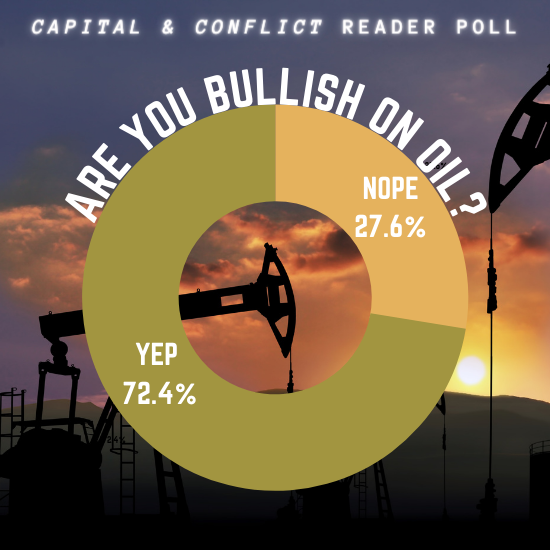

BROUGHTON, EDINBURGH – Well, the results are in from Monday’s poll…

And I must say, I’m a little surprised:

A lot of oil bulls out there – nearly three quarters of respondents. And there I was thinking I had a contrarian view!

Some readers weren’t interested in my binary poll however, and take a more nuanced view. A big oil price will be a big problem for Big Oil, says one reader…

Boaz, I have no idea whether “oil will hit $100 a barrel before the year is out” so I didn’t click on either button. What matters to me is a somewhat longer view. As the prospects for oil decline, so will investment in its discovery and extraction — possibly faster than demand. That’s when the price may perhaps rise, but it will take longer than a year to reach that point because the cheap extractors in the middle east will keep the flow going for a good while yet and will not want to see raised prices for fear of accelerating the shift to renewables and thereby speeding up their own demise.

Given the number of supply chain shocks we’ve seen over the past year (lockdowns, the Ever Given in Suez, Houthi attacks on Saudi oil refineries, etc) I’m not so confident in Middle Eastern oil supply capping higher oil prices (if it can’t flow to where it’s needed, more flow does not equal a lower price). And not everyone in the Middle East wants oil prices capped anyway – Iran has a lot of bills to pay, and it needs its oil revenues to pay them. As I said back in March, I expect they’ll continue to use their proxies to boost the oil price.

But regarding the shift to renewables, our energy expert James Allen sees the decline of oil not only baked into the cake, but beginning to accelerate. And he thinks that if you’ve not got exposure to it, you’re missing out on one of the biggest investment trends in human history. Don’t take my word for it though – get it from the horse’s mouth here.

“Big Oil must adapt to Beyond Oil” he says – and next week, he’s going to tell you the wide-reaching consequences of what that means. For while we’ve seen some wild surges in renewables stocks over the lockdown period – to James’s eyes, the best is yet to come…

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

Category: Economics, Geopolitics