Ayn Rand famously declared that “We can ignore reality, but we cannot ignore the consequences of ignoring reality”.

Escaping reality is big business, and likely always will be. Even during Oliver Cromwell’s Puritan cultural purges, people still risked going to the theatre in search of comedic relief.

Today, the escaping reality business has never been better. People lose themselves in Hollywood movies, Netflix tv series, triple-A video games, and articles asserting that socialism does in fact work, it just hasn’t been implemented correctly yet.

While I hope you are entertained by my daily scribblings, our goal at Southbank Investment Research is not to escape reality, but to dig deep enough into its weeds to figure out what’s really going on, and how you can apply that knowledge, that gnosis, to your financial advantage.

In short, we are trying to find out what truths, what reality is everybody else in the investment world ignoring? And what will the consequences of that be?

Or to make it even shorter: what is reality? What is actually going on?

I spoke to a chap last year who works in private intelligence – something of a “spy of fortune”, if you will. He wasn’t exactly a James Bond character – though he was very well travelled (I have my doubts about his claim that Sudanese date gin is superior to whisky, though I need to investigate further), and he was even better informed.

This chap goes to considerable lengths to maintain his edge and be sure of what’s actually going on in the real world, bypassing all the noise from journalists and secondary sources who might have an agenda. For example, he owns a shipping company, for no other reason than to be informed of who is ordering what, from where to where, and in what quantity. Leaders and businessmen can talk of future plans and make promises as much as they like, but unless they’re incredibly well geographically located, if they want to make good on what they say, it’s likely they’ll need something physical shipped in from abroad.

This knowledge of cargo gave him valuable insight during the eurozone’s sovereign debt crisis. He discovered that a large shipment of cotton used to make banknotes was in transit with a final destination of Germany. Through a contact, he discovered that a large quantity of unstamped blank coins were also on their way across the oceans, with Deutschland as their final destination, and was one of the first outsiders to realise that Germany was having Deutschmarks printed and minted, in preparation for the total collapse of the euro.

Unfortunately, Southbank Investment Research does not own a shipping fleet (not yet, anyway – Southbank Shipping Solutions, S.S.S, does have a nice ring to it…), so we have to make do with other tools to scry the future.

Prices have classically been a great way of figuring out what’s going on beneath the noise and displaying reality. As so many socialists, communists, etc, lack the brain or willpower to understand, prices are more than simply what a vendor charges a customer.

Within prices lie information, derived from all of the costs it took to create and distribute a product or service, as well how abundant or scarce said item is now, and the likelihood of that scarcity/abundance continuing in the future. Prices act as a communication mechanism stretching all the way through production to consumption, with each link in the chain both influencing and reacting in their own self-interest to changes in price.

Commies, state planners, and big government types in general neglect the automatic efficiency of this magnificent system at their peril. If, for example, the state nationalises the production of grain to distribute food as they like (“in the interests of the many, not the few”, etc etc), they destroy this efficient information-sharing system, and nobody knows the true value, the true price, of that grain any more.

All the state can do is rely on past prices and past trading activity to gauge what current demand for grain might actually be and then estimate the labour cost of meeting that demand. This is a flawed venture from the get-go as the future is inherently unknowable; as the state so ironically forces financial firms to state: past performance is not indicative of future results.

The inability of the state to adapt to changes in conditions the way free markets do through prices, amplified by the corruption and inefficiency socialism inevitably breeds, helps explain why zoo animals end up becoming protein sources in commie countries.

And so it’s through prices that we try to cut through the noise and discover what is really going on. But even prices these days are not what they used to be, as state planners in central banks are locked in an endless struggle to make those prices higher. It’s like trying to measure something, while somebody with a monopoly over rulers and tape measures changes the definition of a mile, a yard and an inch every day.

Tricky – but try we must. For while prices can now be very deceptive, and spread misinformation throughout the market, they’re not totally useless. The direction of travel can still be ascertained.

