If the world enters a recession in the near future, it will be one of the most well-predicted events in economic history.

All over the press, from Bloomberg, to the Financial Times, to the Economist, to CNN and the Guardian, red flags are being waved. The moment we’ve all been waiting for they claim, may soon be upon us.

But if following the crowd made you money, everybody would be rich. And if the mainstream press were half-decent at predicting the future, Southbank Investment Research would be out of business…

A watched kettle never boils

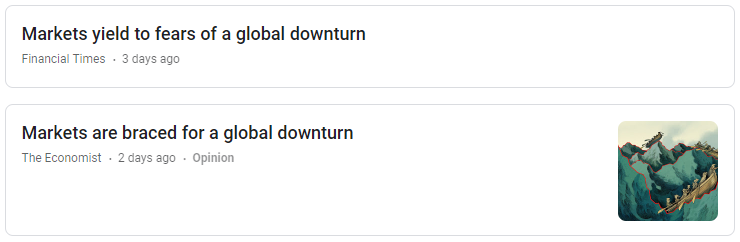

Fear is now firmly in fashion…

And all the press coverage is making bearish market signals a subject for polite conversation!

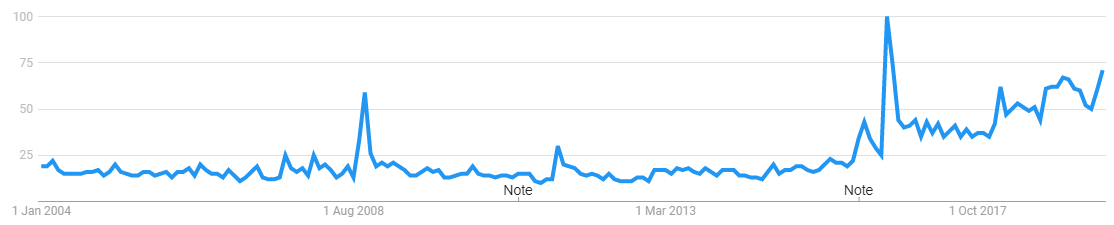

Who would’ve thought “inverted yield curve” would become a topic of discussion at the water cooler? Google searches for the phrase just went through the roof:

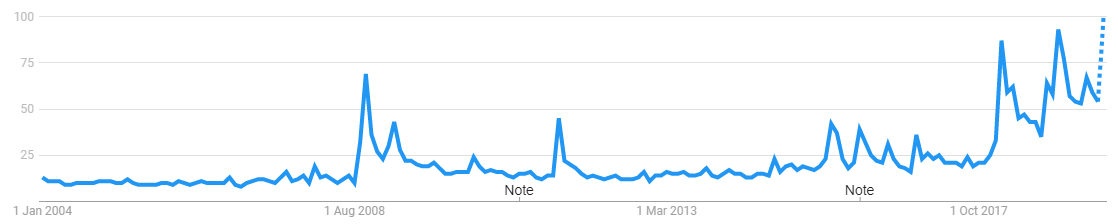

British investors have begun checking the level of the FTSE more frantically…

Google searches for “FTSE” within the UK

Google searches for “FTSE” within the UK

As have American investors checking the Dow in the US…

Google searches for “Dow” within the US

Google searches for “Dow” within the US

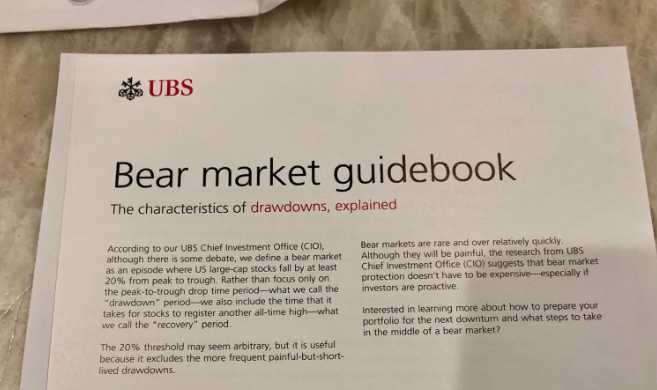

UBS has even begun sending out “bear market guidebooks” in the mail to attract new business:

Courtesy of @BretonWes on Twitter

Courtesy of @BretonWes on Twitter

(Click to enlarge)

A last hurrah

I’m a contrarian by nature. All this mainstream anticipation of a bear market for stocks has got me thinking we’re in for a melt-up.

Don’t worry, I’ve not suddenly had a change of heart and become oblivious to the dangers which threaten stocks – Lord knows I’ve highlighted many of them to you in this very letter. There are plenty of unexploded bombs out there – – which threaten to bring the whole house down.

But provided nobody steps on a mine (a European banking collapse, for example), and the music continues… we may see everybody get caught on the wrong foot, and clamour back into risky assets when the sun re-emerges from behind the current cloud.

If I’m right, we’ll see the beloved FAANG stocks, the darlings of this bull market, get boosted yet again. In this scenario, gold should pause from its breakneck rise – .

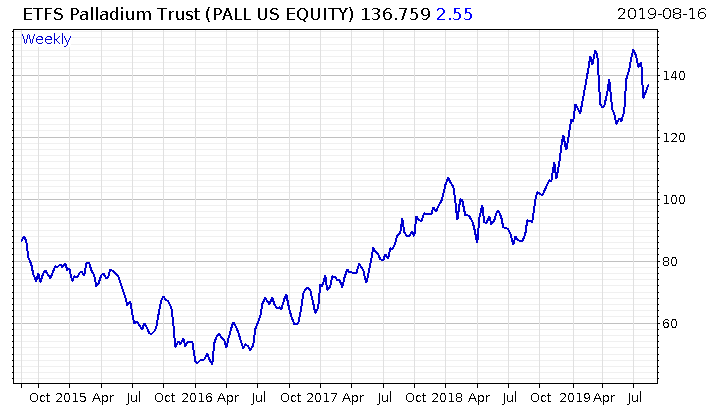

Palladium, the industrial metal used in petrol catalytic converters, has been in short supply this year, leading to significant price increases (exacerbated by folks buying petrol cars to diesel). If there’s any juice left in this economic expansion, I expect it to perform strongly.

I could be totally wrong of course, and the global economy may be heading to hell in a handbasket even without an external event triggering it.

But if bear markets and economic declines could be so easily predicted by the mainstream, then investing would be easy – and that it ain’t. Let’s watch.

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates