Some 14 years ago, a cartoonist called Andy Riley published a book called Loads More Lies to Tell Small Kids, a sequel to Great Lies to Tell Small Kids. I distinctly remember one illustration which claimed Lego blocks are social creatures, and so if you put one of them alone in an empty shoebox, you can watch it slowly go insane.

I didn’t really get the joke back then. But now… I can’t help but chuckle every time I think about it.

I hope self-isolation isn’t wearing you thin, and that this letter finds you healthy and at ease. I’d like to say that’s an apt description of my current condition, but the more I stay cooped up like this, the more it rubs me the wrong way.

Nobody ever says that bald fellas have an advantage during lockdowns, but it’s true. I’m writing this looking like some urban castaway, with hair and beard all ahoo. With a bit of imagination, and taking into account the parrots breezing by outside, perhaps I could qualify for some kind of 21st century Long John Silver impersonator, minus the pegleg.

Whatever the case, there’s certainly treasure being buried out there in the market – in more ways than one.

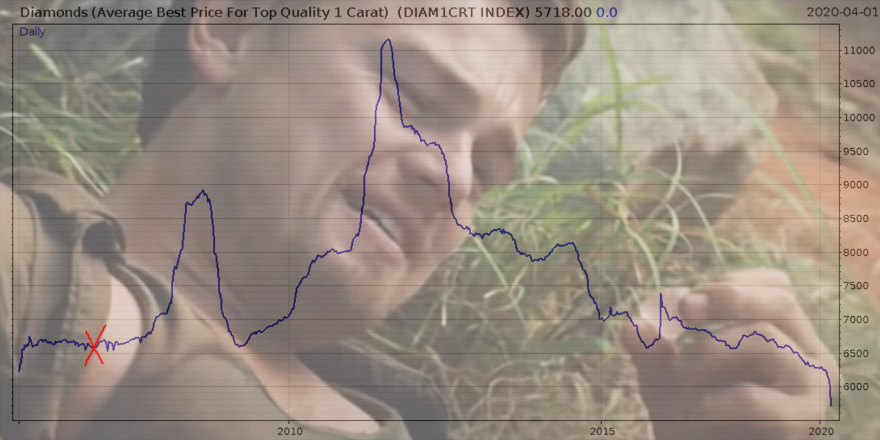

Diamonds are now in the rough – literally. Indeed, the average price for a high quality 1 carat diamond is now lower than when Blood Diamond was released in 2006, right before a big boom.

Average 1 carat diamond price over the past 20 years – release of Blood Diamond indicated in red.

Average 1 carat diamond price over the past 20 years – release of Blood Diamond indicated in red.

Source: me, on Twitter

You wouldn’t expect rare stones to be getting “buried” when you consider the incredible attempts of the monetary authorities to destroy the value of paper money (more on that in a second), but here we are. Much of the price fall however, is due to the decreased number of stones being sold, as the processing for 90% of the world’s diamonds is in India, which is now in lockdown. The diamond industry has pretty much seized up, and during this lockdown phase the few stones that are being traded are going cheap.

Perhaps the lack of folks getting married during this period is responsible for the collapse of demand. Could now actually be the perfect time to buy an engagement ring for that special someone? If you’re living with them in lockdown and they aren’t driving you insane, perhaps they’re the one…

Self-isolation is an educational experience – you can learn a lot about yourself when you’ve only your imagination for company. Like whether you will actually do those things you said you would and have been putting off now that you have the space and – at least over the weekend – plenty of time to yourself. You may discover heretofore untapped talents of procrastination, and/or rediscover your love for a hobby to avoid being productive (this is all hypothetical of course – I couldn’t possibly relate).

It’s actions that define who we are of course, and the virus is bringing out plenty of action (or inaction) and various actors are revealing their true nature to the world. In fact, it’s brought us a whole new label of hypocrite – the champagne socialists, cashmere communists and learjet liberals now have a new pal: the junkie capitalist.

And junk is the word. It’s a term for a type of loan to a company which is less likely to pay back its debt. Investors who buy these “junk bonds” do so because they pay a higher interest rate – it’s their reward for taking on more risk. They get higher interest payments in return for taking on the burden of not getting their money back at all, as the company is more likely to go bust.

As interest rates have been pushed down and kept down by central banks following the credit crisis, more and more investors have been buying junk debt as it’s so hard to earn some decent interest anywhere else. This increased demand for junk bonds has provided easy financing for companies that may not have really deserved it, and forced the likes of pensions funds into ever riskier territory due to their need for income. Companies that would have gone bust due to inefficiency and poor management have been kept alive by using debt to finance more debt.

Non-financial corporations around the world are now twice as indebted as they were in 2008. This great credit build-up which we have witnessed, brought about by central banks keeping interest rates absurdly low, has at the same time been warned about by those very same central bankers.

Janet Yellen, who was the chair of the Federal Reserve prior to Jerome Powell, was very vocal about the risks growing in the credit market shortly after she left her post – though of course she took no responsibility for having created the problem. She was quoted as saying the following, in a Reuters article from February 2019:

“I have expressed concerns about leveraged lending,” Yellen said during a keynote discussion that was closed to the press. “I do think non-financial corporations have run up, really, quite a lot of debt…”

“What I would worry about is if the economy encounters a downturn, we could see a good deal of corporate distress. If corporations are in distress, they fire workers and cut back on investment spending. And I think that’s something that could make the next recession a deeper recession,”

Jerome Powell, while working at the Fed, though prior to leading the institution, said the following in a speech back in 2016:

“… a long period of very low interest rates could lead to excessive risk-taking and, over time, to unsustainably high asset prices and credit growth.”

