You wouldn’t expect a government actuary report to be terrifying. But let me tell you, the “Government Actuary’s Quinquennial Review of the National Insurance Fund as at April 2015” report definitely is.

First, notice its rather optimistic assumptions. It modelled elevated levels of immigration, wage growth over 4% a year, stable inflation at 2% and a state pension age rising to 70 without a political drama.

No recessions, busts or crises anytime in the next 50 years though…

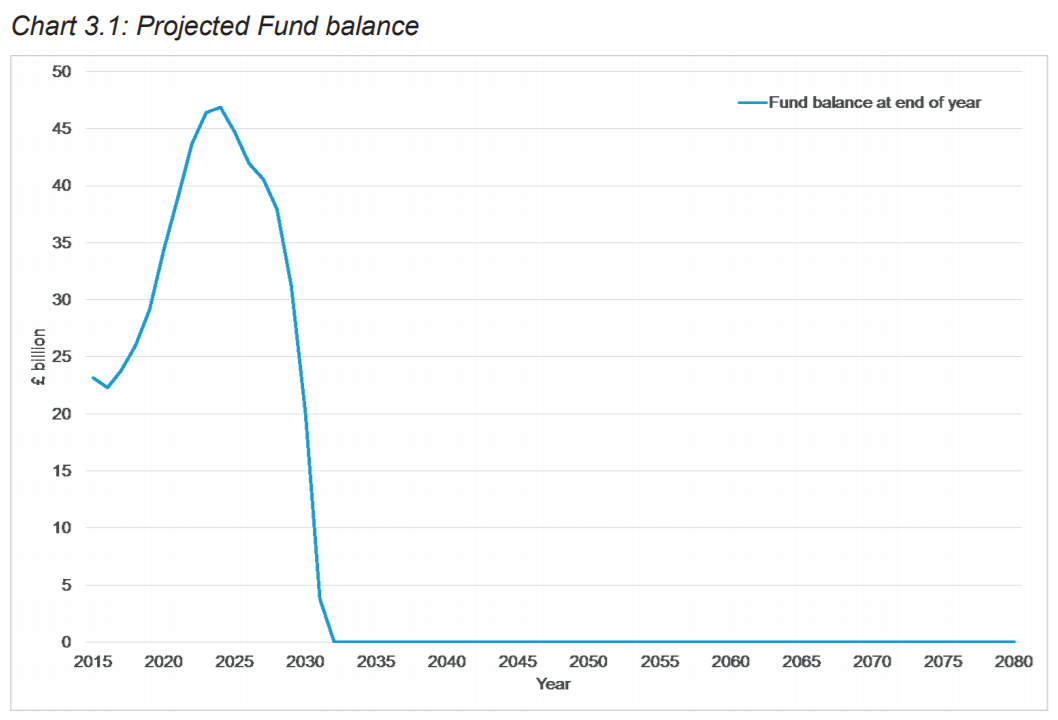

Even living in dreamland didn’t help with the conclusion. According to the Government Actuary’s Department (GAD), the National Insurance Fund will run out of assets around 2032. That’s 15 years away.

This chart shows the projected balance for the National Insurance Fund (NIF). In a few years’ time, we’ll be over the hump. And the deficits will grow so fast that it’ll take less than ten years to pull the rug out from under the NIF’s funding.

But that calculation masks three rather important problems. At least three that I’ll mention.

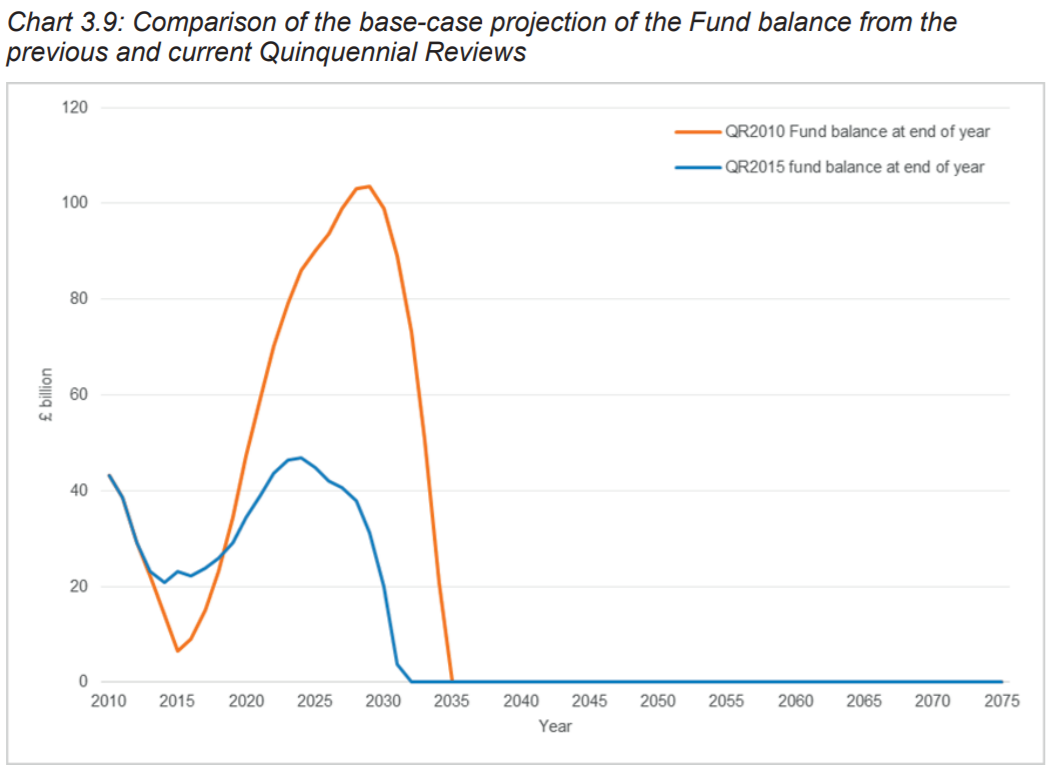

First of all, all those rosy assumptions are rubbish. You only need to compare the report from five years ago to see what impact a dose of reality has.

This chart shows how the NIF will not even reach half the accumulation of assets the actuaries expected in 2010, shown in orange. And it’ll run out of money about three years sooner.

Returns on the NIF’s investments, UK government bonds, have tumbled. The economy and wages aren’t booming anywhere near what was expected, so contributions are less.

That doesn’t stop GAD from making the same mistake going forward. Although it does model a version of events where the NIF runs out of money in 2027 too.

The second issue with the chart is explained by GAD in its report. Before the NIF balance hits 0, the government will have to top it up. Under existing law, a stable balance must be maintained. So the chart above really just shows that the pension bill is about to show up on the government’s balance sheet.

Third, there’s something deeper you need to realise.

The National Insurance Fund is already empty

The National Insurance Fund invests its holdings in UK government bonds, known as gilts. If you think this through, it leads to a horrifying conclusion.

The idea of setting up the NIF and having us all contribute with taxes was to spare the government budget the costs of paying out the pension and other expenses. We were supposed to build up a fund full of assets to live off in retirement.

But if that money is invested in gilts, then the government has spent it…

Think about this for a moment.

The government promised you a state pension. Knowing this was a fiscal nightmare, it set up the NIF, funded through taxes. That money was invested in government bonds. So the government has borrowed and spent the hard earned money you paid into the NIF. The money is gone.

The government’s debt is the asset in the fund. But that asset is the liability of the government which also promised you the pension in the first place.

The same person who owes you a state pension owes the NIF tens of billions of pounds and must bail out the NIF too. Somehow, the politicians have turned three liabilities into an asset at the NIF.

This is the ultimate sleight of hand trick. It’s so abhorrent to the mind that it’s difficult to grasp.

When the NIF goes under, sometime in the next 15 years according to GAD, the government will have to pay up.

It’ll go from receiving funding for its gilts out of the NIF, to having to pay into the NIF to cover spending promises, while the NIF sells its bonds.

That is going to completely trash the Treasury budget and put serious funding pressure on any more borrowing. Gilt yields could spike badly.

Profiting from Pension Panic

If you’ve realised that you’ll need to make far greater provisions for your retirement than any financial adviser will admit, the question is how you’ll go about doing it.

Throwing more money into your pension pot through greater contributions is the usual answer. It’s also the wrong one, as far as I’m concerned.

Gambling your retirement on financial markets is precisely what has let you down over the last two decades. You want to do more of it?

A better option these days is to be more active with your money. Trade both the upswings and bear markets. There have been four since 2000, despite the FTSE going nowhere in the end. That’s four opportunities to profit. Or none if you buy and hold.

Until next time,

Nick Hubble

Capital & Conflict

Category: Economics