Let’s start the day with a correction. And not just the stockmarket kind.

In Monday’s Capital & Conflict I told you Italy’s Target2 balances had hit a record last month. But they only remained near record levels instead. Thanks to sharp-eyed readers for picking up on that and emailing in.

Now to the other correction taking place.

Overnight, Italy’s government decided not to amend its budget. According to the country’s prime minister and deputy prime minister, the letter they’ve sent to the EU refuses to make amendments to the whopping deficit.

This means the deadline has passed and the ball is back in the EU’s court. What’ll it do about the violation of EU spending rules?

For a while, a compromise had looked possible. There was some talk about the Italians admitting to lower economic growth. Because the proposed budget deficit is measured as a per cent of GDP, forecasting lower GDP growth would mean less actual spending.

If you’re confused, don’t worry. We’re talking about adjusting anticipated government spending, anticipated tax revenue and anticipated economic growth. None of this has anything to do with reality. Nor does it tell you what’ll actually happen in the end anyway.

The Italian budget battle gets even more confusing when you consider the fines the EU could impose on Italy for its budget belligerence. The fines are expressed as a percentage of GDP too. 0.2% of forecast GDP is the most commonly mentioned figure for possible sanctions.

In other words, the Italians and the Europeans couldn’t even agree on the appropriate size of the fine, let alone whether there should be a fine, let alone what the fine should be for. All because they can’t agree on their GDP forecast, which will be wrong anyway.

Not to mention the ironic fact that fining Italy only makes the problem it is being fined for even worse. If debt and spending is your problem, then borrowing money to pay a fine is not very helpful.

The financial markets looked at all this and decided they didn’t like it. The Italian stockmarket is down heavily as I write this. And Italian bonds are tumbling too. But we’re not yet back to the Bloody October levels of crisis I warned you about in August and September.

So what happens next in the budget battle? I’m working on answering just that question in Zero Hour Alert. My book lays out how and why Italy is destined to default and drag the euro down with it.

But we now know more of the specific dates on which the EU could take action against Italy. And on which dates other key players might make their move too.

Each of those days could unleash the next round of market plunges.

Zero Hour Alert readers need to be ready. The next few months are going to be a bumpy road.

But enough about Italy, for now. Today I want to talk tightrope walking.

Time to get a safety net

I was once a circus performer. And instructor.

I can teach flying trapeze in English, German, French, Thai, Korean, Japanese and Chinese.

The first thing you learn in the circus world is very helpful to investing. Always have a safety net. And learn how to fall in it properly. Before you do anything else.

The first time one of my coaches stood up on the board of a flying trapeze rig, his mentor immediately pushed him off. The seven metre drop to the safety net gave him enough time to make sure he landed safely on his back. And that ability and lesson is what kept him safe from then on. Because everyone falls.

In fact, each time you learn a new trick in flying trapeze, you first learn how to take it to the net consistently and safely. Once you’ve proven you’re extremely good at failing, the catcher is willing to get up in his swing and try to catch you.

But the timing is different for each and every person, so it usually takes a few more missed catches and bounces in the net before things work out.

Flying trapeze training sessions and flying trapeze performances look very different. Flying trapeze artists spend more time in the net than in the air.

So what are investors supposed to learn from all this?

It means learning to fail, and learning to manage that failure, before you succeed. Deliberately.

Things like using stop losses, defensive asset allocation, proper diversification, risk management, being able to profit from falling stocks, dummy trading, and having some of your wealth outside the financial system. These are crucial tools to protect yourself. You need to know how to use them.

There’s one asset which covers a whole bunch of those safety net features. Gold.

Buying gold is so unpopular with the mainstream investment industry because it’s an admission that things can go badly wrong. A flying trapeze performance would be much more exciting without a net. But anyone who has tried flying trapeze without a net will tell you it’s not much fun and looks terrible. It’d feel like you’re naked at work. Your job performance would suffer immensely.

Which is why the trapeze artists who have flown without a net tend to do so under the influence of alcohol after a hard day setting up most of the rig.

As in the circus world, in investing, things do go terribly wrong. Stocks crash, banks go bust and countries default. The models professional investors use suggest these events are so unlikely that it doesn’t pay to worry about them.

But that’s what makes worrying about them such a good idea. It creates an opportunity that the most powerful players in the market ignore. And the best way to take advantage of this opportunity is gold.

It’s time to buy gold

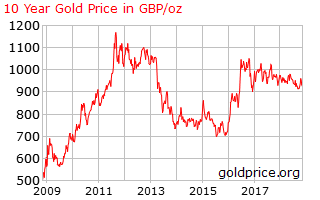

Gold has had a miserable few years of investment returns. Despite huge amounts of quantitative easing being pumped into the system, the gold price only trundled sideways.

In the UK, the pound’s Brexit tumble in 2016 is the only thing that gave British gold investors something to cheer about.

Source: Goldprice.org

Source: Goldprice.org

Gold’s ability to generate profits from a falling pound is in and of itself useful. But I’ve written about that before. I call it the gold quadrants effect.

There’s a different reason why now might be the time to buy gold.

Gold does well when real interest rates are falling. When inflation is rising faster than monetary policy can keep up.

In the run-up to the global financial crisis, gold had an enormous bull market. A bull market which made our publishing company’s founder wealthy and his writing about gold renowned.

We may be entering the same sort of market. A world where central bankers struggle to keep up with rising inflation. Because if they raise rates too fast, they’ll trigger the next crisis. So they’ll err on the side of sluggishness.

The world has taken on huge amounts of debt. Interest rates can’t go up much without that debt becoming unaffordable. This could leave us with an inflationary surge that can’t be reined in.

That’s an ideal environment for the gold price to surge.

Usually, you read about gold as a crisis hedge in Capital & Conflict. And yes, the gold price can perform well when other assets are tumbling. Not to mention you can own gold safely outside the financial system.

What I’m trying to show you here is that gold could be a good investment in coming years even if you don’t believe there will be a crisis. The sort of crisis I’m predicting.

Gold is like the safety net under the central bankers’ tightwire act. It doesn’t matter which way they fall off, gold still has you covered. Inflation or financial crisis, gold will benefit.

Until next time,

Nick Hubble

Capital & Conflict

Category: Investing in Gold