particularly in China, but don’t hold your breath.

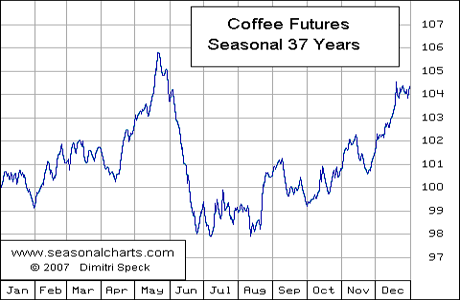

Another bullish point is that in seasonal terms (see the chart below, courtesy of Dimitri Speck), you can see that April and May is typically a good time of year for the coffee price.

To me, the risk/reward of a bet on coffee in the 1.30 – 1.40 area, with a stop-loss placed a few percent below 1.30, looks reasonable. Particularly if the market gives us another pullback in the coming fortnight.

If you want to play coffee, the simplest way is via a spreadbet. But if you’d rather invest in companies that could profit from growing demand for the beverage, you could opt for Starbucks (Nasdaq: SBUX) or Whitbread (LSE: WTB), which owns the Costa Coffee chain, the second-largest coffee retailer in the world after Starbucks.

A final note for full disclosure: I don’t like coffee. I think it’s over-rated.

Category: Market updates