The average balanced portfolio – the sort of thing that might make up a typical retirement fund – today has a combined yield on bonds and equities of about 2%.

Historically, the average is closer to 4%. When things get cheap, you might be looking at 6%.

In that context, I’d say that a multinational with a multi-billion-dollar market cap, which has been around for more than 150 years, has an A+ credit rating and a solid record of increased dividend payments, and yet is currently yielding close to 8%, looks like a pretty compelling bet.

That bet is the subject of today’s Money Morning…

The fundamentals for BHP Billiton shout ‘buy’ – but the trend isn’t your friend

I’m talking, of course, about the world’s largest mining company, BHP Billiton (LSE: BLT).

Before we touch on the fundamental stupidity of ever again even considering investing in a mining company, let’s look at some basic numbers.

The company, which has been around since the 1860s, currently has a market capitalisation of around £60bn.

The share price stands at 1,135p – about 19% above its low for the year of 955p (it hit that on 24 August).

Revenue last year was $45bn, pre-tax profits came in at $8bn, and earnings per share were 120c. The current price/earnings ratio is 13.5.

BHP employs about 41,000 people in 25 different countries in mining, oil, gas and processing operations. BHP’s main products are coal, copper, iron ore, petroleum and potash.

That, in a nutshell, is the investment case for BHP. If you think commodities have got further to fall, there’s no point in buying BHP. If you think they’ve bottomed, then you should be all over it.

And if you think they are in the process of bottoming, then the case gets stronger still – that juicy yield will pay you for holding the stock until they properly do.

No doubt about it, the fundamental numbers are compelling. But the price action is not.

BHP is in a clear downtrend. Three months ago the price was 1,400p. A year ago the price was 1,700p. Three years ago we were flirting with 2,000p.

This month’s highs were lower than last month’s, which were lower than the month before. This month’s lows are lower too. The trend is down.

As I’m forever saying, trends go on for a lot longer than you expect, and often defy reason. On a trending basis, there is no basis to own BHP, nor indeed commodities in general.

The thing is, commodities can’t go to zero – and they’re not far off it

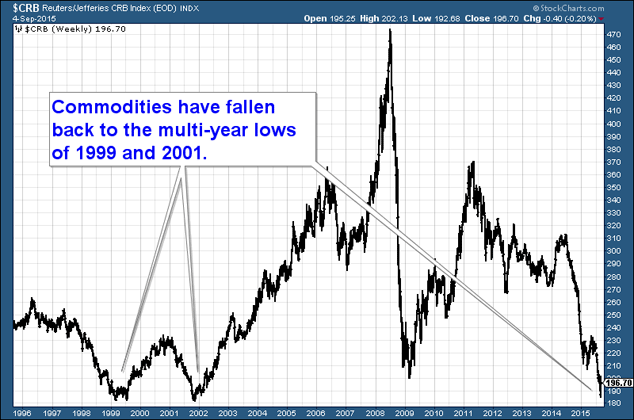

However, the CRB (the commodities price index) has now fallen below its crash lows of 2008. Two weeks ago it flirted with its lows of 1999 and 2001. Amazing. All those incredible gains of the commodities bull market of the noughties given back – just check out the chart below.

Commodities can’t go to zero. At a certain point value has to trump trend. The 1991/2001 lows is a fairly obvious technical point for that trump to take place.

Some high-profile investors, most notably Carl Icahn, clearly feel the same way. In June, he completed the take-out of non-listed Brazilian iron-ore producer Ferrous Resources at a discount of more than 90% to the highs it reached in 2007.

Last month he doubled down on oil and copper giant, Freeport McMoran, with an 8.5% stake now disclosed. He also has large positions in energy stocks CVR Energy, Chesapeake Energy and Transocean.

I’m sure, like you, he gets the whole China-imploding-looming-deflation argument. But he also knows oil and metals prices do go up as well as down. And whatever your views of Icahn may be, you do not acquire a net worth of over $20bn by making bad investment decisions.

BHP could fall further – but it’s definitely cheap

So, back to BHP Billiton.

Unlike commodities generally, it has not retreated to its lows of 1991 and 2001. It hasn’t even retreated to its 2008 crash lows at around 700p. 700p is perhaps a possible target. Then again it might never reach those prices.

1,000p has proved a fairly pivotal price point in the past, so I guess there’s a chance it will be again.

But I come back to that yield of close to 8%. That’s an extremely compelling number. I don’t own BHP. But as a long-term buy for the pension fund, in a world where yield is so hard to find, I look at that and I think the case for owning it is a strong one.

This might not be the bottom in commodities – nobody knows that for sure – but you can say BHP is cheap. And in 2015 cheap is not so easy to find.

Category: Market updates