The first time it flashed, the stock market went DOWN 50%…

The second time it flashed, the stock market went DOWN 50%…

Now, it’s started flashing for a third time – and I think you need to take evasive action immediately.

This is why…

After the First World War, the US economy boomed.

Thanks to technological progress and increased consumer demand industrial production virtually doubled in the 1920s.

Between 1919 and 1920, America’s gross national product grew from $78 billion to $103 billion.

Needless to say, the stock market boomed, bringing ever larger numbers of investors into the market.

The bubble became so large Philip Snowden, Chancellor of the Exchequer in Britain, called it a ‘speculative orgy’. He was right…

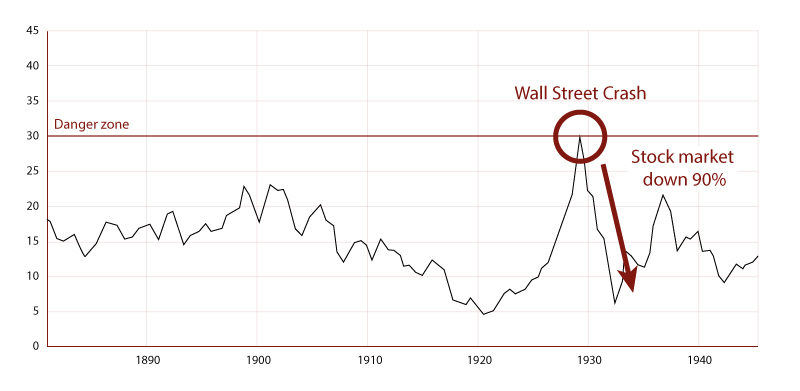

And it drove one niche indicator up to an unprecedented level. When it crosses the 30 mark, that’s a red alert for me.

And that’s precisely what happened for the first time in 1929, as you can see on the chart below.

As you’re no doubt aware, the 1929 ‘Wall Street Crash’ was a disaster.

Bankrupt investors threw themselves to their death.

When it finally reached its record low in July 1932, the Dow Jones had fallen 89%, and it did not recover to 1929 levels until 1954.

The effects of the 1929 Crash were not limited to America.

With the US economy in recession, British exports were battered and unemployment soared.

British stocks were down 50%.

To find out which indicator I’m talking about – and why I think it has created an urgent situation in the FTSE – click here.

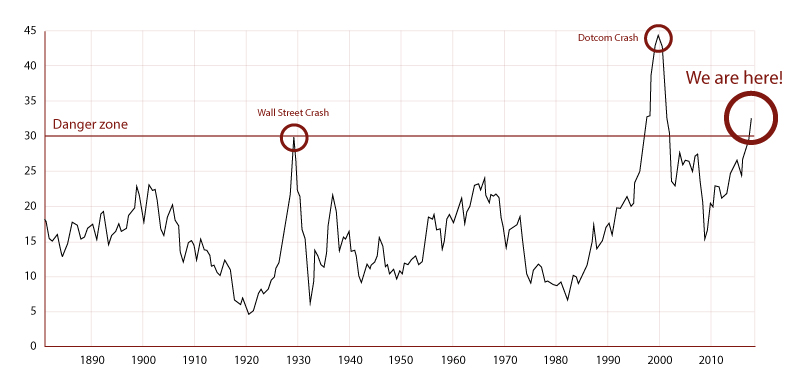

The second time it passed the 30 mark was in 2000.

The dawn of the internet led investors to speculate on companies for the sole reason they were “online”…

Driving this same indicator up to a record high – just under 45!

As someone who was investing professionally at the time, I can tell you it was complete madness.

People you’d expect to know better lost all sense of perspective – and got badly burned.

The vast majority of these companies failed, eviscerating $5 TRILLION of market value in the United States.

The FTSE 100 lost 50% of its value.

So both times this indicator has crossed the 30 mark, investors have been clobbered.

Which is why you’re reading this today…

Last year this indicator reached the same mark for a third time

As you can see, it’s currently at over 31…

That’s much higher than it was before Black Monday in 1987 and the oil crisis in 1973.

And that’s even when you factor in the 10% correction we saw in February 2018.

With a long term average of 16.8, that means US stock market is now almost 100% overvalued, according to this one indicator.

I.e. if it were to revert to its average the market would HALVE in value.

It could obviously drop well below that figure in a crash.

Click here to learn why I believe the next crash could happen at ANY moment.

Stock market crashes cost people dearly.

Years of hard work and saving goes up in smoke.

In 2008, every British household was down by an average of £31,000 according to data from Halifax.

Could your family overcome a loss that large today?

It’s not just money that’s involved, either. Jobs go too… people lose their homes… the emotional costs can be devastating.

That’s not a chance you have to take…

I’m offering you an escape route

My name is Tim Price.

You may have come across my writing in MoneyWeek or The Spectator.

But my main business is protecting and growing wealth. My fund management business currently has over £100 million under management.

My understanding of the financial system has been forged over the best part of three decades. I like to think I’m well attuned to both the dangers and the opportunities the market offers.

Past performance is not a reliable indicator of future results

In 2008, when the FTSE 100 dropped from over 6,900 to 3,500, my clients’ wealth held firm.

I’ve won awards for my performance as a fund manager. In 2005 I was awarded the Defensive Investor of the Year, and I’ve been nominated a further five times in the same awards programme.

So make no mistake: this is NOT a message telling you to keep all your money in the bank.

Right now there ARE markets where I believe your family’s money will be safer.

They just aren’t in the usual places.

Most investors won’t even consider them.

I can’t be sure the next crash will play out exactly as I expect – I don’t have a crystal ball. As with any investment strategy, I can’t guarantee 100% protection.

But they are where my analysis has led me to invest my clients’ money.

I’m happy to disclose that information here. I would never tell you to invest in anything I wouldn’t myself.

Today I’m offering you the chance to follow suit.

My urgent letter to UK investors contains everything you need to know.

Yours faithfully,

Tim Price,

Editor, London Investment Alert

An urgent letter to UK stock investors:

“The ‘great unravelling’ could cut the FTSE 100 in HALF”

Tim Price explains what you need to do with your money.

Risk Warning

Your capital is at risk when you invest in shares – you can lose some or all of your money, so never risk more than you can afford to lose. Past performance and forecasts are not reliable indicators of future results. Bid/ offer spreads, commissions, fees and other charges can reduce returns from investments. There is no guarantee dividends will be paid.

Profits from share dealing are a form of capital gain and subject to taxation. Tax treatment depends on individual circumstances and may be subject to change in the future.

Investment Director: Tim Price. Editors or contributors may have an interest in shares recommended. Information and opinions expressed do not necessarily reflect the views of other editors/contributors of Southbank Investment Research Limited. Full details of our complaints procedure and terms and conditions can be found on our website, southbankresearch.com.

London Investment Alert is issued by Southbank Investment Research Ltd.

Southbank Investment Research Limited is authorised and regulated by the Financial Conduct Authority. FCA No 706697. https://register.fca.org.uk/.