We went from a 2008 collapse to a 1999 stock bubble in under three months.

– Chris Cole, Hedge fund manager earlier in the week

Late last year, our publisher Nick O’Connor asked all of us editors at Southbank Investment Research to make a few predictions as to what would happen in 2020. We recorded a few of these in an interview format, called them the 20/20 Visions series, and they went out over Christmas.

It feels like a different epoch now. But anyhow, back then I reckoned we were on the cusp of a colossal market melt-up, with every major central bank gunning the printing presses in an attempt to keep the economic expansion going, on top of an already incredibly strong equity market bull run (in the world’s biggest stockmarket – the States – at least).

There had been too much agreement amongst the market commentariat in autumn that the curtains were closing and the bear was ambling into the theatre. As bear markets and stock crashes don’t occur when everyone is expecting them too, it was time to expect the unexpected to my eyes – a brutal “last hurrah” move higher.

January and February rolled around, and it looked like my prediction had legs. Even the news of the WuFlu spreading around the world was met with lower volatility and higher stocks. Crypto was getting juiced. Gold was going up. Platinum group metals, another of my favourites, was soaring high. The crescendo of money printing seemed to be lifting almost all assets…

And then March came around. Pretty much everything got whacked for six, and with the global economy now jammed to a halt, it was looking like the melt-up thesis I had envisioned lay in tatters.

And yet here we are, three months later, and the Nasdaq has just hit 10,000 for the first time – a new all-time high, with a nice round number to boot. For the an index full of technology companies, things are even better now than they were when “corona” just meant bland lager…

The other US indices, the S&P and the Dow aren’t all that far off their all-time highs. Could my original prediction still hold water?

Like I said yesterday, all of this crazy action strikes me as a sugar rush that’ll wear off. Sports gamblers have been moving into the stockmarket now the football isn’t on. Kids are trading stocks and options like this is all just a big video game.

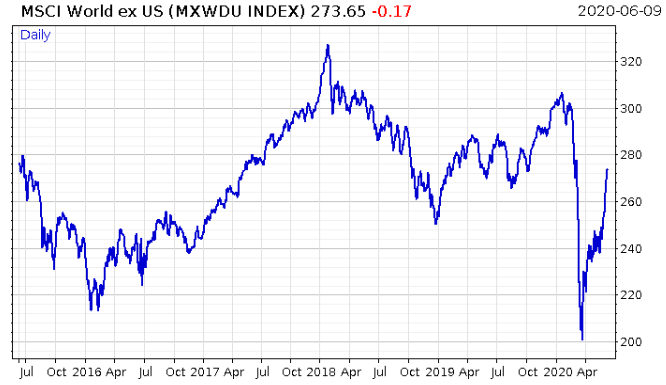

And outside the US, there sure as hell ain’t a melt-up going on. The MSCI World ex US Index, which represents the global stockmarket outside the US of A, isn’t anywhere close to its last all-time high, which it hit at the beginning of 2018:

Even when you add the US stocks back in so the index just shows you the global stockmarket, it’s still a fair bit off:

But if it keeps getting crazier in the States, I’ll need to start reconsidering my melt-up thesis.

As I mentioned yesterday, one of our publications here at Southbank Investment Research has been absolutely rinsing the crazy rallies we’ve seen in some stocks since March. James Allen and Kit Winder over at Exponential Energy Fortunes have been absolutely coining it for their subscribers, with some absurd gains being made.

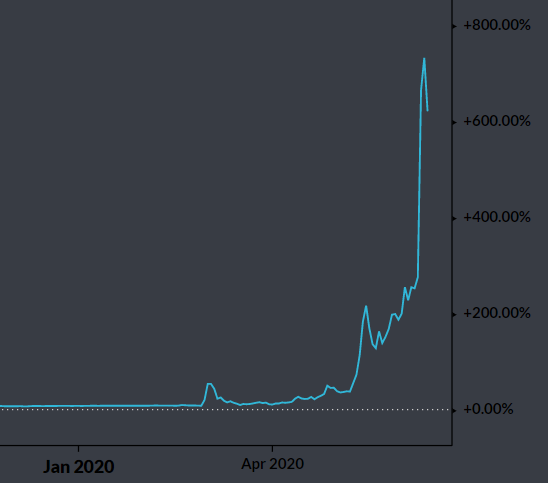

Here’s a chart of Nikola Corporation ($NKLA) which James advised his subscribers to buy back in March:

Source: Koyfin

Nikola is in the business of making hydrogen-powered trucks. It too was inspired by Nikola Tesla, though should not be confused with Elon Musk’s Tesla ($TSLA), its rival in the electric vehicle space.

It’s an interesting company with a compelling plan to bring efficient renewable energy power into the trucking space. Operating on the auto-frontier, it’s also very risky – the business has yet to generate revenues yet, let alone positive earnings. But taking all that into consideration, James still believed the company had a bright future, and gave his thesis to his readers back in March.

From then on, things got wild. $NKLA became a darling of the speculators who seem capable of pushing stocks to absurd altitudes at the moment, and when James told his readers to sell earlier this week, the company was rivalling the likes of Ford, Fiat, and General Motors in valuation – despite the company not even beginning to turn a profit or pay a dividend. The play certainly paid the bills for his readers though – they’re sitting on a 593% gain now.

James, in his classic modest fashion, actually felt bad about the gains coming so soon. As he told subscribers in his note to sell the stock:

It’s a shame, because I was expecting Nikola to be a long-term hold, maybe reaping us as much as a few hundred per cent gain or more over the next year or two.

But to be in a position to bank nearly 600% in just three months, well, on reflection I don’t feel comfortable looking a gift horse in the mouth…

This kind of dynamic sounds similar to the dot-com boom, where companies with solid growth prospects (and many which did not) reached crazy valuations thanks to the excitement over new technology coming to market. When the crash came, even those which did end up remaking the world (like Amazon) still got wrecked, only to regain and overtake their former vast value a few years later. The promise the technology held was imagined too early by investors.

Perhaps a similar dynamic will repeat for companies like $NKLA, with a crash when the speculative money runs out, but the company surviving, thriving and regaining its currently inflated value in the years following when it actually start delivering on its promise, and we actually see Nikola Badger trucks prowling the streets.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates