After Ireland and the PIGS (the most troubled eurozone nations), the next domino to topple in the great European debt fiasco will be France.

It’s run a budget deficit since the 1970s. Its government debt is nearly €2trn – 91% of GDP. It has an economically illiterate socialist loon in charge.

And, in order to flee crazy punitive taxes, all its entrepreneurs have left and gone to South Kensington.

Don’t touch France with a bargepole – right?

Think again…

Why political prejudices make for poor investments

I’m lucky enough to be a member of a secret club whose members – fund managers, analysts, economists, traders, strategists and the like – meet discreetly once every few months.

Over dinner, each of us is expected to stand and speak for two minutes on a financial subject of our choice – macro or micro. It could be an investment idea, a developing theme or trend, an interesting chart, a strategy, a potential opportunity, or a niche market. No touting for business is allowed.

Over the course of an evening you’ll usually hear between ten and 20 talks. With so many people from so many different fields analysing markets from so many different angles, there are always interesting ideas being thrown about and discussed.

Today, I’d like to share one of the charts from one of last week’s talks with you.

Let me start with a simple question. Given the choice between investing in the French or the German stock market, which would you go for?

My instinct – perhaps prejudice is a better word – is that the investment case for Germany is considerably stronger than the one for France. Germany runs a budget surplus. Its manufacturing is without equal both in terms of quality and output. And its people don’t stop work every day for three hours at lunch.

France, on the other hand – well, you’ve already read what I wrote at the beginning of the article.

What’s more (here’s prejudice number two), we all know that conservative governments manage economies better than the left – don’t they? Right-leaning governments tend to rein in their spending, and they don’t impose 75% tax rates on top earners. Therefore, stock markets should do better under right-wing governments.

With France currently just one year into a socialist government, and Angela Merkel’s conservatives the dominant force in Germany for some time to come, all my prejudices say that Germany’s a far better bet.

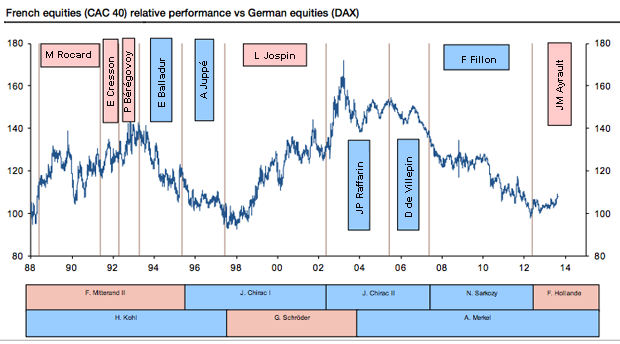

So the following chart slapped your bigoted author right in the face. It shows the ratio between French equities (CAC 40) and German equities (DAX) since 1988. In other words, it shows the relative performance of the two – which did better. In addition it marks the political leanings of the French prime minister of the time – pink being left wing, and blue right wing.

When the blue line is rising, French equities are outperforming German. When the blue line is falling, German equities are outperforming. (The chart is originally from a SocGen research note of August 29, from the asset allocation team headed by Alain Bokobza).

So since 2003, the DAX has outperformed the CAC 40 (while the French had right-wing leaders). But from 1998 to 2002, under the left-wing Lionel Jospin, French equities outperformed (although Germany also had a left-leaning leader at this point).

In fact the consistency with which French equities outperform German with a left-wing (pink) prime minister and the consistency with which they underperform with a right-wing (blue) prime minister is pretty amazing, at least in my view.

Of course, while this is an interesting correlation, there is way more to it than the political leanings of French and German politicians. And obviously, there’s the wider state of the global economy and the general direction of global markets to consider.

Politics aside, this could be a very profitable trend

But politics aside, more importantly I see an index that, after a downtrend of many years, has made a low and retested it. Now a trend is starting to develop in the opposite direction – that of French stocks outperforming German ones.

It’s always nice to get in at the start of a long-term trend. So is this one likely to continue? I’ve been digging a little deeper, and I think it looks promising.

The performance of the German DAX index over the last 15 years has been fairly similar to that of the S&P 500. It hit an all-time high in 2000, then crashed with the tech bust. There was another bull market from 2003, and the highs were re-tested in 2007. Then the 2008 crash came.

We then had the rally from 2009, and those highs were re-tested earlier this year. So give or take a few points, the DAX is at a record high again.

But the performance of the French CAC index has been rather different. Yes, it traded in the same general direction as equities worldwide, but its 2000 high of 6,945 has never been re-tested. In 2007, when the DAX, the FTSE 100 and the S&P 500 were all re-testing their 2000 highs – and the Dow was well above them – the CAC was languishing at 6,170.

When this year’s re-test came, the CAC was still wrestling with its 2011 highs at 4,170. Here we see the CAC since 1990.

In other words, it is been a lagging market and there’s plenty of potential catching up to be done. France, despite everything, is still one of the world’s biggest economies. With no end to quantitative easing in sight from the Fed, and the potential for more action from the European Central Bank now that the German election is over, maybe we’ll see a so-called ‘dash for trash’ – with the CAC a beneficiary.

And if there’s a slump, the CAC would be falling from lower heights than the DAX. So it could still outperform – even if it’s just because it falls less heavily than the German index.

So what’s the way to play this?

I suggest a simple pairs trade: short Germany and long France. You bet on the DAX to fall and the CAC 40 to rise. So if both markets fall, as long as Germany falls harder than France, you profit. If they both rise, then as long as France rises faster than Germany, you profit.

The easiest way to do this is by using a simple spreadbet or a contract for difference (CFD). Clearly spread betting is very risky – you can lose more than your initial stake – so make sure you know what you’re doing before you attempt a trade like this.

With pairs trading, it’s important to get the ratio right. At present with the DAX at around 8,600 and the CAC at 4,200, the DAX is roughly twice the CAC. So roughly speaking, in spread betting terms, for every £1 you were short the DAX, you’d be long £2 on the CAC.

Oh, and just a heads up – the World MoneyShow is coming back to London very shortly. My colleagues Tim Price and John Burford will be there, and other big names including Jim Rogers will also be attending. It’s at the Queen Elizabeth II Conference Centre, from 8-10 November – and it’s free to attend! All you need to do is register here now.

Category: Market updates