As we mentioned at the beginning of this piece, ignoring reality has become extraordinary good business. Investors in Western entertainment have roughly quintupled their money over the last decade:

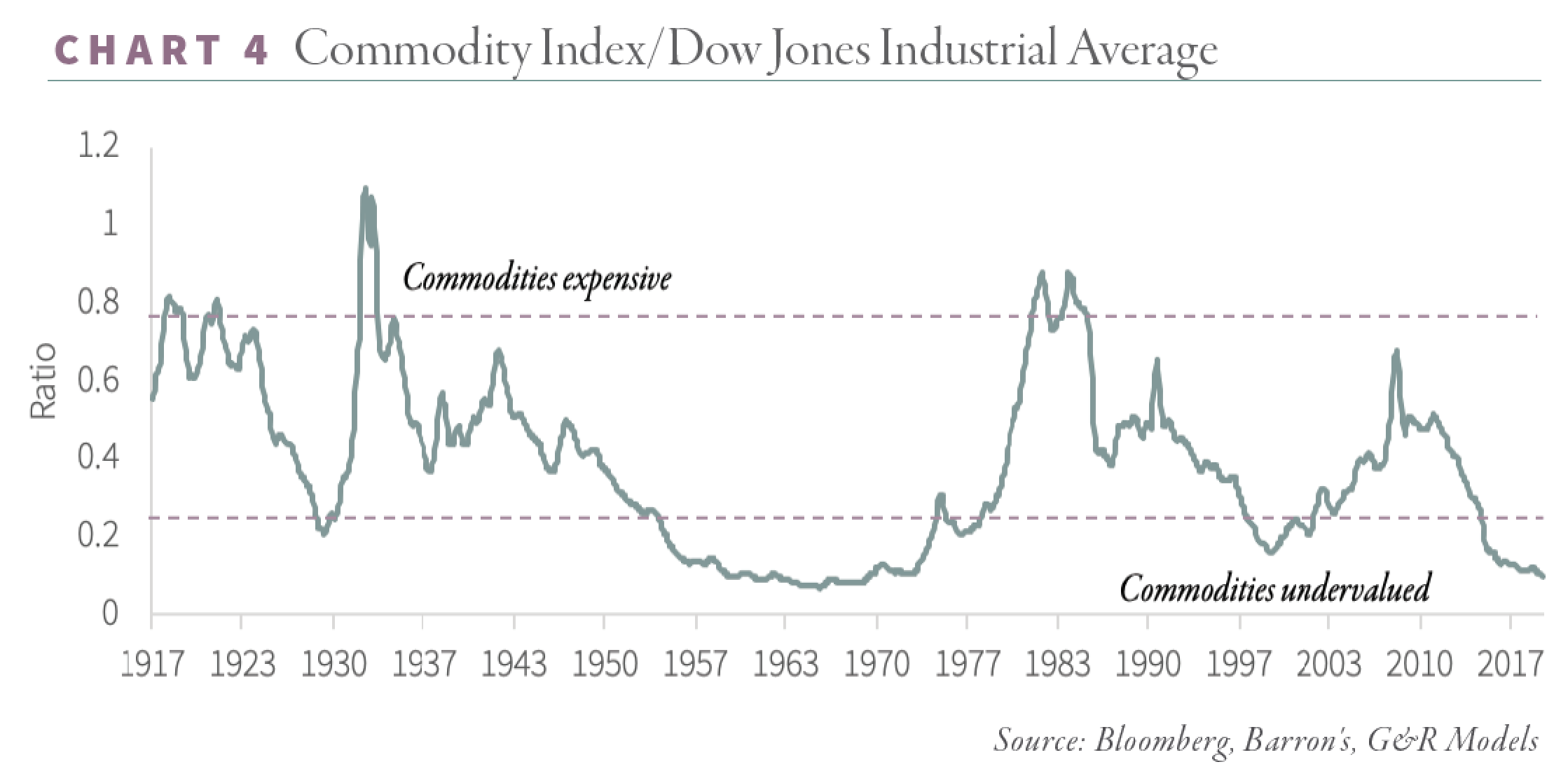

But while investors have been focusing on escaping reality, pouring their cash into Hollywood and video games, they’ve ironically been ignoring investment assets that are as real as real can get: commodities.

But while investors have been focusing on escaping reality, pouring their cash into Hollywood and video games, they’ve ironically been ignoring investment assets that are as real as real can get: commodities.

Oil. Iron. Copper. Coal. Not lights on a screen, or music on a playlist, or a video character endlessly respawning. Solid and simple pieces of reality you can hold in your hand, basic inputs on which the world rests.

The fruits of the earth, shunned and ignored as investors have tried to shrug off such earthly, beastly objects.

But ignoring reality, as Ayn Rand famously said, has consequences. And as we’ll explore tomorrow, the fringes of the commodities market have begun roaring back to life…

But ignoring reality, as Ayn Rand famously said, has consequences. And as we’ll explore tomorrow, the fringes of the commodities market have begun roaring back to life…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates