I have a confession. The market crash in October wasn’t just about Italy’s budget debacle. It was also about the underlying force which is getting Italy into trouble right now.

Here’s how I explain it in Chapter 5 of my new book…

***

The Unholy Trinity explains the forces at play inside the eurozone which lead to its failure. This failure is inevitable, it’s only a question of when. But an equally important force is bearing down from outside the eurozone. You’ve seen it all over the news – rising interest rates.

For 35 years, debt has become steadily cheaper. That’s why the world has seen such an extraordinary debt bloom. Government debt to GDP, the average mortgage, student debt, credit cards, corporate debt and every other form of debt have all surged. Especially in Britain.

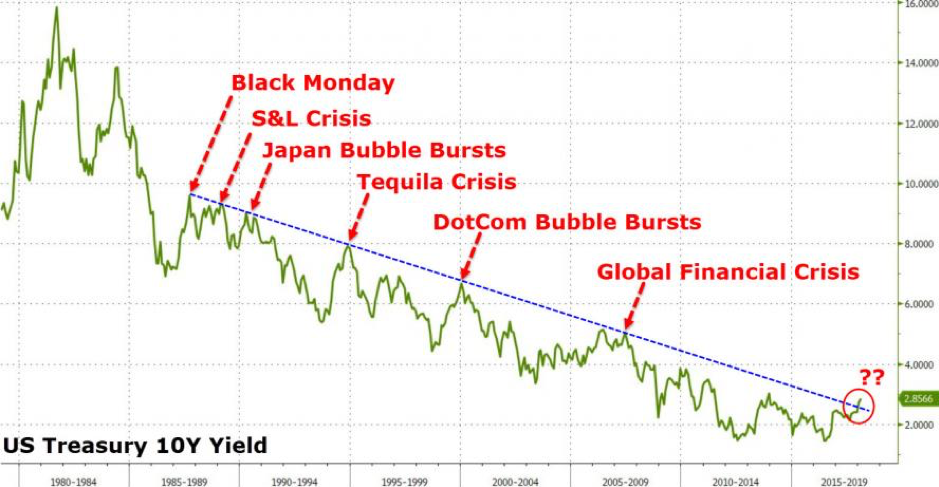

But it hasn’t been smooth sailing. Each time interest rates spiked on their 35-year downtrend, we saw some sort of financial crisis. Let’s take a look at the US experience, which dominates interest rates around the world.

In 1987, the US ten-year treasury yield spiked from 7% to over 10%. Then came the famous Black Monday, when stock tumbles set records. In the 90s, countries in Asia and elsewhere had their crises. In 2000, the tech bubble burst. In 2008 it was sub-prime borrowers in the US who suffered when rates rose. 2012 it was European governments. We also had the taper tantrum of 2013.

Source: Zero Hedge

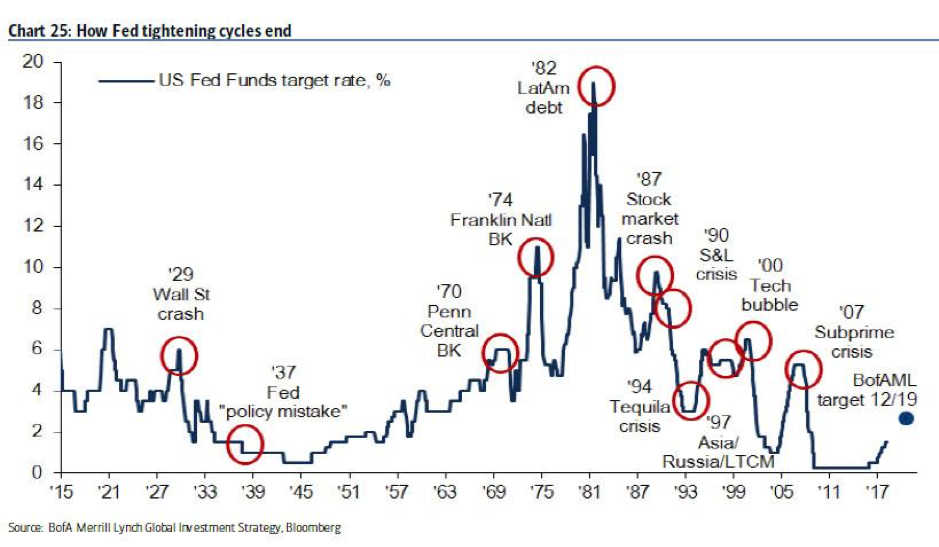

This chart from Bank of America shows the same thing going back much further.

Source: Bank of America

Even at today’s ridiculously low interest rates, the phenomenon still plays out. When US interest rates briefly spiked recently, they triggered a 10% correction in the US stockmarket.

Well, interest rates are entering an upcycle once more. I don’t know whether this is the beginning of a major bull market in interest rates that will last decades, or just another blip on the 35-year downtrend. It doesn’t matter.

Given the proven propensity of a crisis to occur while borrowing costs are rising, when interest rates begin their upcycle, you have to scour the world for the weakest hands to discover the source of the coming crash. Who will snap first in a world where debt is becoming more expensive?

Is it sub-prime borrowers, who borrowed more than they can afford based on rising house prices? Perhaps companies, who borrowed too much when times were good? Or tech stock buying margin borrowers, who face margin calls from their lenders when stocks correct?

In mid-2018 it was Turkey. As Ambrose Evans-Pritchard wrote at the time, “Turkey is the first big victim of Fed tightening, but it won’t be the last”. Attention immediately turned to Spain, one of Turkey’s biggest lenders, Poland thanks to its external debts, and Italy, because of its precarious banking sector and government financing.

The Turkish crisis is proving manageable so far. But as you know by now, I think the next major crisis will be triggered by Italy. When it comes to rising interest rates, Italy is the weakest hand that could cause a major crisis. In this chapter, we examine why.

Deutsche Bank summarised where Italy finds itself:

A country nearing an election and with high populist party support, with a generationally underperforming economy, a comparatively huge debt burden, and a fragile banking system which continues to have to deal with legacy toxic debt holdings ticks a number of boxes to us for the ingredients of a potential next financial crisis.

Weeks later, a May mini-crisis in Italian bonds caused turmoil. But that was just a warning.

Don’t forget, Italy isn’t just in trouble because of its vast debts and suffering economy. That’s nothing new. It’s because the country lacks the escape mechanisms it used to rely on. The escape mechanisms available to countries outside the euro, like Britain.

Countries outside the eurozone can cut interest rates, print money, and devalue their currencies, as Britain did after the Brexit vote. But the Italians’ hands are tied. They can’t devalue their currency. And capital flight is already at terrifying levels, as exposed by Target2. Southern Europe cannot escape the Unholy Trinity. Not without leaving the eurozone.

But back to interest rates. Let’s looks at what’s making rates go up.

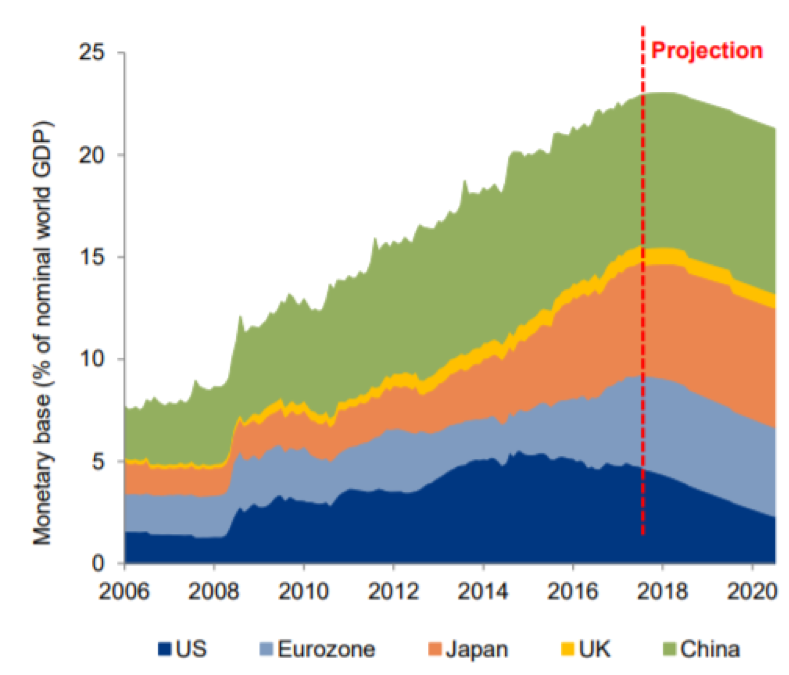

Thanks to inflation, central banks around the world are expected to tighten monetary policy. The ECB will be winding up its QE around September, with recent ECB comments suggesting there might even be a rate hike next year. This chart shows how central banks in the world put together will begin reversing QE this year, something pundits are calling quantitative tightening (QT).

Source: Allianz (Dec 2017)

Given most of this QE was spent on government bonds, ending the purchases will drop the biggest buyer out of the market. That means higher borrowing costs.

In March 2018, Italy was able to borrow money for far less in interest than the United States of America, despite being far higher risk. Why? Because of the continued support of the ECB, while the US’ Federal Reserve had stopped its purchases of American bonds already.

But now ECB support is waning. The effects can be dramatic, as we saw in May of 2018. Italian 10-year bond yields spiked from below 1.8% to 3.2%.

Spikes like these have two effects. They make it more expensive for the government to borrow money. And they cause a problem for the banks holding government bonds. In the next sections we’ll examine both.

Let’s take a closer look at the many reasons why I’m singling out the boot of Europe to trigger the coming crisis you can expect from rising interest rates.

But keep in mind, the key issue here is that a rescue is no longer possible. As I’ll explain in Chapter 7, that’s the key to why Italy’s fiscal position is very much your problem, whereas the similarly bad debt situation elsewhere is not.

***

You’ll have to buy my book to find out more. But there’s a different reason I’m emailing you today.

What if the Fed does an about face?

At my speech in October last year, I explained to readers that there was no problem which governments and central banks couldn’t paper over. Markets could only go up. The audience was shocked I’d changed my bearish views.

This year, I singled out Europe as the only place where a crisis could actually play out. For reasons unique to Europe and its currency, a bailout can’t happen there.

But here’s the thing. What if the Americans try to rescue Europe? What if they don’t increase interest rates because it’s causing such carnage in international financial markets?

It’s not just Europe that’s in trouble. Trump’s trade wars are triggering interest rate spikes and currency instability around the world. Turkey and Italy are just two early victims, as you just read about.

If the Fed’s rate hike cycle is slowed or put on hold, the pressure on Europe would ease. The crisis in Europe could be delayed.

I’m telling you this because there is an enormous corresponding opportunity to profit.

The reason the Federal Reserve is raising interest rates is because the US economy is running hot. Without Fed rate hikes, the US economy could begin to overheat.

If the Americans keep one eye on Europe, what’ll happen under their noses in the US?

My friend Eoin Treacy believes you should make a specific bet on this. He’s expecting the traditional melt up that that takes place before the meltdown.

And I believe the coming change to Federal Reserve policy is the catalyst, if he’s right.

Find out more about Eoin’s big call here. You can’t argue with his evidence.

Until next time,

Nick Hubble

Capital & Conflict

Category: The End of Europe