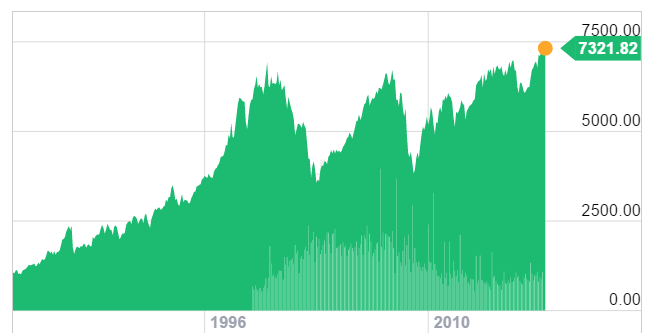

It’s time to take stock of the stockmarket. It’s been a remarkable two decades. We’ve had three booms and two crashes. In the end the FTSE 100 index has gone nowhere, especially adjusted for inflation. Less than half the companies included in the FTSE 100 index in 1999 are still there, so it’s been incredibly difficult just to match the index with your own portfolio.

There’s never been a better illustration of how important it is to be aware of the big-picture risks and opportunities if you want to succeed in investing. A technology and property bubble dominated the stockmarket’s performance. Passive investing has been disappointing for almost 17 years.

Compared to other countries, our stockmarket has done ok. Over the last ten years we’ve outdone most European markets, almost kept pace with recession-proof Australia, but the US index surged above our own.

That’s the past. Today we’ll look into the big-picture risks and opportunities we face this year.

At this point investors are asking themselves if we’re still stuck in the same sideways trading range that’s typical of bear markets. Or are we finally breaking out and set for a new boom?

The answer lies in which events come to pass at home around the world. Britain is certainly not isolated.

I’m not going to predict what will happen to the stockmarket this year. That’s a mug’s game. As the economist John Maynard Keynes once said, the market can stay irrational longer than you can stay solvent. So even if you’re right about everything that comes to pass, timing can be your undoing.

Instead of predictions, I’m going to make you aware of the factors that will determine how the stockmarket performs. If the positive boom stories unfold, the market will go up. If the negative doom crises come to pass, the market will crash again.

To predict the stockmarket, all you have to do is keep tabs on these factors. That’s what we do each day at Capital & Conflict.

But what are these factors?

pro.southbankresearch.com/m/664571

1. Brexit could be a surprise success

Only the most ardent Brexit supporters expect Brexit to be a quick and easy success. Usually they acknowledge it’s going to be a tough few years before things improve. But what if they’re wrong?

There’s only one reason for negotiations with Europe to go badly. If Europe wants to vindictively punish Britain for leaving in order to discourage others, it can make life difficult for us. However, every other incentive in the Brexit negotiations is aligned for a mutual success.

Trade with Europe doesn’t suddenly become a bad thing when we leave the EU. It’s still good for citizens in both places. And eventually politicians will have to reflect this in their choices. Otherwise, jobs will suffer. And Europe can’t afford that.

When it comes to trade with countries outside the EU, Britain will be better off the moment we leave the EU. The EU’s “average applied tariff” is 5.3, which is high among developed countries. The US is 3.5 and Australia and New Zealand are well below 3. Even Mongolia and Peru have a lower level than the EU. Here’s a World Trade Organisation (WTO) map of the world’s trading nations and their tariff levels:

This exposes the EU as a protectionist bloc. Our trade with other nations outside the EU is set to boom even before we make trade agreements. And those should be much more forthcoming than they were in the EU, because we have far fewer political interest groups to pander to.

How does this relate to the stockmarket? If the EU backs down on its vindictiveness and British trade booms, Brexit could be a surprise success. There are already signs of this.

The tumbling pound lit up the stockmarket in the wake of Brexit. We reached record highs. That’s because many of the FTSE 100 stocks have a big proportion of foreign earnings. They make bigger profits as the pound falls. This is great for British investors, while foreign investors miss out thanks to the fallen pound.

According to a poll of the world’s central bankers, emerging-market countries are shifting their currency reserves out of euro and into the pound thanks to our economic prospects and political stability.

In the wake of Brexit, investment in the UK surged. The world’s most innovative and fast growing companies like Amazon and Google reaffirmed their investments in Britain, and Associated British Ports released huge expansion plans for its ports. Even the bank JP Morgan reversed its threat to move bankers to Europe.

So the stockmarket, economy, foreign investors and policymakers all gave a vote of confidence in Brexit.

2. Transformative technology always holds the potential for a boom

Britain is a world capital for startups, technology and business investment, as I just mentioned. That means we’re first in line to benefit from medical, robotic and financial revolutions. Here are a quick few I think you should be invested in.

Bitcoin and the technology that makes it work, the blockchain, are being harnessed by financial institutions. The big banks and trading houses are trying to make transactions instant, free and legally secure by designing their version of the blockchain. That would eliminate a huge proportion of banking costs, which would benefit shareholders and consumers alike. The blockchain innovation is being led by British research and development.

Personalised medicine is a fascinating boom that could save the NHS and turn it into a world leader at the same time. Did you know that many drugs don’t work in the majority of people they’re prescribed to? Imagine the cost savings and medical benefits if you could predict how people will react to different treatments. No more waste, faster treatment, better treatment, predictable and less side-effects, and faster recovery.

Well, it already is possible to predict these factors. The answers are written in our genes. And we’re learning to read them. I know, for example, that I’m susceptible to type 2 diabetes, and that the go-to drug that sufferers take to combat the disease won’t work on me. This knowledge could save me and the healthcare system countless time and money. But the technology of gene sequencing is still in its infancy. The good news is, it’s easy to make the benefits pay off when we master the technology. The boom in medical care could be huge.

A teacher once told my dad’s school friend that he would amount to nothing more than a bricklayer. Years later he became a highly sought-after bricklayer because of his extraordinary speed. He then founded a company on the same premise. It promised clients their walls would be done in no time. It was a roaring success.

The next step is to use brick-laying robots, which can work around the clock at a predictable fast pace with far lower costs. The first commercial one is being released now.

As robots take over more and more jobs, that frees up more and more workers to go on to do something else. This is how our economy grows over time.

But the point is that a technological revolution could cause an economic and financial boom, just as Google, Amazon and Apple have done these past years.

3. Central bankers pump up the stockmarket

There’s an incredibly simple reason why stockmarkets won’t crash this year. Central banks and governments won’t allow them to. And between the two, they have the power to goose the index indefinitely.

The government makes the rules. The central bank has an infinite budget. If they decide that the stockmarket is too important to crash, and they’ll do “whatever it takes” to stop that from happening, they can achieve it.

If this sounds absurd, you haven’t been reading the news. The US Federal Reserve is actively pumping up stocks in the hope that the so-called “wealth effect” will pick up spending. The Bank of Japan is a majority shareholder in an estimated 55 large firms. It owns around 60% of the country’s exchange-traded funds (ETFs). The US legislated into place a Plunge Protection Team to keep markets stable. And the EU is looking into having the European Central Bank fund a bad bank which buys up a trillion euros worth of bad loans. More on them in a second.

If governments and central banks fail to keep stocks afloat, pension funds will implode, economies will tumble, government deficits will be even more unsustainable and jobs will disappear. They simply can’t afford that.

But there are still reasons to worry about the stockmarket…

4. The CAPEd villain is back

The famous stockmarket academic Robert Shiller isn’t the type to give you a clear warning. But his CAPE ratio is at almost 30 for the US stockmarket. It’s only been that high on three occasions – 1929, 1999 and 2007. Do I need to point out what followed each date?

CAPE measures price-to-earnings (p/e) ratios, the price you pay per dollar of earnings. For example, a company with a stock price of five pounds and profits of one pound per year has a p/e of 5. Small business owners often value their enterprise at about five times annual profits. At a CAPE of 25, investors are paying 25 dollars per dollar of profits. That’s frighteningly expensive.

The FTSE 100 CAPE ratio is even more extreme, more than double its average of 15. Either profits will have to boom or stock prices are in for a plunge.

Watching the CAPE can tell you when to buy too – when stocks are cheap.

5. US monetary policy tightening

Just as central banks can push stock prices up, they can pull out the rug too. American central bank policymakers are considering shrinking their balance sheet according to their meeting minutes from March. That means reducing the money supply in the economy. That seems arcane, so let’s take a look at how this affects you

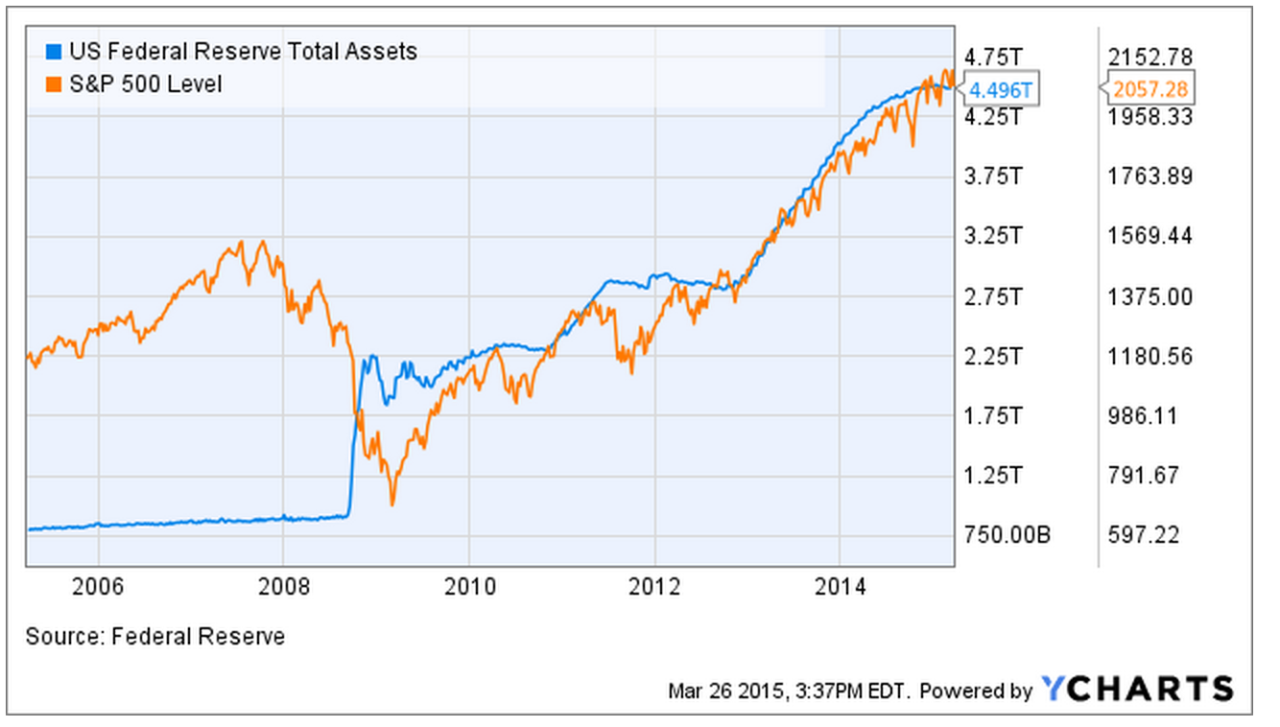

This chart shows the US stockmarket index in orange and the Federal Reserve’s balance sheet in blue.

As you can see, the blue and orange line move together since 2008.

The narrative is as follows. At the height of the financial crisis of 2008, the Fed printed and pumped money into the financial sector to save it. That boosted the stockmarket… for a while.

Ever since, whenever the fragile recovery looked like it would falter and stocks began to dip or go sideways, the Fed began to print again.

Eventually, it gave up on keeping the money supply stable and agreed on a steady regular increase. Stocks kept pace.

This is exactly how a drug addict behaves. First they use a drug to get high, then they use it when they’re feeling down, then they need it regularly just to keep going.

What do you think will happen if the drug-dealing Fed decreases the dose, as it’s discussing? If the balance sheet shrinks, stocks could crash like an addict on withdrawal.

6. Europe’s financial sector is a mess

Europe’s debt crisis of 2012 isn’t over. Banks and governments are not on a sustainable path. Eventually the issue will come to a head again.

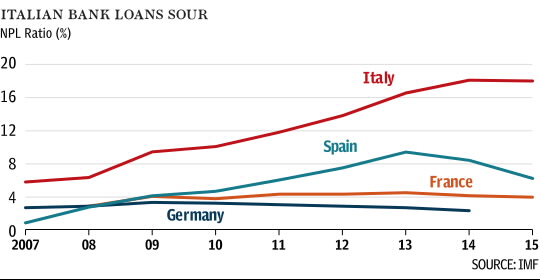

Europe’s banks have one trillion euros in bad debts. 5.4% of loans are bad, compared to 1.7% in the US and 1.6% in Japan in 2015. Between European nations the percentage varies between 1% and 47%.

Italy’s banks are the favourite when it comes to the trigger for Europe’s next financial crisis. Tim Price from London Investment Alert has been tracking the problem that’s come to be known as “Le Sofferenze”. Here’s how Tim put it in a recently published warning on the fate of the European project:

“Le Sofferenze” is what the Italians are calling their banks’ bad loans. It means “the suffering”.

These non-performing loans are now so big they are stifling any hope of a banking recovery.

It all comes down to the country’s failing economy, which is still 8% smaller than it was before the 2008 financial crisis.

The chart below reveals the scale of the problem. Le Sofferenze now account for 18% of all loans.

To put that in context, Britain’s banks’ “bad loans” amount to less than 1.5% of their total. The global average is 4.3%.

And the problem is getting worse at a frightening speed: in the last five years, the sum of non-performing loans has increased 85%. The total now stands at €360 billion.

Let me repeat that: Italian banks have taken on 85% more “bad debt” in the last five years alone.

The 2008 recession was triggered by the build-up of bad loans in the US housing sector. But the percentage of bad loans made by US banks in 2008 was just 5%. The bad loans made by Italian banks are currently more than three times that level.

So imagine the financial chaos, social unrest and negative impact of the last crisis all over again – and perhaps even worse.

Italy’s banks are big enough to dwarf the Greek crisis. Which also threatens to make a comeback. But the point is that the EU would struggle to bail out Italy.

And it’s not just Italian banks. Major French and German banks were found to lack capital in stress tests. When Spain’s Banco Popular was exposed, its share price fell 25% in one morning.

During the financial crisis people often spoke about kicking the can down the road. Well the can is getting mighty close once more.

So which is it for the stockmarket this year? Boom or doom?

Obviously I don’t know. But I know what to watch. Which technologies, financial indicators, political developments and central bank policies. And now you do too. I hope you’ll join me at Capital & Conflict as I try and keep you updated.

But if you’re impatient about taking action now to protect yourself from the doom, or you want to profit from the boom, I can help you right now too.

My friend Phil Anderson tells me he knows just where in the cycle of crashes and booms we are. And unlike other investors, he’s staked his personal fortune on it… to great success in the past.

I was sceptical when I first met him more than four years ago. Leaving the family’s undergarments business to look at investment cycles seemed like a poor choice to me. But you can’t argue with his results.

So why not see what you think of his shockingly simple and effective investment rule? It only has three parts.

Kind regards,

Nick Hubble

Editor, Capital & Conflict

Category: Economics