However, for all their hinting to investors that there were excesses in the market, hoping that this would restore some sanity to the credit space, it’s actions that matter and not words.

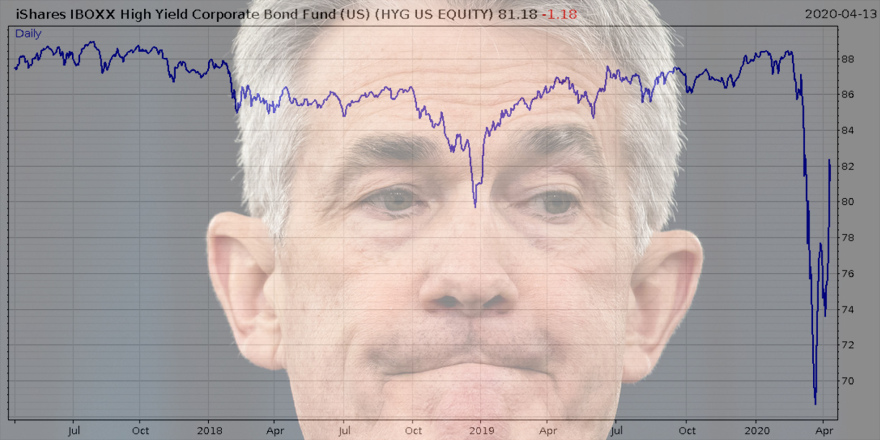

And as the market rightly predicted, when push comes to shove, the Fed was and is willing to bail out the junk bond market on top of everything else, taking the incredible move of printing money not just to buy the junk bonds, but to buy shares in an exchange-traded fund (ETF) that owns junk bonds, managed by BlackRock.

Here’s a chart of the ETF Jerome decided to buy to help “stabilise” the market. That last, massive uptick on the right is a result of him printing money to buy shares in it, which rallied harder in a single day than they had since the global financial crisis.

The $HYG junk bond ETF the Jerome Powell just began printing money to buy.

The $HYG junk bond ETF the Jerome Powell just began printing money to buy.

Source: me, on Twitter

And lo, now that the Jerome has decided he’ll bail out the junk bond market, junk companies are acting accordingly – and issuing (creating) more junk bonds.

Just this Monday, $2 billion more in junk debt was issued, including by a cinema chain that has shut 300 branches through North America (Cinemark) and a discount clothing brand (Burlington Coat Factory). These bonds are sound investments, I’m sure – or actually, I’m not sure, but it doesn’t matter because the Fed will buy them anyhow.

It’s the “participation trophy” mentality, but taken to market, at huge scale, by the state. Everybody gets a prize, no matter their performance on sports day.

Bad management? Bad business model? Bad product? No problem, buddy – Jerome has your back. Here’s your medal, thanks for playing. You did great.

This is Junkie Capitalism folks. This is not the prosperity and wealth created by free market forces unhindered by government intervention. This is a farce. And it won’t end well.

But I said there’d be buried treasure, and there is. The market is digging it up:

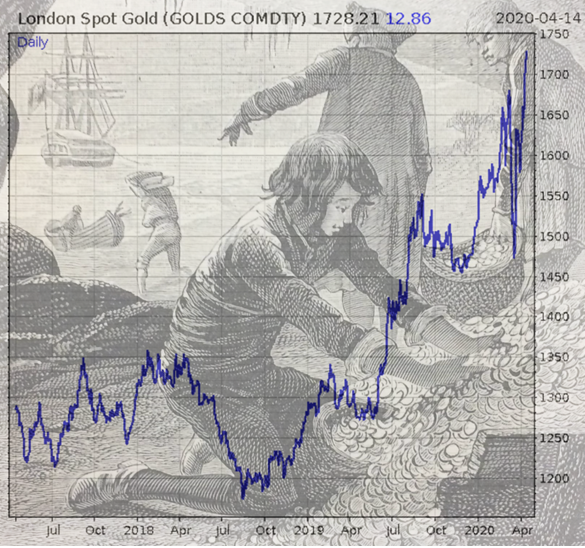

Treasure Island: gold is not at all-time highs in dollars yet (the $,1900 mark reached in 2011), but it’s sailing that way

Treasure Island: gold is not at all-time highs in dollars yet (the $,1900 mark reached in 2011), but it’s sailing that way

Source: me, on Twitter

In these times of extreme moral hazard, diamonds may not be gleaming yet, but gold sure as hell is. It only makes sense that when there’s an abundance of paper debts being churned out, that investors want something solid, and trustworthy.

Gold has already reached the sunlit uplands for British investors, with the sterling price only a whisker from all-time highs.

The dollar price of gold, which the gold market focuses on the most, peaked in September 2011 at $1,900, a level it has yet to reach. But as you can see from the chart above, it’s heading there at a mighty clip, with a monetary gale filling its sails…

Back tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates