SODERMALM, STOCKHOLM – Following on from yesterday’s rather alarming chart, I thought I’d continue today with another one, this time courtesy of Charlie Morris over at The Fleet Street Letter Wealth Builder.

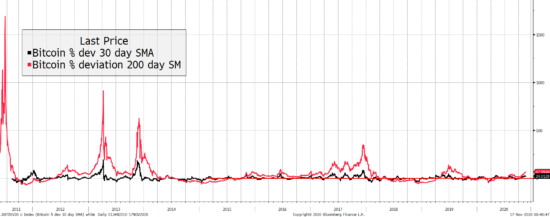

What you’re looking at there is not the price of bitcoin, but how much its price is deviating from its short- and long-term average (30-day moving average in black and the 200-day moving average in red). To put it in simpler terms, a chart like this will tell you if recent behaviour of an asset is out of the ordinary.

And in this case, the recent behaviour of bitcoin is not deviating far at all from its trend. $7k at the beginning of this year, and above $16,700 as of this morning? Positively ordinary…

I dunno about you, but I find that pretty unsettling. For it suggests (to me at least) that if this bull run continues, that we’ve yet to see the really frothy action arrive in the market – when speculation gets out of hand and prices become unsustainable.

Here’s the same chart zoomed in a little more. In terms of trend, bitcoin was misbehaving a lot more last year than it has been in 2020…

When tech began soaring through the lockdown, I wondered if bitcoin would get juiced, as it’s like an internet stock on steroids. While bitcoin did go up, its really big recent moves have occurred late in the tech rally.

Charlie has had the wily idea that to understanding bitcoin’s relationship with tech companies, is to simply price tech companies in bitcoin, and then see what the chart looks like. If you look at it through this lens – using the Nasdaq 100 as a proxy for tech – you can see bitcoin recently broke ahead in a big way:

Source: Bloomberg – bitcoin relative to Nasdaq futures past three years

Source: Bloomberg – bitcoin relative to Nasdaq futures past three years

Here’s what Charlie had to say about it:

Although it is still early days, we can be fairly certain that tech is a bubble, yet bitcoin isn’t. However you measure it, tech is highly valued and the reopening of the economy will cement 2020 as the year of peak growth. In contrast, bitcoin is growing rapidly and I would estimate the trend growth rate to be 86% per annum.

The three-year consolidation following the price surge in 2017 is over. Bitcoin has found its feet, and a new bull market is underway. Just as investors flock to gold when they see it outperforming the stockmarket, I believe bitcoin will attract capital from tech; and there is plenty of it.

I believe the incubation or experimental stage is behind us. People are beginning to realise that bitcoin is a proven force, and the big names are coming aboard. They see it as a hard asset, which will one day have similar financial qualities to what gold has today. And the reason they seek an alternative store of value is because they know the tech party has come to an end. Bitcoin has challenged tech, and is now challenging gold…

I have studied the gold market since 1999 and have found it fascinating. Along with silver, it has played a central role in monetary systems since the early days of civilisation. That proved particularly useful when communications were poor, money was weighed, and information was exchanged by ship. Exchange rates were fixed to gold, because gold is gold, wherever you are. Gold was the original fintech.

In the 1970s, as the US dollar was forced to devalue against gold, the inflation that followed saw gold surge 27-fold. Investors flocked to gold to protect themselves from devaluation. In 2020, with the monetary system unstable for different reasons, there is a sense that another major debasement is underway. I have no doubt that gold will prove useful, and indeed have a $7,000 price target by 2030.

4x is attractive, but in the 1970s, it was 27x. Gold will be an effective hedge, but bitcoin has the potential to do so much more…

Want to hear more from Charlie? Click here.

I’ve written about bitcoin on-and-off in this letter for years, and I wonder if many people’s opinion of it have changed over time – that the “incubation period” that Charlie describes is over.

What do you make of bitcoin? I’ll prepare a little poll for tomorrow’s letter.

That’s all from me for now though – I’m just off to apply the final touches to that silver project I’ve been hinting about for a while…

Back tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

PS If you haven’t taken a look at Charlie’s “Money Map” yet, you should give it a look. Market navigation is becoming ever harder in these trying times – but Charlie knows how to chart the right course.

Category: Investing in Bitcoin