It’s happening. Blood is being spilt in the financial markets over Italy. Italian government bonds continue to plummet as investors sell them off cheaper and cheaper.

The latest trigger? Claudio Borghi, a senior official and lawmaker in the Italian government, said that most of the country’s problems would be solved if they left the euro and returned to a currency of their own.

At the time of writing, the yield on the Italian ten-year bond – the interest rate that the market is willing to lend Italy money – has reached 3.4%, up from 2.89% on last Thursday.

To put that in context, that’s almost 3% more than the German government has to pay on its ten-year bonds. The difference, or spread between the countries borrowing costs, hasn’t been this high in five years.

The yield spread between Italy and Spain, which suffers similar economic woes, hasn’t been this high since 2011.

Markets are finally beginning to grasp The Italian Problem we’ve been warning of for months.

But have no fear, dear reader. For according to the Italian Deputy Premier Matteo Salvini, the “spread and stockmarket can go up or down, ours is a budget which invests in labour and so the results will become visible and the gentlemen of the spread will understand”.

It gets worse

A problem for Italian bonds… is a problem for Italian banks. Italian banks own a colossal €381 billion in Italian bonds, more than triple what they owned before the financial crisis, and have further increased their holdings since the beginning of the year. As those bonds lose value, the banks take losses and their capital buffers get weaker.

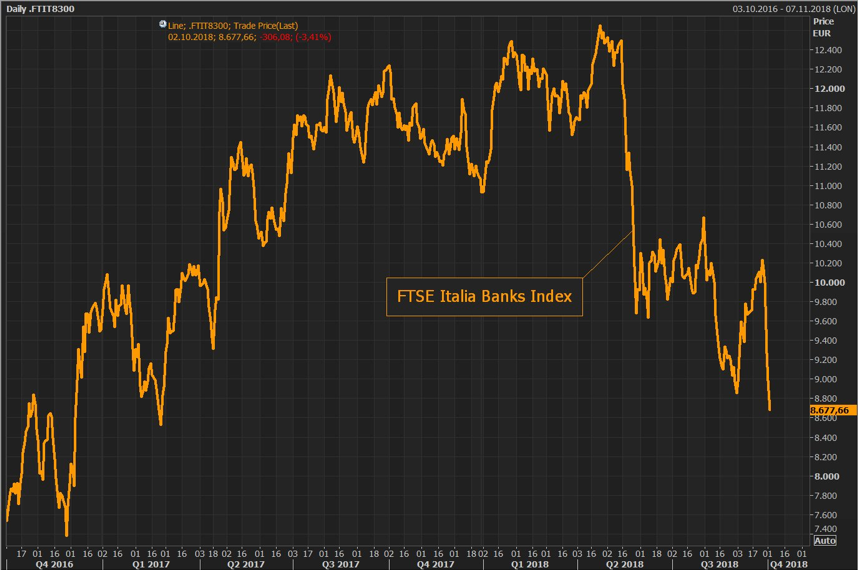

With that in mind, it’s no wonder that the FTSE Italian bank index is beginning to nosedive.

Source: Bloomberg

But while the trigger is Italy, there are bombs planted throughout the plumbing of the eurozone itself.

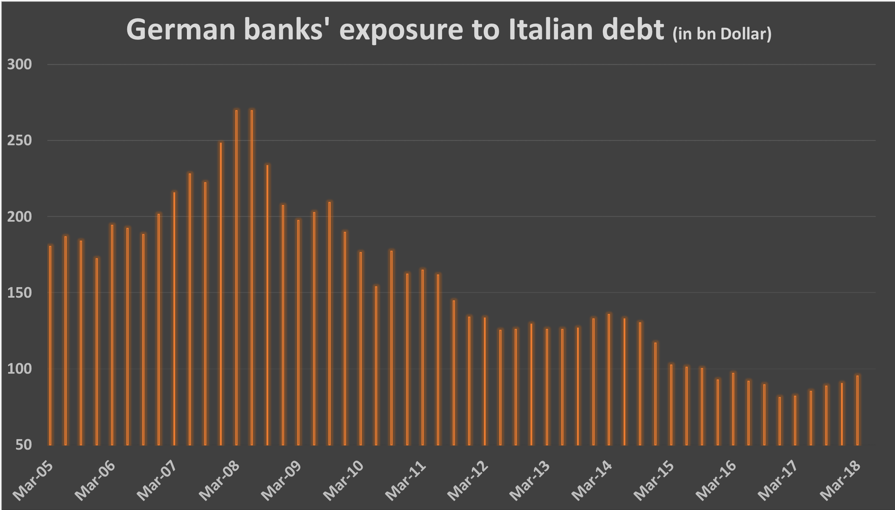

French banks own more than €277 billion in Italian bonds. And while Germany has prudently cut its exposure to Italian debt sharply since the financial crisis… it still has an exposure of some €82.5 billion.

Source: Holger Zschaepitz on Twitter

The more damage Italian bonds take, the more damage those banks do. And if you consider the possibility of an Italian default, which we see on the cards, the consequences could be catastrophic.

But wait, there’s more!

To make matters worse it just so happens that right now, the European Central Bank (ECB) is running out of cheques.

It has been writing €30 billion worth of them a month, to buy European government bonds. By buying EU government debt in this way, it’s allowed European governments to borrow extreme amounts of money, extremely cheaply.

But now it is autumn. And Mario Draghi is snapping his chequebook shut. Or halfway shut at least – from this month forward, the ECB will “only” print €15 billion a month to buy bonds. And if Super Mario keeps his word to the markets, the ECB will stop buying bonds entirely by the end of the year.

The ECB’s monthly purchases of Italian debt will drop from around €3.7 billion to around €1.8 billion a month from now on. Effectively, the ECB will now only buy 9% of the bonds Italy issues, where previously it bought 18%.

A 9% change may seem small, but right now Italy could really use an idiot (a price insensitive buyer) in the market bidding for its debt. The reduction in that ECB backstop pours more accelerant on Italian bonds, and as a result on the banks that hold them. Higher yields, and more chaos, await.

Draghi may well print himself a new chequebook soon, despite his plans to stop writing them by the end of the year. But that won’t fix anything – only prevent the “gentlemen of the spread” from scalping Italian bonds for a while longer.

My colleague Nick Hubble has written a flash update to Zero Hour Alert subscribers on the recent news – it’ll be going out this afternoon. He’s got a “boots on the ground” contact in Italy keeping him informed of the sentiment there – and it’s beginning to feel a lot like Greece…

Meanwhile, this month’s issue of Zero Hour Alert will hit on Friday – with an investment idea that may surprise you. Draghi’s dysfunction is causing chaos in Italy, but he’s printing riches for a privileged few elsewhere – and shameless speculators can take part!

Until next time,

Boaz Shoshan

Editor, Southbank Investment Research

Category: The End of Europe