Have thieves snuck under your car, ripped out its catalytic converter and harvested its innards yet?

No? Well if I were you I’d be getting very protective of that grimy box under the chassis… for the precious metal within it is fetching an ever prettier penny. And the deceptively labelled “cat thieves” are out in force, with a penchant to pillage it.

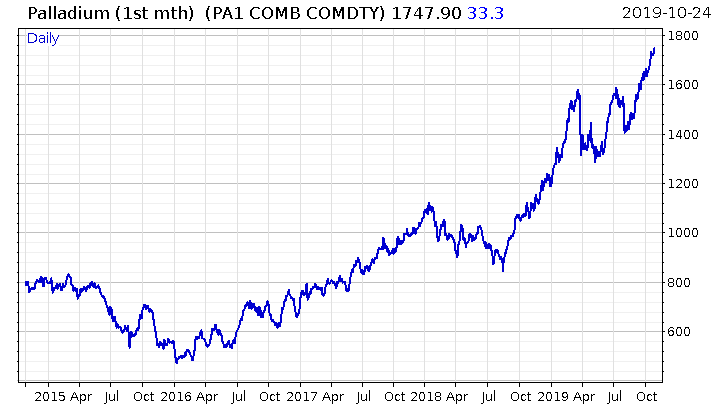

We wrote about how the rising palladium price was driving an increase in catalytic converter theft at the beginning of this year, and speculated that both would keep going up (There’s something under your car… — 21 February).

As expected, the situation has only gotten worse.

…or better, depending on your perspective. If I’m right, some investors stand to do very well out of it…

The catalyst for crime

There have been almost three thousand cases of catalytic converter theft so far this year in London alone (a nearly 100% increase on last year). The devices reduce the harmful emissions in exhaust fumes through a combination of precious metals, which are consumed by the fumes over time.

Interestingly, hybrid cars like the are more likely to be targeted for “cat theft”, as they produce less exhaust fumes (the Toyota Prius and Honda Jazz are a particular favourite apparently). Less exhaust fumes means the precious metals within the catalytic converter will be eroded less, and so yield a greater crop to criminals wanting to harvest them.

“Cat thieves” aren’t only ramping up their operations in the UK either. Google searches for “catalytic converter theft” are rapidly increasing globally:

Ultimately, what has brought about news headlines like this…

…is this chart:

In short, there’s just not enough palladium out there to keep up with demand. So if you own palladium that’s not bolted under a car, things are looking pretty good.

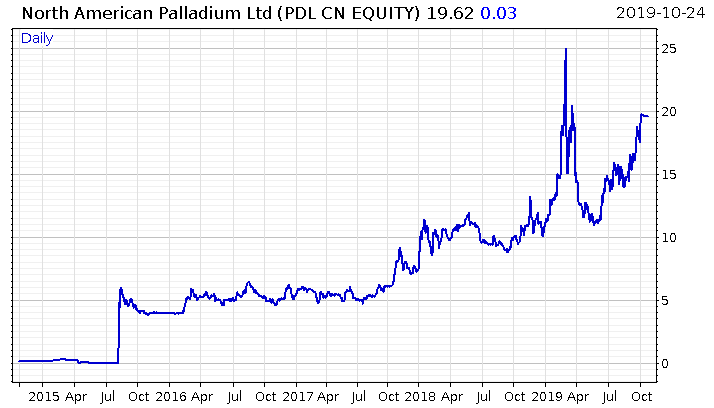

I’ve still not sold mine since I bought it in 2016. And though that chart looks parabolic and like it cannot go any further, I reckon it could have a lot further to go. And that includes the miners, which have been walking on sunshine recently:

Despite its name, Impala Platinum is a major palladium miner

Despite its name, Impala Platinum is a major palladium miner

The global supply of palladium remains very tight. From the Financial Times, at the beginning of October:

…the 7m ounces-a-year palladium market is set to remain tight unless there is an unexpected release of supplies.

Yet it is difficult to see where these supplies might come from. Russia’s Norilsk Nickel, the world’s largest producer, raised doubts last week about its ability to replenish its Global Palladium Fund.

Established in 2016, the fund helps stabilise the market, buying metal from various sources, including Russia’s central bank, and selling it to industrial customers. However, analysts believe that Moscow’s strategic stockpile of palladium — a key source of supply — is close to being exhausted, while other holders are reluctant to sell because they expect higher prices…

But that’s the supply side. What about demand?

Autoerratic resuscitation

When I wrote about palladium back in February, the main threat to its price was a fall in the auto market – the world’s demand for cars. Much of what’s been written about recent economic slowdown worldwide has centred around this sector, which has taken a pummelling since the beginning of 2018.

But it looks like the auto sector has bottomed, and is now starting to pick up again. This is $CARZ, an ETF which tracks a global car manufacturing index:

Chart courtesy of Pinecone Macro on Twitter. Note the last time the ETF hit a low. much of what’s happened in markets this year feels like a repeat of 2016: crazy bond yields, a rise in crypto and gold etc.

Chart courtesy of Pinecone Macro on Twitter. Note the last time the ETF hit a low. much of what’s happened in markets this year feels like a repeat of 2016: crazy bond yields, a rise in crypto and gold etc.

Bear in mind that palladium’s meteoric rise has occurred during this slowdown in the auto sector.

If demand for cars picks up now, and there still ain’t enough supply of palladium, we could see that palladium chart go ever more parabolic: after all, car manufacturers must install catalytic converters on their cars if they want to sell them, regardless of how expensive the metals within are becoming.

There is the possibility that they’ll come up with new converter designs that swap out palladium for the much cheaper platinum, but that takes time and the auto industry is wary of seemingly cheaper converter tech following the Volkswagen emissions scandal.

I remain bullish – let’s watch. And if you’ve got a Prius, maybe consider hedging the risk of a “cat thief” paying it a visit with some shares in Impala…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates