Look into the camera. Hold the sign up in front of you.

Keep the sign there, and now turn your head to the left.

And now to the right. Good.

Getting your mugshots taken in this manner feels like you’re about to be put in prison.

I just wanted my keys to the crypto market back.

The long weekend has been a damn wild one, and not just for European politics. Somebody, somewhere on Sunday evening, decided that they wanted to buy bitcoin. A lot of it.

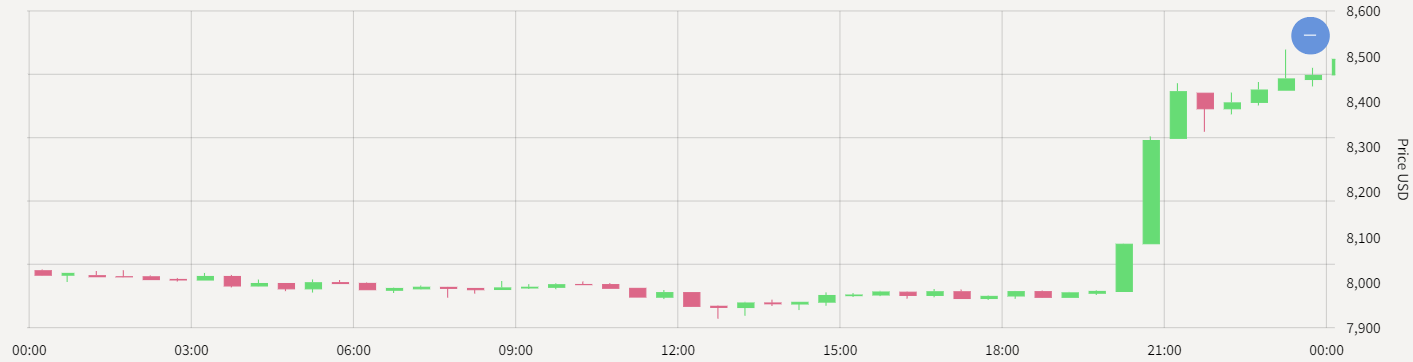

This is a chart of the bitcoin price in USD for that day, divided into 30-minute candles.

I was watching the price action as it happened, as I recently increased my BTC holdings, and was contemplating moving more money into “alts”, or “altcoins”. (These are cryptocurrencies other than BTC which can provide much higher returns during periods where the BTC market is strong.)

Bitcoin looked had been slowly falling from the $8,000 mark throughout the morning, until in the early afternoon the tide turned, and it slowly crept upward again.

When it reclaimed $8,000 territory, the psychological sunlit uplands, something happened. Either a large order was automatically triggered, or somebody bought hard.

The European election results went to the back of my mind as I watched an ever larger green candle fill the chart. The price jumped 300 bucks in an hour, and carried on moving up from there. It’s around $8.7k at the time of writing.

It’s feeling like a new bull market for BTC is ahead. And when BTC flies, the alts soar, or to use crypto parlance, the alts “moon”. I’ve been loading up on a few of them accordingly, though only with capital I’m prepared to see evaporated – the crypto space is still one of the riskiest markets out there.

Though that’s not to say the market hasn’t matured at all. As I went about my small altcoin buying spree, I logged into an old account I opened ages ago with a reputable American crypto exchange, only to find it had been suspended!

If I wanted to use it again, it demanded mugshots of me holding my passport and a handwritten sign with the name of the exchange and the date. The front of my face wasn’t good enough either – they wanted left and right profiles of my head. If I didn’t trust the exchange, I would have thought it was trying to frame me for a crime…

But the law has caught up with crypto, and it’s becoming harder and harder to find exchanges (in the West at least) that don’t ask for ID documents to vet users in keeping with money-laundering laws. Even on peer-to-peer exchanges like Local Bitcoins it’s much harder to buy bitcoin without proving who you are, especially if you’re buying in size.

If you’re interested in making any crypto investments, or even if you think you might be interested in doing so in the future, I’d recommend setting up an account now with a reliable crypto exchange that takes fiat currency (like Coinbase). Vetting you to make sure you’re not a money-launderer takes time, and the more traction this bitcoin rally gets, the more applications they’ll be deluged with.

Conversely, if you’ve had accounts with such exchanges for some time, I recommend you log in and make sure your account hasn’t been frozen like mine, and that you can still deposit and withdraw funds as freely as you would like.

That’s all from me for today.

Tomorrow, we’ll connect the dots behind this sudden move higher for crypto, and ponder how long this “mid-Sunday’s pipe dream” will last…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates