Would you borrow money to buy stocks?

Me neither…

But that’s what an ever-increasing part of the market is doing.

Great news if stocks go up…

A potential disaster if they go down.

Because that £50,000 you borrowed to invest is now worth considerably less…

This is known as ‘margin debt’.

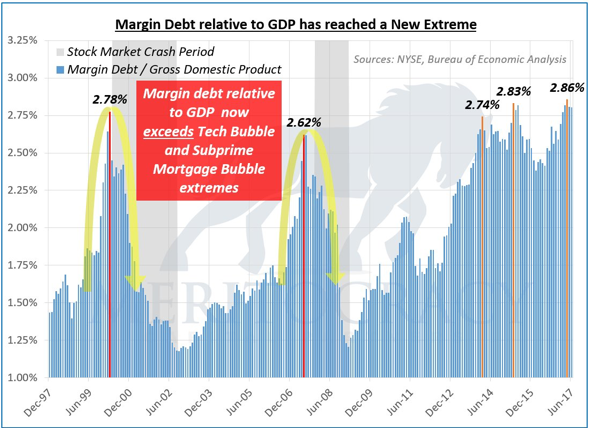

And in July this year, margin debt hit a record $549.86 billion.

This accounts for 2.86% of US GDP.

As Howard Ma, the Chief Investment Officer at Meritocracy Capital Partners, said recently, the 2% threshold is when “bubbles became evident despite widespread denial”.

Margin debt has now been above 2% for the last 56 months, as the following chart shows…

Source: Market Watch

Source: Market Watch

As you can see, the percentage of margin debt in the market is now higher than it was in the dotcom crisis and the global financial crisis.

Additionally, hedge-fund borrowing recently hit its highest level since the financial crisis.

It’s another signal that fear has turned to greed. People are borrowing ever bigger quantities to get a bigger slice of the action.

Does this mean a crash is certain? No.

But what we do know is that when the margin debt level has been at this level before, that’s been the end result.

Here’s Howard Ma’s conclusion [emphasis mine]:

“It is crystal-clear to me the stock market is in another financially leveraged bubble,” he wrote. “This one is unprecedented. It has extreme depth (2.86% of GDP) and immense breadth (56 consecutive months). If financial leverage [margin debt] is indeed the correct way of gauging the potential harm from the prospective aftermath…then this bubble could prove to be the biggest one ever.”

In my opinion, he’s bang on.

Having seen it laid out for you today, you now know what is really going on. But that’s not enough on its own. Information is pointless if you don’t have the ideas and direction you need to act on it.

So I’m talking to you as an investor… as someone who now understands the severity of the situation we’re in… as someone who wants to take your and your family’s safety into your own hands.

If that isn’t you… stop reading here.

If that IS you…

Here’s how I’m suggesting you set up your portfolio.

Regards,

Tim Price

Editor, London Investment Alert

Risk Warning

Your capital is at risk when you invest in shares – you can lose some or all of your money, so never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/ offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Profits from share dealing are a form of capital gain and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change in the future.

Investment Director: Tim Price. Editors or contributors may have an interest in shares recommended. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Limited. Full details of our complaints procedure and terms and conditions can be found on our website, southbankresearch.com.

London Investment Alert is issued by Southbank Investment Research Ltd.

Southbank Investment Research Limited is authorised and regulated by the Financial Conduct Authority. FCA No 706697. https://register.fca.org.uk/.