It’ll be a short note from me today – I’m just about to chat to a world-renowned gold insider for our 2019 Gold Summit. If you’ve not claimed your ticket yet, I recommend you do – we’ve got a terrific line-up in store, and it’s all going live next week. You don’t need to be nuts for precious metals either – we’ve room for pure speculators too. Grab a ticket here.

The gentleman I’ll be meeting today has a knack for finding out what’s really going on in the gold market by measuring it against dozens of other assets (including beer). Investors generally think of gold in fiat currency terms – how many pounds or dollars a gram or troy ounce of gold costs. But for the devout gold bugs, this is back-to-front: you should be counting how many pounds or dollars you can buy with your gold.

With that in mind I’ve been taking a look at the purchasing power of paper money compared to gold over the last year. This effectively means just inverting a gold price in different currencies, but it provides an interesting change in perspective: it lets you see how gold performs as a store of wealth, rather than as a financial speculation.

Looking at gold through this lens you discover that a surprising number of currencies have begun falling into a golden abyss, starting last year. And not just the sketchy ones either, like the Venezuelan bolivar or the Iranian rial – the “safe havens” are losing their lustre relative to gold too…

Swiss francs, those fancy vertical banknotes which investors flock to in financial crises, began losing buying power against gold in September:

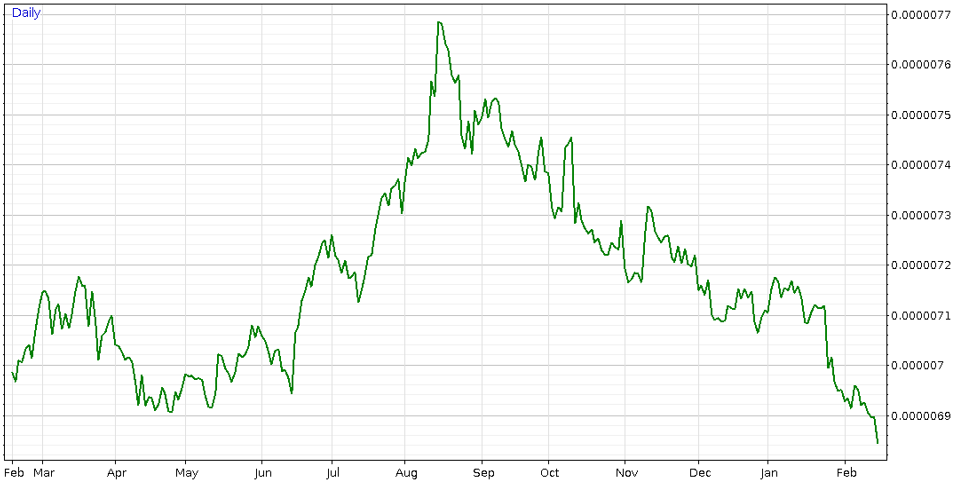

The Japanese yen, another “safe haven” currency, is also losing its purchasing power against the yellow metal:

Here in Blighty, the same event is occurring, except it gets blamed on Brexit:

Traders and large financial institutions are no doubt making big bets in the currency markets over Brexit. But the rise of gold since late last year against other currencies, particularly the safe havens, tells me something else is afoot. I reckon the gold market has pricked up its ears to the sound of money printing slowly drawing loser on the horizon. But I’ll have a chance to ask an expert today – and you can find out watch what he says next week at The 2019 Gold Summit.

One last chart before I leave. Last year, my colleague Nickolai Hubble predicted the euro was going to enter serious flux during what he called “Bloody October”. Right on cue, that’s almost exactly the right moment when the purchasing power of the euro compared to gold got shredded:

For the euro, this golden abyss is deep indeed…

To discover Nickolai’s next prediction, click here.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Investing in Gold