The next two to three years could be the best time in decades to be invested in the UK stock market. Expect the FTSE 100 to smash through 8,000 – maybe even run on to 10,000.

That’s the argument Eoin Treacy put forward in a private conversation with staff here at Southbank Investment Research last week.

It’s a claim that Akhil Patel, editor of Cycles, Trends and Forecasts, has also made in recent weeks. Eoin and Akhil have different ways of investing and analysing the markets. So how have they both come to the same conclusion?

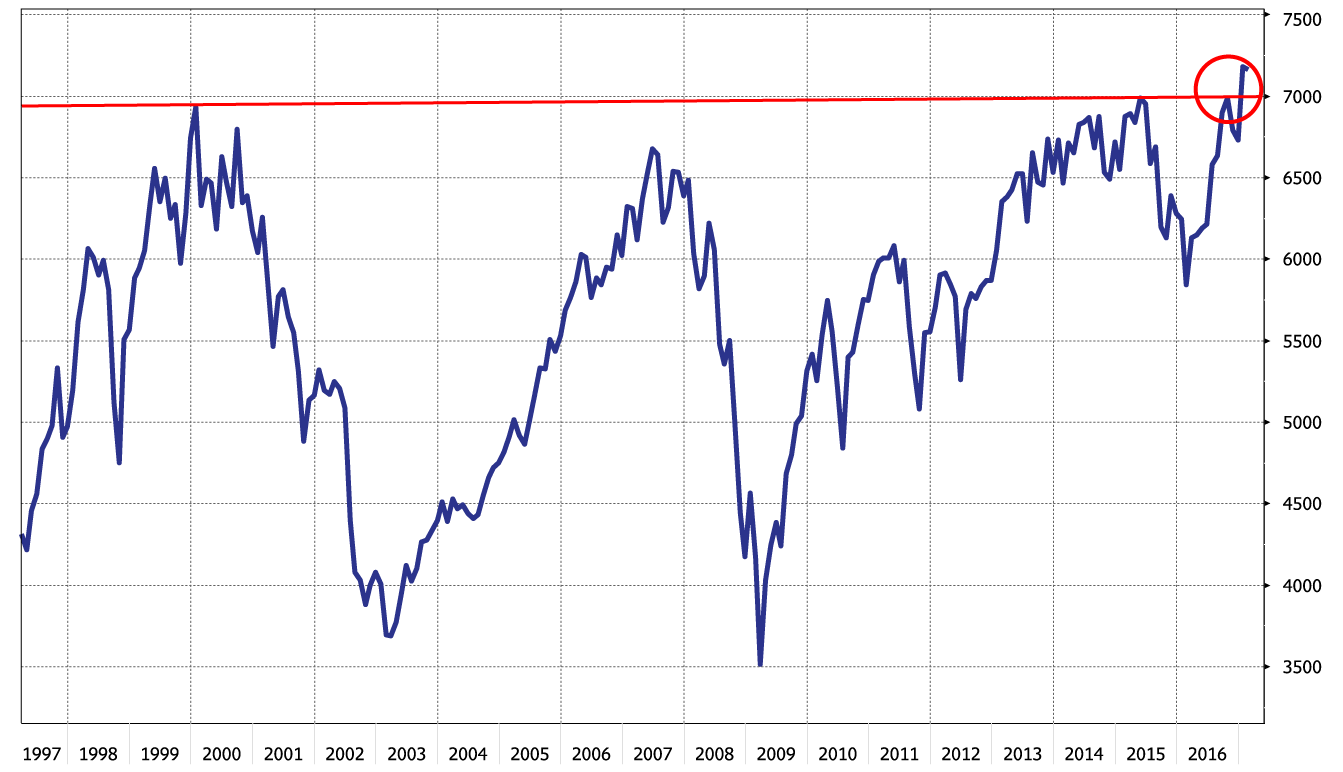

For Eoin – who trades the markets using behavioural psychology as a tool to shape his thinking – it all comes down to a simple fact. The FTSE 100 has been “range bound” for 17 years. It broke out of that range at the end of January.

That’s a significant and extremely bullish signal. Why?

To explain, take a look at this chart of the price action in the FTSE 100 over the past two decades.

You can see the market has traded in a range between 3,500 and 7,000. That’s a big, long-term range. But essentially it means that if you’d bought 17 years ago, you’ve not really made a lot. You could have traded the ups and downs. But we haven’t seen a really big, powerful trend taking the markets above previous all-time highs since the 1990s.

If you’re interested in investor psychology, as Eoin is, that’s an important point to remember. In a range like this, where the market bounces between two levels without making any real progress, people become bored and frustrated.

It’s easy to understand why. Ranges are boring. Trends – a strong up or down move – are much more interesting. And markets can only ever be ranging or trending.

Put another way, an extremely long-term range is a bear market in expectations. I don’t mean people expect the market to drop. They stop expecting anything.

They have an incentive to sell near the top of the range and buy near the bottom, because the market has conditioned them to think in that narrow band. And if you’re a private investor on the sidelines with money to deploy, there’s no urgent reason to jump into the market.

What Eoin is interested in is when a market suddenly shifts from a range to a trend. That’s called a breakout. It takes a powerful psychological trigger to do so – in this case it’s been the lower pound firing up foreign earnings for UK-based firms.

But once it happens and sentiment shifts… the market can explode higher much faster than anyone realises. The FTSE 100 has broken out of its range. The deadlock has been broken. We’ve now moved to a trending phase.

According to Eoin, that engenders a very different psychological response. We’re moving into a period where you’ll see new “all-time highs” reported on the news at an increasing rate. That news flow feeds off itself as it attracts more money into the market, driving it even higher.

It’s a classic “breakout” scenario. And it’s one I know Eoin is already sizing up for entry points. More on that when I get it.

The grand cycle is more important than Brexit

As I said, Akhil Patel came to a similar conclusion in a recent Cycles, Trends and Forecasts letter to subscribers.

He believes we’re on the cusp of one of the greatest periods of wealth creation in human history. Why?

Well, not behavioural psychology – though that does play a role. Akhil bases his analysis of the economy on his understanding of the underlying cycles within the economy. The most important of these is the 18-year cycle in stocks and real estate.

We’re in the wrong part of the cycle to see a major decline in stock market prices.

The real drivers of growth in the economy – like credit growth, technological innovation and infrastructure spending – are all picking up. The UK money supply (which helps us understand if banks are lending) appeared to tick up at the end of 2016, after flat-lining for four years.

Akhil believes this is extremely bullish for the economy. He believes Brexit will do nothing to derail what could be a huge bull market for stocks, property and commodities.

What Brexit does do is provide plenty of fertile ground for gloomy forecasts and negative analysis in the press. Whether accurate or not, that analysis will give plenty of people second thoughts about investing in the stockmarket.

That means we likely have a market at all-time highs and a large amount of money still waiting on the sidelines. Markets peak when people are fully invested and there’s no one left to buy. That’s not what we’re seeing today.

Which is where Akhil and Eoin’s ideas converge. If there’s money on the sidelines waiting to be deployed, people need a good reason to change their minds and move into the market. The psychology of the market needs to shift. A mega-boom in stocks and property, backed up by a market reaching new all-time highs regularly, would provide a perfect psychological trigger.

Range and breakouts

And given we’ve had a 17-year range, the resulting move up in the markets could be extreme. The longer the range, the more powerful the breakout. Akhil refers to legendary Wall Street trader W D Gann’s book Truth of the Stock Tape to back this idea up (emphasis added):

When stocks establish certain levels of accumulation or distribution over a longer number of months or years and then cross them it is almost a sure sign that they are going to new high or low levels before they meet with resistance again…

When a stock advances… into new territory or to prices which it has not reached for months or years, it shows that the force or driving power is working in that direction. It is the same principle as any other force which has been restrained and breaks out. Water may be held back by a dam, but if it breaks through the dam, you would know that it would continue downward until it reached another dam, or some obstruction or resistance which would stop it. Therefore it is important to watch old levels of stocks. The longer the time that elapses between the breaking into new territory, the greater the move you can expect…

The FTSE 100 has broken out of its range. Where next? FTSE 100 hits 10,000? Watch this space.As Akhil put it, “once the FTSE 100 decisively breaks above the 7,100 mark then it is likely to run up much higher. The longer the period of testing up against this level, the greater the breakout.

Category: Economics