Who’d have thought that we’d see Carlsberg encourage abstinence this year? A brewery discouraging the consumption of booze?

Sure is wild. But as we noted a couple months back (Theatre of the absurd, 25 June), 2019 is feeling very much like 2016. And 2016, as I’m sure most of us can agree, was a pretty wild year.

The filling or draining of a punchbowl is often used as a metaphor for low or high interest rates. Central banks, which influence interest rates, “control the bowl”. They can fill it with punch, encouraging risk taking by lowering interest rates, making debt cheaper. Or they can drain it, hiking interest rates and discouraging risk taking in favour of saving. Either way, they influence the direction of “the party”.

For almost all of the last decade, we’ve seen ever more punch poured into the bowl to the point where in developed countries the bowl is nearly full (close to 0% interest rates) or overflowing (negative interest rates). The boys at the bank want everybody drunk in their pursuit of inflation.

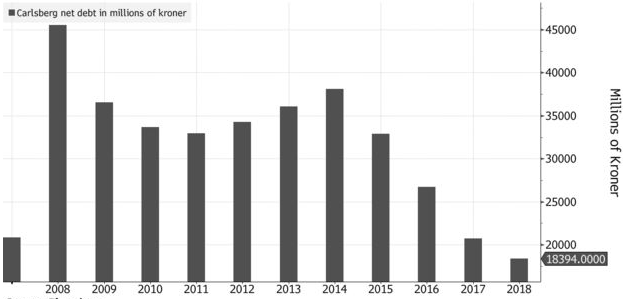

But Carlsberg, of all companies, refuses to partake. Though drunk on debt in 2008 (like many others at the economic “party”), over the last five years it’s been going dry:

Carlsberg net debt – source: Bloomberg

Carlsberg net debt – source: Bloomberg

Large corporates that aren’t loading up on debt these days are a rare breed. Carlsberg stands out even more as it’s a Danish company.

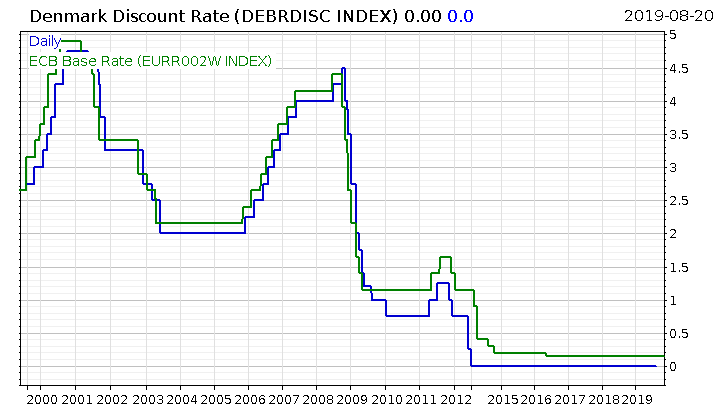

As the Danes peg their currency (the krone), to the euro, they tie their interest rates to that of the eurozone. This is because if the Danish central banks set interest rates significantly differently from those set by the European Central Bank (ECB), the currency peg would break. Effectively, the Danes import their monetary policy from the ECB, and their interest rates trace each other:

This unceasing perversion of interest rates has led to Jyske, a Danish bank, offering mortgages that pay negative interest (ten-year mortgages that pay you 0.5%)

This unceasing perversion of interest rates has led to Jyske, a Danish bank, offering mortgages that pay negative interest (ten-year mortgages that pay you 0.5%)

But despite all the efforts of the punchbearers, the CEO of Carlsberg will not be seduced. From Bloomberg:

Cees ’t Hart, the chief executive officer of the Danish brewer, says the worry is that companies that succumb to the temptation to issue debt just because it’s cheap could end up with balance sheets they can’t afford.

“The moment you get seduced by low rates and companies feel like they have to use them to do very big things — maybe bigger than they can absorb — they have to remember they all have to pay the bill later,” Hart said in a phone interview.

“There are many companies that have been a lot more aggressive than we have who have then gotten into problems afterwards,” he said.

…“Of course, at the moment rates are low and that makes things easier, but the thing with interest rates is that they can go up as well again.”

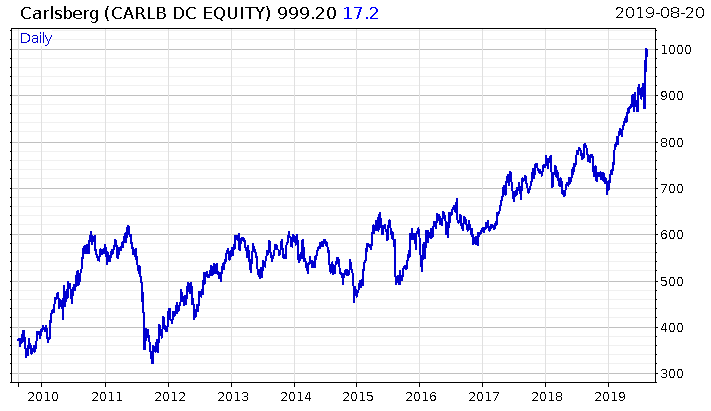

Going on the wagon has certainly aided investors in the company:

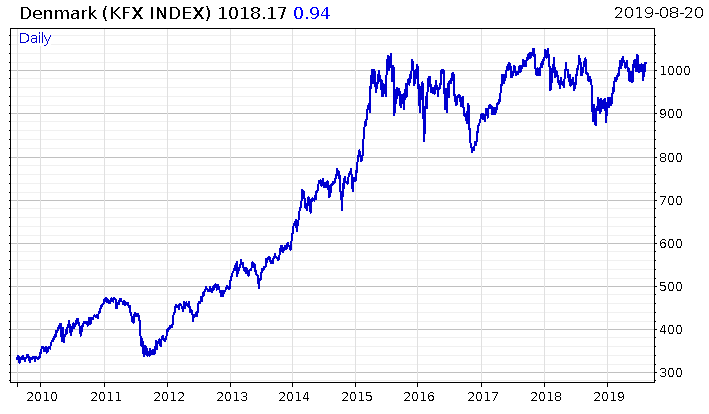

Carlsberg’s meteoric rise is interesting, as it stands out from the broader Danish stockmarket, which has been stuck in a range since 2015:

What happened in 2015, I wonder..?

Well, it just so happens that 2015 was the year that short-term Danish interest rates went deeply below zero for the first time, and they haven’t got back up:

Could it be that flooding the party in punch is not conducive to a healthy economy? Those who began extricating themselves from this party back in 2014 like Carlsberg certainly appear to be feeling the better for it.

It’s a sign of the times that the value of abstinence is espoused by a brewery. I’ve never been a fan of Carlsberg’s lager (more of a Guinness man), so further encouragement on their part is not necessary.

But the ECB is reaching for the punch pump once again as European growth is stagnating, and deflation threatening to permanently end the party. The Danes will have no choice but to follow suit and man the punch pump with ever further interest rate suppression. That is of course unless they decide to change the euro/krone currency peg, and debase their money manually.

It’s no surprise that in the background to this absurd situation the value of gold in Danish krone is reaching levels last seen during the eurozone crisis, nudging all-time highs:

The more punch is poured, the further gold will rise – .

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates