What’s worse than finding a worm in your apple?

Being eaten by it.

And I’m not talking about the worm.

Bigger than BMW… Volkswagen… Daimler… Adidas… Lufthansa… Siemens… and 24 other titans of the German economy…

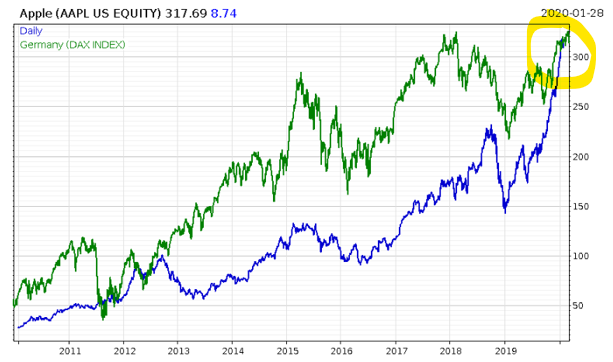

$AAPL is now bigger than all of them combined. With Tim Cook at the helm, Apple’s valuation is now greater than $1.35 trillion, surpassing the market cap of Germany’s 30 largest companies, the entire DAX index:

Apple (blue) overtakes the DAX (green)

Apple (blue) overtakes the DAX (green)

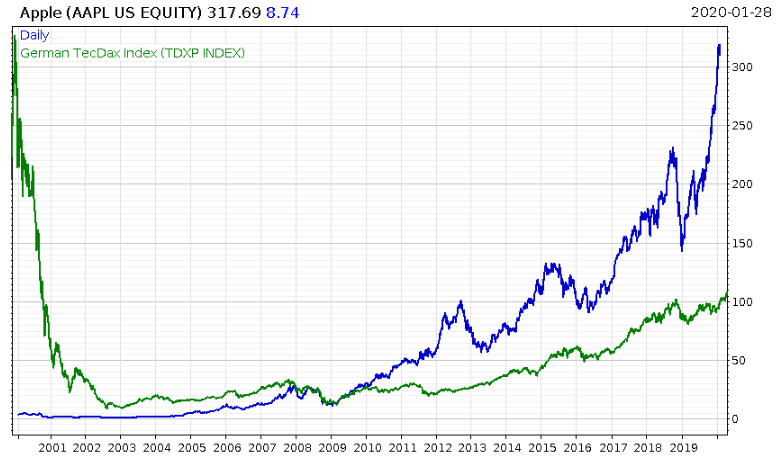

Once upon a time, investors believed in German, and indeed European tech companies – but that was in the dotcom boom. Since then Silicon Valley has devoured them all. Just look at the performance of the German tech sector in green below, the TecDAX index. Charted against Apple, it almost looks symmetrical:

There is a component of financial engineering involved in Apple’s supremacy. The company has bought back some $319 billion of its own stock over the past seven years, a sum greater than the market cap of 490 of its peers in the S&P 500.

But there’s a reason Apple has access to that kind of capital: the company knows how to make money. As Apple bites into them, the Germans are afraid they are being cored. From the Financial Times, emphasis mine:

… although profits and exports remain strong, there is a sense of malaise among many German business leaders and politicians that a new industrial era based on software and data is passing them by.

“The big picture story is that we have missed the train on technology — the sector that is dominating the 21st century,” says Carsten Brzeski, chief economist for ING Germany. “The next 20 years will be dominated by ecommerce, the internet of things and artificial intelligence. In all of these things, Germany is running behind.”

Some leading German executives also worry that Silicon Valley tech companies could swallow up significant parts of German industry because of their immense scale.

Way back in 2011, Marc Andreessen, the innovator behind the first widely adopted internet browser (Mosaic) and since venture capitalist, penned a piece for the Wall Street Journal in which he claimed “software is eating the world”.

The incredible rise of Apple and how powerful its stewards have become is testament to that statement. But what Andreessen went on to say later in that piece was just as prophetic:

Today’s stock market actually hates technology, as shown by all-time low price/earnings ratios for major public technology companies. Apple, for example, has a P/E ratio of around 15.2 — about the same as the broader stock market, despite Apple’s immense profitability and dominant market position…

But too much of the debate is still around financial valuation, as opposed to the underlying intrinsic value of the best of Silicon Valley’s new companies. My own theory is that we are in the middle of a dramatic and broad technological and economic shift in which software companies are poised to take over large swathes of the economy.

More and more major businesses and industries are being run on software and delivered as online services — from movies to agriculture to national defense. Many of the winners are Silicon Valley-style entrepreneurial technology companies that are invading and overturning established industry structures. Over the next 10 years, I expect many more industries to be disrupted by software, with new world-beating Silicon Valley companies doing the disruption in more cases than not.

…while people watching the values of their 401(k)s bounce up and down the last few weeks might doubt it, this is a profoundly positive story for the American economy, in particular. It’s not an accident that many of the biggest recent technology companies — including Google, Amazon, eBay and more — are American companies. Our combination of great research universities, a pro-risk business culture, deep pools of innovation-seeking equity capital and reliable business and contract law is unprecedented and unparalleled in the world.

The man was well ahead of his time, and has a bank account to show for it. Almost everything is now widely accepted. Nobody cares about P/E ratios for tech companies any more (Apple’s is now over 26) – even if they should be. And while China has been in the unicorn breeding business, the US still leads the way.

Angela Merkel fears Germany will become the world’s “extended workbench”, just a cog churning out other people’s final products with little agency.

The all-consuming, all-devouring power of tech has let a single American company put German industry to shame.

But… as disruptive as Apple has been, that doesn’t mean it too won’t be disrupted. Indeed, its colossal size and near-monopoly status invites it to be. Austrian school of economics argues that no monopoly or cartel can exist without state help, as the economic incentive for somebody within either to break ranks and create a more efficient product or service on their own (and thus earn a higher reward) becomes too great.

So what will be the next disruptive force of innovation to devour and consume established norms and titans of business? What will “eat” the future world?

Perhaps we’re looking in the wrong direction. Perhaps the limelight on the likes of smartphones and home computers where Apple has cut its teeth, is not where the next disruptor lies. Maybe the next wave of technological advancement is occurring in the dark somewhere away from domestic electronics

But as Sam Volkering was telling his subscribers yesterday – the revolution will be within money itself….

Can you feel it? It’s bubbling under the surface. That little feeling you get where you know you’re on the cusp of something big.

That murmur you hear around you from those who are quite suddenly interested again when they laughed at you just months ago.

You know what I mean. Those sniggers and sneers when you even mentioned the word “cryptocurrency”. When people dismissed everything you might know or tell them because they are, were, simply uneducated.

But they’re sniffing about now. The interest is creeping back into the crypto space. They’re realising this wasn’t a fad, this wasn’t a flash in the pan. They’re starting to see this could be one of the biggest wealth-creation events in the history of the world.

And while they sniff and sneak about wanting to know more, coming to the market for the first time even, you’re here, primed and ready to go…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates