Who knew? If you’re faced with a zombie apocalypse in coming years, the solution is simple. Just set up some interest rate trip wires around your home. Or nail a certified copy of your adjustable-rate mortgage balance to your door.

Zombies can’t handle higher interest rates. They rely on the adrenalin kick of quantitative easing (QE) to remain alive. Or debt-financed government deficits. So they’re sure to leave you unbothered if you follow my survival guide.

Don’t believe me? Take a look at the overnight news. American stocks were on the verge of regaining half their losses from the recent correction. But then something went terribly wrong.

The Federal Reserve’s minutes revealed an utterly terrifying prospect. Interest rate increases. Four this year, or potentially five according to Goldman Sachs.

The Fed’s interest rate manipulators explained how higher job growth, deficit spending, tax cuts, pay increases and inflation would mean higher GDP growth. Too much of it and you get a misallocation of capital and speculative excess. Thus, the time has come to increase rates.

Now you might think interest rate increases are perfectly normal. But they’re not during a zombie apocalypse.

The world is in way too much debt to be able to afford higher rates now. And from such a low base, four rate hikes of 0.25% amount to a 67% increase.

And so carnage struck the stock, bond, currency and commodity markets.

The Dow Jones fell 500 points to finish the day down.

The US ten-year Treasury is verging on 3% after spiking again. That’s close to a four-year high, and could soon become a seven-year high. The US two-year Treasury yield is tearing away to a nine-year high.

The US dollar strengthened too, forcing other currencies and commodity prices down.

With US ten-year bond yields approaching four-year highs, so are US mortgage rates. And thanks to the higher rates, home purchase applications fell 15% in just a few weeks, the biggest drop in three years. Remember, rates are going up even faster here on in.

In Europe, commentators are lauding impressive economic growth. But it’s nothing but zombie twitches induced by electric shocks of monetary policy. The European Central Bank is set to finish its QE programme in autumn.

But it has already more than halved it from 2016 levels. Interest rate increases will come next year. So the cracks are showing already. PMI business indices disappointed for February in France, Germany and the EU as a whole. Ambrose Evans-Pritchard reports in The Telegraph that Europe’s monetary indicators are falling:

Simon Ward from Janus Henderson says his key measure of money growth in the currency bloc – six-month real M1 – has seen the steepest drop since the onset of the Lehman crisis over recent months.

The broader M3 aggregates are telling a similar story, suggesting that the stronger euro and the gradual withdrawal of stimulus by the European Central Bank is starting to take a toll. The money figures tend to lead the real economy by around nine months.

All this fragility reminds us just how dodgy the global recovery really is. And it’s obvious why. It’s made up of zombies facing higher interest rates.

When the patient is a zombie

The problem with keeping the undead alive is that you can’t stop supporting them or they’ll die.

The zombie economy isn’t some wacky theory. The Bank of International Settlements (BIS) regularly covers the issue.

The basic idea is that low interest rates prevent unproductive firms from going bankrupt. I’d add unproductive people who borrowed too much to the list of zombies, but that’s a bit politically incorrect.

These zombies survive by rolling over debt instead of investing, growing and making profit to pay back debts. They use up the limited resources which productive firms and people would get their hands on in a recession.

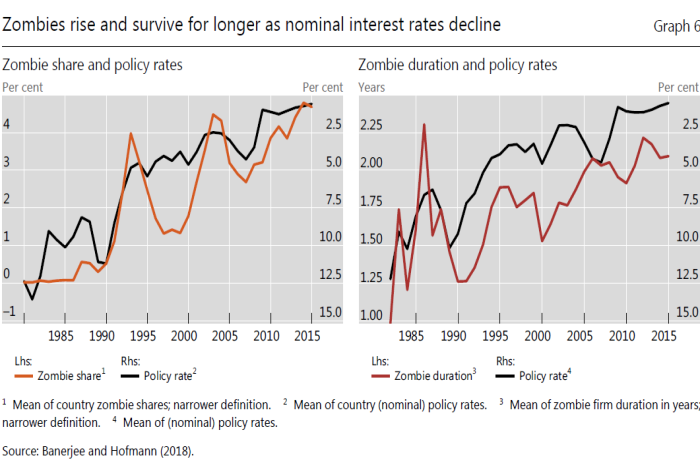

The BIS is the world’s official zombie tracker too. It established a close link between the rise in zombie firms and low interest rates.

The problem is that without a spike in rates and a recession that reallocates resources from failed companies to productive ones, the problem slowly gets bigger. There is a trade-off between stability and productivity. Somebody should write a PhD about that.

It’s not just monetary policy which zombies need to survive. Chris Hamilton of the Economica blog took a look at total US GDP growth and the fiscal deficit. His conclusion is simple: “Without the federal deficit spending, the economy would be shrinking.” And that explains the power of Donald Trump’s tax cuts.

In the US, tax cuts and proposed spending are delivering higher rates of growth that are making Trump popular. According to polls about his policy, the number of people who think the new tax plan will help their firms has doubled in three months.

The University of Michigan reported this from its economic surveys: “[…] favorable references to government policies were cited by 35% in February, unchanged from January, and the highest level recorded in more than a half century.”

The number of small businesses looking to expand is at a record. While only 33% of people expect to benefit from Trump’s tax cuts, about 80% will in the end. More than half of people now approve of the policy, up from 37% in December.

All that sounds great. But when tax cuts are financed with borrowing, it’s zombie GDP growth – debt.

The problem with zombies is that they eventually run out of puff. Or those keeping them alive do.

Monetary policy is tightening. At some point, government bond markets will too. Interest rates will rise thanks to both. And then we’ll see how many zombies are hiding in our economy.

Until next time,

Nick Hubble

Capital & Conflict

Category: Economics