What is the cost-to-income ratio?

In finance, the cost-to-income ratio (also called the cost/income ratio or C/I ratio) is the measure of the costs of running a company in relation to its operating income. It is an important financial tool, particularly when evaluating banks.

The ratio gives investors a clear view of how efficiently the company is being run – the lower the C/I ratio is, the more profitable it should be.

Investors’ Pick: FREE Guide to Understanding the Price of Gold + 9 Gold Stocks

Changes in the ratio can also highlight potential problems: if the ratio rises from one period to the next, it means that costs are rising at a higher rate than income, which could suggest that the company has taken its eye off the ball in the drive to attract more business.

How to calculate the cost-to-income ratio

To obtain the cost to income ratio, divide the operating costs (administrative and fixed costs, such as salaries and property expenses, but not bad debts that have been written off) by operating income.

Example of cost-to-income ratio

Say that Company A has £180,000 of operating expenses each month. It also has an operating income of £285,000 each month.

Divide the company’s operating expenses by the company’s operating income. In the example, £180,000 divided by £285,000 equals Company A’s cost-to-income ratio of 0.632. This will usually be expressed as a percentage, being a 63.2% cost-to-income ratio.

Other uses of the cost-to-income ratio

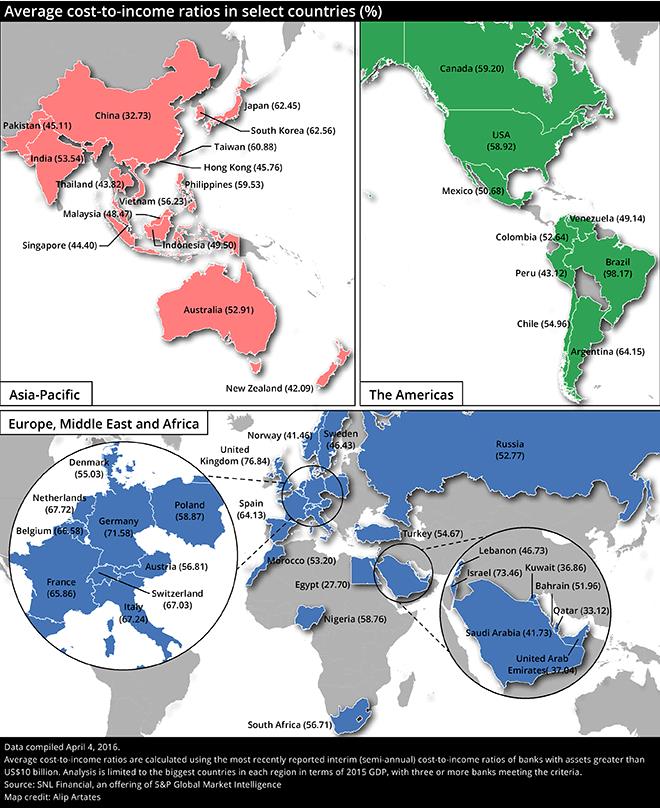

This formula can be used also to analyse the performance of whole sectors, rather than individual firms. For instance, the banking industry from each country can be compared with this tool.

Read more:

Category: Financial Glossary