It was only a matter of time.

The Bank of England (BoE) took it upon itself to cut interest rates, following the Americans’ example of a double-cut, reducing the BoE base rate by 0.5% down to 0.25%.

They’re meeting again in just two weeks’ time. At this rate, we’ll be at negative interest rates by April Fools’ Day…

I’m guessing this is some kind of ritual where the pain of the saver is induced to balance out the pain caused by the coronavirus, and if the deities of central banking smile on the offering presented to them, then this will all be alright. The cosmic balance sheet will net them off against each other and nullify the problem. That’s my read on it anyhow.

On a more serious note, the price of gold in pounds would normally be off to the races in the event of a single 0.25% interest rate cut, let alone two. But it’s actually down a couple of quid since yesterday morning.

This should rightly appear strange. Central banks everywhere are frantically trying to debase their currencies, and stocks everywhere are getting beaten with a shovel while there’s a pandemic on the loose. Why is the shiny safe-haven currency not taking off like an Apollo mission?

Because we’re in a raw liquidity crunch folks. Market participants don’t want assets, they need currency. And that’s left nowhere to hide in the financial system.

Leverage within the financial system is being unwound in epic fashion: those who have borrowed at scale to magnify their potential investment returns (investment banks, hedge funds, and others) are having to sell assets to maintain their positions (the oft alluded to “margin call”) or simply closing their positions and selling the assets anyway.

The net result of this is that pretty much all financial assets that can be sold, are sold: not good news for those that buy multiple types of assets to “diversify” their portfolio.

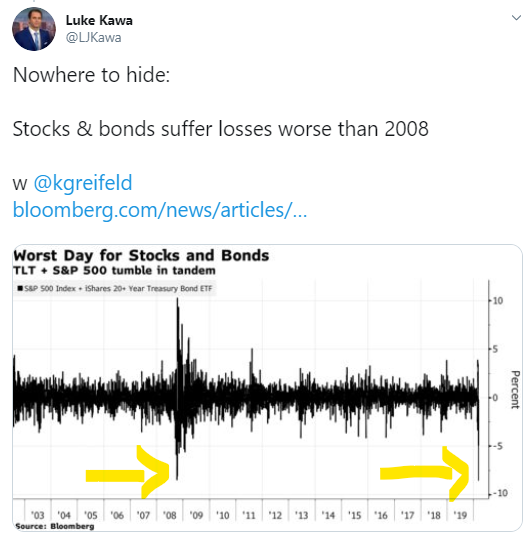

Yesterday, those who hedged their stocks with bonds actually had a worse day than any other, even during the financial crisis:

Gold, for all its great properties, in such a scenario just has the same properties of all other assets – just another item on the line that can and must be sold to raise cash. Regardless of personal attachment to the shiny stuff, if you have a legal obligation with a clearing counterparty to pay up when your favourite stocks fall, you’ve gotta pay.

But have no fear, dear reader. Gold will have its time in the sun. And likely soon. The panic selling leads to central banks adding more money to the market to maintain price stability, which devalues their currency (what the BoE was really trying to do yesterday). Once the new money has sloshed around and given the appearance of calm, the market then prices in the devaluation of the currency, by bidding up gold.

As Lyn Alden, the macro strategist, observed recently: “During the leading edge of the prior two recessions, gold sold off about 15% (2000) and 30% (2008). This is during the liquidity crunch. Gold then rallied to new all-time highs well before the S&P 500 recovered…”

Liquidity pressure may bite hard first, but gold outshines stocks once it’s passed. As for the amount of money that’s about to be added to the system, well, I won’t beat around the bush:

You are about to witness the greatest economic experiment in history.

That phrase may sound familiar. You may well remember it being said after the financial crisis with the extraordinary intervention of the authorities to keep the economic show on the road.

But that was then. This is now, when many of those extraordinary interventions have become relatively every day. A much greater experiment will be embarked upon now to deal with Covid-19 and its broader impact. The value of currency will be sacrificed to achieve this, either by national central banks, treasuries, or likely both.

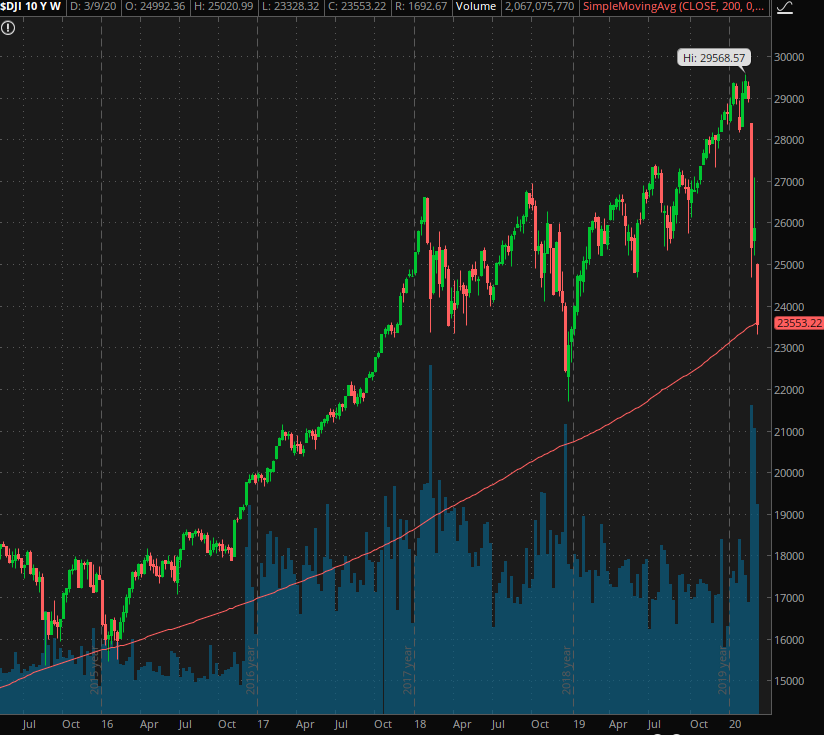

The Dow Jones, the world’s most popular stockmarket index, is now in a bear market, losing 20% of its value faster than at any point in history.

As Donald Trump has nailed his colours to the stockmarket’s performance, we’re likely going to see huge attempts to get it shining green again now the election race has begun for real.

He’s just been granted a fleeting reprieve by Mr Market.

The Dow managed to bounce off its 200-week moving average yesterday. The last time it touched that indicator was January 2016, a great time to buy the US stockmarket as things transpired.

Source: “Bubble Boy” on Twitter

Source: “Bubble Boy” on Twitter

“If we’re saved. That was the moment.” Remarks “Bubble Boy”, the pseudonymous investor.

If the Don wants to goose this thing higher, he’s gonna have to move fast…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates