SODERMALM, STOCKHOLM – “Greatness from small beginnings” – or more literally – “Great things, from small things” was the motto of Sir Francis Drake.

Emblazoned on the coat of arms he was granted by Elizabeth I, sic parvis magna was an apt slogan for the man. Here was a lowly sailor, elevated to royal favour and fortune from service to the crown… which in this case meant plundering so much Spanish gold that you couldn’t carry it back to Blighty. I suspect the honours list would be somewhat shorter today had standards been maintained.

I was reminded of Drake’s old motto when I was reading some of Charlie Morris’s recent research, where he stated that “All great assets are volatile in their youth”.

He alluded to Amazon and Apple, both hugely volatile stocks before they became the titans of the stockmarket they are today. These things were pinging around like nobody’s business after they IPOed; their price swings were likely one of the leading causes of hypertension for City folks and Wall Streeters alike back in the early noughties.

But after a while, the blood pressure eased… and those stocks ascended to greatness. Charlie thinks we’re seeing the same thing happen with another asset at the moment, but we’re still in the hypertension phase. Greatness yet awaits…

Can anyone guess the asset in question?

If you’ve been reading my scribblings for a while, you’ll probably know what it is. It’s that old bastard who’s been declared dead over 380 times by the newspapers, but who just won’t die.

Yes, dear reader. It’s the “tulip”, the “Ponzi”, the “baseball card”…

… that of course, isn’t actually any of these things.

It’s bitcoin.

While Charlie runs a tight ship over at The Fleet Street Letter Wealth Builder, allocating mostly to FTSE 350 stocks and investment funds, he moonlights in the digital asset space, where he’s in the process of getting a crypto hedge fund up and running.

Charlie missed out on “a private jet, and probably a yacht too” in 2011 when he was told about bitcoin by a friend, but didn’t buy any. It didn’t take long for him to realise he’d made a mistake and he was witnessing the early infancy of a new asset class.

I was reading Charlie’s writings on bitcoin well before I joined Southbank Investment Research. His approach is unique – in the several years I’ve spent observing the space, I’ve not encountered anyone who analyses the asset like he does. And with bitcoin breaching the $15k level, I think you should get a snippet of his take on it:

Just like every week, it has been another notable week for bitcoin. Our digital friend has held firm while the FAANGs (Facebook, Apple, Amazon, Netflix, Google) have run out of steam. The FAANGs have enjoyed a monumental bubble that cannot possibly be sustained on any rational analysis. They are great companies for sure, but their prices reflect their continued success being extrapolated into the mid-century. In contrast, bitcoin is just getting started.

Bitcoin overtakes the FAANGs in 2020

Source: Bloomberg – bitcoin and FAANGs 2020 year to date rebased

Source: Bloomberg – bitcoin and FAANGs 2020 year to date rebased

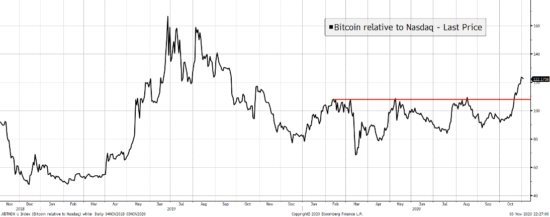

Remarkably, bitcoin is now the best performing “asset class” of 2020, and to beat the FAANGs is an impressive achievement. Regular readers will know that the detachment from tech is something I have been anticipating for some time. I highlighted the break ahead of the Nasdaq; a force that is looking increasingly decisive.

Bitcoin leadership over the Nasdaq is convincing

Source: Bloomberg – bitcoin relative to the Nasdaq since 2018

Source: Bloomberg – bitcoin relative to the Nasdaq since 2018

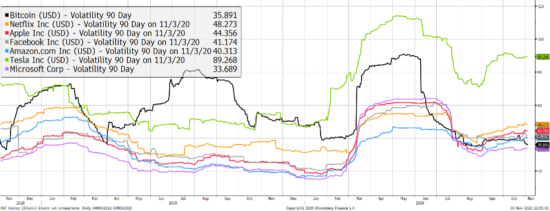

Not only is bitcoin showing leadership at a time of uncertainty, but it is also doing so with structurally lower volatility than in the past. This is hugely important because bitcoin has a reputation for being volatile, yet that may be beginning to change.

One important indication of asset quality is volatility. The highest quality assets are stable and calm, whereas low-quality assets are volatile. Never underestimate the value attributed to price stability. Billions and billions opt to allocate to less volatile assets.

Looking at the past two years, bitcoin is demonstrating less volatility than most of the leading tech stocks. Looking at 90-day realised volatility, only Microsoft has lower volatility. For bitcoin, this is an important development in price stability.

Tesla behaves like bitcoin used to, yet today, bitcoin is “catching down”, in volatility terms, with the highly credible Microsoft. Bitcoin has recently displayed lower price volatility than Tesla, Netflix, Apple and Facebook. Microsoft is still the daddy.

Bitcoin is less volatile than the FAANGs

Source: Bloomberg. 90-day realised volatility of securities as shown since 2018.

Source: Bloomberg. 90-day realised volatility of securities as shown since 2018.

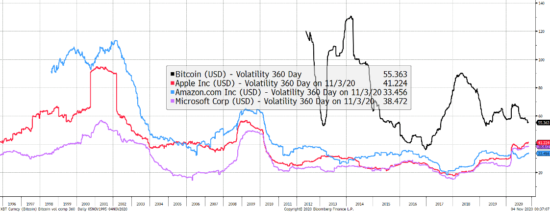

The commonly held belief is that bitcoin is volatile. That was true, and something that is true for any asset in its early stages of life. But as it matures and establishes itself, volatility falls. Using 360-day volatility to calm the results, we can observe longer term trends back to 1996. At that time, Microsoft was already insanely profitable, while Apple was struggling and Amazon was a loss-making startup selling books.

All great assets are volatile in their youth

Source: Bloomberg – 360-day realised volatility of securities as shown since 1996

Source: Bloomberg – 360-day realised volatility of securities as shown since 1996

Sometimes it helps to zoom out and put things into perspective. From 1998 to 2001, Amazon was as volatile as bitcoin was at its scandalous heights. Apple was close behind. But as Apple turned the corner when Steve Jobs returned and launched the iPod, and as Amazon diversified beyond selling “paper” books, their long-term volatility fell as their asset quality rose.

Bitcoin is following that same path, and even taking into account the collapse in March, the long-term investment case is building. Bitcoin’s structural volatility is falling. The best is yet to come…

Ab chao magna: greatness from chaotic beginnings. It’s a worthy motto for any seeking their fortune in the bitcoin space.

You’ll be hearing more from Charlie in the near future – stay tuned.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Investing in Bitcoin