August already huh, dear reader?

The year feels like it’s flying by… and yet the days before lockdown, from January through to March, feel like forever ago.

Strange times. I wonder how we’ll look back on 2020 in a few years – at the chaos, the hysteria… and for many stocks, the mania. A foreshadowing of the decade to come? Or a fever dream we woke up from with relief, determined not to experience again?

I reckon we’re in for the former…

It was John Maynard Keynes, the hugely influential economist, who once said that “There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

Now that governments have put themselves in a position where debauching the currency is effectively the only course of action they can take, the “overturning of the basis of society” is baked into the cake. I’m not so sure it’ll be “subtle” though…

Bank of America made a list of trends that may come to define the 2020s – changes from the 2010s as the millennial generation comes of age and the boomers retire. There’s some pretty bold claims in there, as you can see:

“YCC & MMT” = Yield Curve Control & Modern Monetary Theory. “Helicopters” used as shorthand for “Helicopter Money” – central banks financing (printing) government spending. EPS to ESG = earnings-per-share to environmental, social and governance standards. “Vol” – volatility.

“YCC & MMT” = Yield Curve Control & Modern Monetary Theory. “Helicopters” used as shorthand for “Helicopter Money” – central banks financing (printing) government spending. EPS to ESG = earnings-per-share to environmental, social and governance standards. “Vol” – volatility.

Source: The Market Ear

Interesting to see a major Wall Street firm predicting such an awful future for Wall Street – I guess they’re not feeling so confident in their lobbyists. But it missed one major change in trend that’s beginning to take place from its list – a phenomenon that’s making early investors very wealthy indeed.

Here’s one trend from the late 2010s that’s certainly getting long in the tooth: tech. Flows of capital from investors into tech funds just continues to soar and soar after bottoming in 2016. The rise in interest rates we saw in 2018 staunched the flow for a while, but not for long:

As regular readers will know, we expect higher inflation to be a serious barrier for growth companies in general, which includes the tech sector. The vague promise of great cash rewards in the future becomes less valuable when the value of cash in the present starts to evaporate. And that’s where we return to the debauchment of currency we referred to earlier…

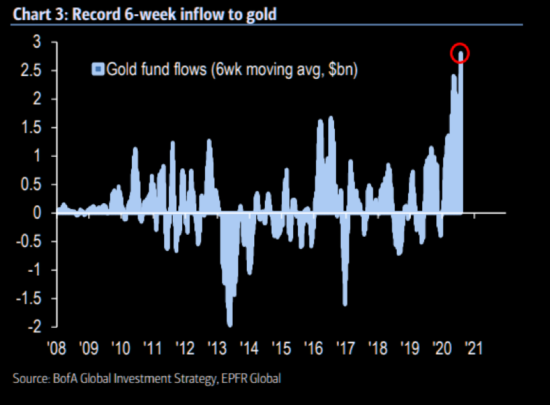

While gold remains small relative to the tech titans, investor interest in it has amped up, with record flows running into gold funds. We may be talking about “only” a few billion dollars going into the shiny stuff over that past month and a half, but that’s more than has been recorded in the past:

But that’s all from me for today. The latest issue of The Fleet Street Letter Monthly Alert is on my desk and needs my attention (it’s all about gold and government spending, funnily enough). Today’s was a short note I know, but I’ll be back tomorrow.

Until then,

Boaz Shoshan

Editor, Capital & Conflict

PS BP will report its earnings tomorrow – and it ain’t looking good for shareholders: a dividend cut is expected. But while the woes of oil are great and many, some energy investors have been making some serious hay during lockdown – we’re talking multiple 100% gains. And you can join them.

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates