ABERDEEN, SCOTLAND – We examined the spectacle of the Ever Given yesterday, the 200,000 tonne container vessel blocking the Suez Canal. As of this morning, it remains wedged in place, creating a traffic jam in global trade 150 vessels long (and counting) behind it.

It seems fitting that the market action over the past few days has mimicked the Ever Given: stuck, and waiting for an external event to give it new direction…

Following a year in the sun, the Nasdaq is showing signs of fatigue – the market is finding it harder to get excited about tech it seems (including bitcoin, which is now in the low $50k range). After a lengthy sell-off, US government debt has caught a bid, lowering yields a little. This was likely due to the arrival of yet another economic crisis in Turkey. But while gold is up a bit, reflecting the lower interest rates, it’s not up by much. Oil meanwhile, has been all over the place – down hard, and then up again. This is perhaps a signal that the market senses even more lockdowns in our future… or maybe just the market taking a breather after a strong few months.

Oil is what I’d like to dwell on today. As you’ll know from my recent letters, I’m bullish on “black gold” this year for a variety of reasons, but the economic reopening especially. While politicos and the Davos Set love to moan about it, there’s no avoiding the fact that the world runs on oil, and if we get to anything close to economic normality again post-WuFlu, we’re gonna need a lot of it. Hell, if we want to create a green renewable future that runs on peace, love, and understanding, we’re still gonna need a lot of it.

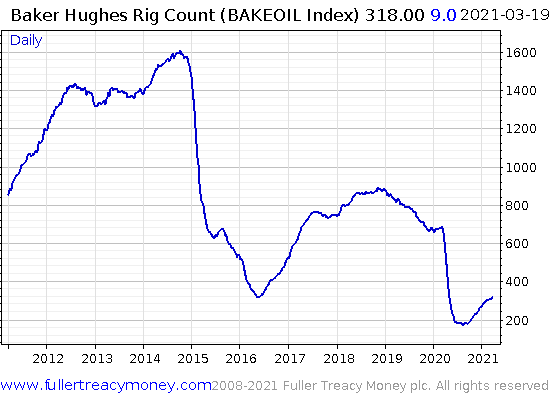

The brutal bear market in oil last year took many sources of oil supply off the market, and they’ve to be switched back on again. The Baker Hughes Rig Count is a good example of this. While US rigs are coming back online, they’re not even halfway back to where they were in early 2020:

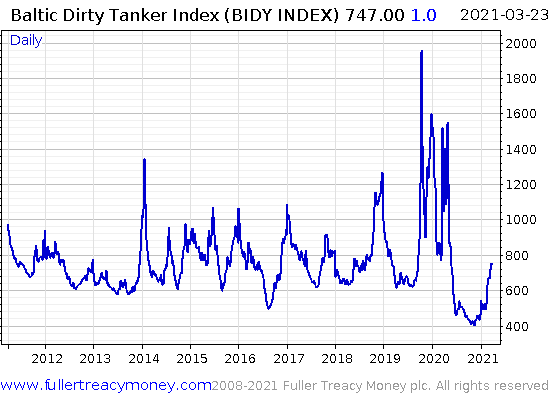

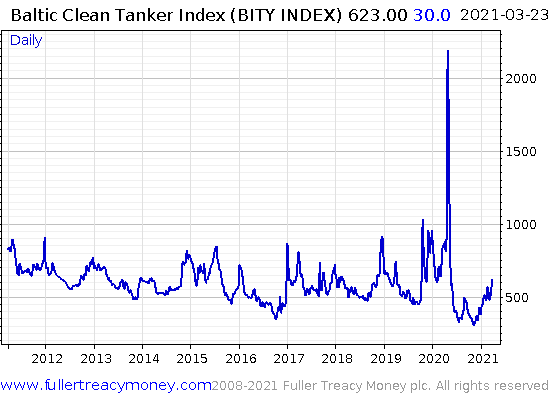

Meanwhile, signs that the global economy is recovering are showing up, at least in the shipping data. The Baltic Dirty Tanker and Clean Tanker indices show you how much demand there is to ship crude oil and refined oil products around the world. Both appear to have bottomed and are on the up – energy demand is returning:

Note the massive spike last year. That was when there was so much oil going around without any demand for it that the tankers were being used as a means of storage. Tanker owners recognised this, and massively hiked their rates to take advantage. These indices ultimately track the cost of shipping rates, and they soared as a result.

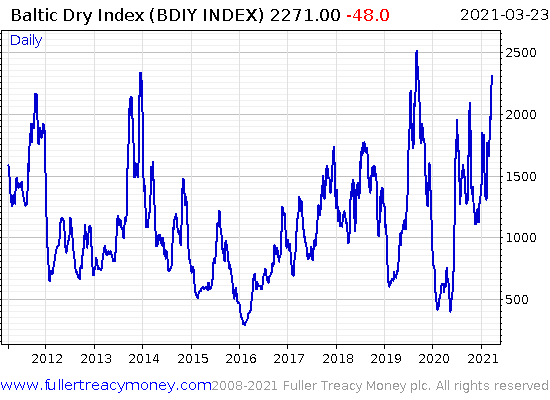

If we look at the Baltic Dry Index, which reflects global demand for shipping dry goods like commodities, it too is looking good:

Note how sensitive this index is to the Chinese economy. It was collapsing in December 2019, almost certainly due to the WuFlu, before much of the world had ever even heard the term “Covid-19”…

These charts are just a few of the reasons I remain bullish on oil this year – with a $100 target in mind.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

PS While I’ve been looking closely at oil recently, our energy specialist James Allen keeps telling me I’m looking in the wrong place – especially if it’s strong investment returns that I’m after. And when he told me about this, it was hard to argue with him…

Category: Geopolitics