I wish I was in Dixie, Hooray, Hooray

In Dixieland I’ll take my stand, to live and die in Dixie

Away, Away, Away down South in Dixie…

– “I Wish I Was in Dixie” (1850s)

You wouldn’t expect an old country song from the “Deep South” of the US (and once the de facto anthem of the Confederacy) to be all that popular in the great financial centres of the world.

But in recent days, the tune is ringing ever louder, from the trading desks of the biggest banks in London, New York, and Hong Kong…

… and it’s issuing a warning that all investors should pay attention to, whether your capital is parked at home, or abroad. For while it comes from the US… it affects everything, not least the price of risky assets – it’s left a trail of destruction you can see in asset markets all around the world.

Use of the word “execution” in markets normally refers to the act of completing a trade, but it’s also a pretty good description of charts like this:

Source: @Ben__Rickert, on Twitter

Source: @Ben__Rickert, on Twitter

That’s commercial real estate in Canada right there. Or, more accurately, it’s an investment product that owns commercial real estate in Canada (a real estate investment trust or REIT)… which has been sold so hard by investors in recent days that the only bids remaining in the market to buy it were 25% below the price it originally started trading at.

It’s like the chart just slammed face first into a brick wall, or was just guillotined. It’s going to be a stressful time at the office working from home for the folks managing that product, who now need to sell vast quantities of commercial real estate in Canada to accurately reflect the value of these shares.

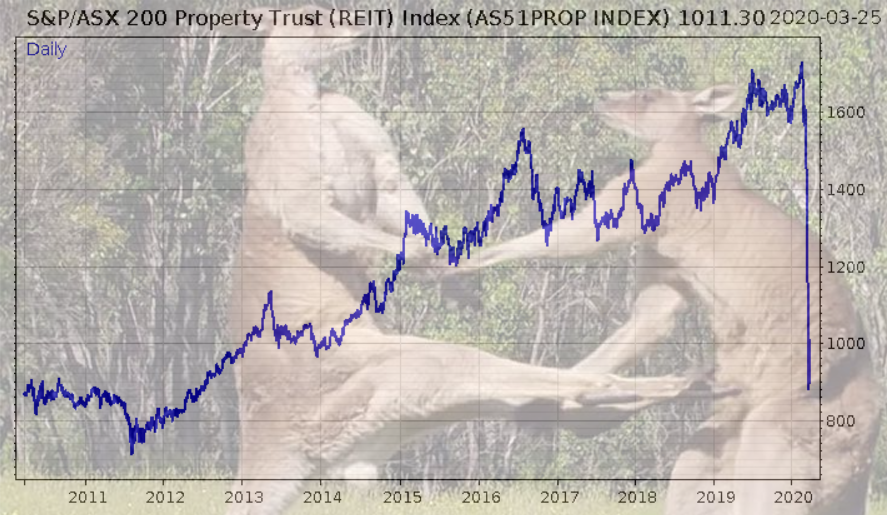

There are charts like this all over the place. Here’s the market for Australian real estate trusts, for investors who don’t actually want to go Down Under to get exposure to the raging property market the Aussies are famous for. It’s almost like a crime scene where investors have suddenly ripped out their capital and fled in a bloody mess:

Down under, Down under

Down under, Down under

Source: me, on Twitter

In recent days, investors have been rushing out of all their favourite risky assets… and bidding up the price of another.

All of a sudden, investors wished they were in Dixie. Or more accurately, the DXY.

The dollar index, or DXY, is a measurement of how valuable the dollar is against the other major currencies of the world, including the pound.

That sudden, dramatic spike makes me sceptical of the sudden “recovery” share prices have experienced over the last couple of days.

But let me start at the beginning of this. I’ve delved a little into this topic over the last couple of weeks, but let’s start a bit further out and provide a broader view.

Zugzwang’s trap

In the game of chess, there is something that’s known as zugzwang. It’s a very bad thing if it happens to you, but a very good thing if you can trap your opponent in it.

What “zugzwang” means, is to be caught in a scenario where the best course of action would be to not do anything – to not move any of your pieces. But of course in chess, when it’s your turn, you have to do *something*. So when you’re in zugzwang, whatever you do will put you at a disadvantage. It’s something of an unwinnable situation in the short term, which may end up losing you the game.

I believe investors may now be in a similar scenario. However, unlike in chess, for investors it is possible not to make any moves, even if it feels counterintuitive. Let me explain.

When I’m talking about investors being in an unwinnable situation, I’m actually referring to a statement made in an obscure academic paper published in 2014 by the Bank for International Settlements (BIS), commonly known as the “central bankers’ central bank”.

In the paper, called “The bank/capital nexus goes global”, the BIS claimed that “there may be no winners from a stronger dollar.”

This is because the global economy is full of so much dollar-denominated debt outside of the US. While the US might benefit from a stronger dollar in its imports, those imports are reliant on the health of foreign economies, which use significant levels of dollar-denominated debt. As a stronger dollar would make those dollar debts much more expensive, and damage those economies, in many regards it’s in the US’s best interest if the dollar remains cheap.

But controlling the value of the dollar is something else entirely. As it’s the global reserve currency and the most liquid currency in the world, investors flock to it in times of crisis, often not even realising it by simply selling whatever risky stuff they have, and holding cash instead – dollars. In this way, at times like this when stocks, and bonds, and gold have gone down in dollar terms… investors can avoid zugzwang and having to buy something that will go down in price, by simply holding dollars.

The scramble for cash as banks get margin calls and try to reduce their risk now affects all markets due to the interconnectedness of the global financial system. Large financial players will sell whatever they have wherever it is, from Sub-Saharan Africa to Southeast Asia in very short order if they face a funding squeeze and need to get dollars, and this cross-border capital flight is reflected in the DXY.

I believe what happens next for the DXY will dictate the fate of the global economy. A lower DXY will ease the global debt burden. A higher DXY, well… there won’t be many winners.

Zooming out a while, and the most recent spike in the DXY doesn’t look too bad:

However, this chart is deceptive as the quantity of dollar debt in the world has expanded greatly since the 2000s – so smaller increases in the DXY are causing larger tightening in the global economy.

And while the Federal Reserve is going to town with all manner of stimulus measures (while not specifically saying it wants to reduce the value of the dollar) those dollars may not actually solve the DXY problem at all. When the Fed started ramping up its repo facility – which permits banks to lend at very cheap short-term rates – to the trillion-dollar level, interestingly very little of the trillions offered were actually borrowed by the banks.

This appears to be because the banks are so constrained by the post-financial crisis regulations, that they cannot actually use the financing being offered; the “siloing” of bank departments mean funds collected in repo on one side of the bank cannot be used to stop funding liabilities on the other side from crumbling. Post-financial crisis regulations leading to the next financial crisis… the universe has a great sense of irony.

The bright side for the UK investor is that sterling, which used to have the problems the dollar does when it was the global reserve currency, no longer does. That’s why gold investors in the UK are up over 5% for the month, while American gold investors are actually down on the month amid the crisis.

But watch the DXY – I believe it will reveal whether or not the “recovery” being touted is actually real, or if the financial system is in the embrace of a boa constrictor. I think the DXY is going to get a lot stronger…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

PS I said we’d be taking a look through the mailbag today, but I ran out of space! We’ll do it tomorrow, I promise. Last orders… [email protected].

Category: Market updates