Next week the world’s central bankers head to Jackson Hole for the annual Economic Policy Symposium. And the financial world is fretting over their words more than ever in anticipation of what might be said at the event.

Mario Draghi’s spokesperson is out confirming the lack of anything interesting in his speech in advance, just to make sure the lack of surprises isn’t surprising either.

Why the interest? Central bankers dominate markets more than ever before. There’s concern that the market desks of the funny money makers are overwhelming normal market activity. They’re buying too much of everything.

Low volume, bizarre valuations, the proportion of various assets which central bankers already own and shortages of assets eligible for purchase are all in the news.

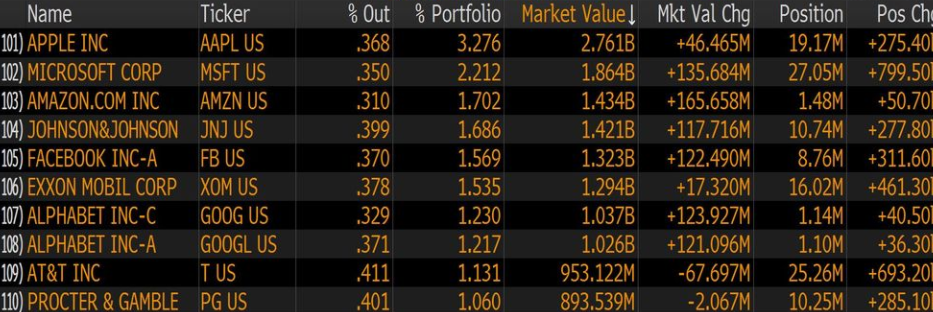

Here’s a selection of examples. The Swiss National Bank owns billions of dollars in Apple shares. The Japanese central bank owns over 70% of its domestic stock exchange-traded funds (ETFs). The European Central Bank is mopping up in the corporate debt market and is running out of German government bonds to buy after already maxing out on Portuguese and Irish debt. The major national banks of the world own a fifth of their governments’ debts. 40% of the Federal Reserve’s balance sheet is invested in government-sponsored entity-backed mortgage securities. And so on and so forth…

Swiss National Bank’s US shareholdings

Source: Bloomberg

With this much influence over markets, a central banker’s slightest mumblings can make or break hedge and pension funds.

But let me tell you what investors haven’t realised yet. Central bankers are fretting over markets to an even greater extent than markets fret about them. And therein lies the key to forecasting stockmarket trends.

Just put yourself in their shoes

Or you can put on the central banker’s hat, as I plan to do at our 6 October conference. Hopefully you’ll join me and the likes of Bill Bonner, Sam Volkering and many more.

But let me ask you this: what would you do in Mark Carney’s, Mario Draghi’s, Janet Yellen’s or Haruhiko Kuroda-san’s shoes?

Imagine you were appointed by Donald Trump this very week on the resignation of Yellen because she is too short to go fly-fish at Jackson Hole and her rubber boots flooded last year. (The annual central bank symposium was first hosted at Jackson Hole to entice avid fly fisherman and giant Federal Reserve chairman Paul Volcker into coming. The climate is just right for trout this time of year.)

Anyway, you find yourself as head of the Federal Reserve. What would you do?

Your mission, should you choose to imagine it

Tasked with managing inflation, employment and financial stability, you have to tightrope walk on three dimensions. And those three can contradict.

I’ve tried to tightrope walk for years and still can’t.

For the last decade, the only thing keeping the economy afloat has been a vast amount of interference by central bankers such as you. Literally trillions of new dollars, euros, yen, pounds and francs have been used to buy vast swathes of government debt, mortgage securities and corporate bonds.

Without your continued help, the financial world would go through the mother of all withdrawals. Could governments finance their deficits with new bonds if you try to sell your holdings of the same bonds at the same time? What interest rates would they have to pay?

Could companies and margin borrowers in the stockmarket refinance their record debts if you increase interest rates? Who knows whether banks could still write mortgages if you try to sell your trillions of dollars of mortgage-backed securities into the market.

Worse still, the stockmarket flutters the moment you open your mouth. Repeat anything other than the very same words you did last month and stocks plummet or surge.

And the world is now fixated on those stock index prices like never before. Every pay cheque, people plough vast sums of their money, willingly or unwillingly, into pension funds that buy stocks no matter the valuation, growth prospects, dividend yield or anything else. It’s a berserker strategy of investing known as “indexing”.

Buy no matter what

And the sudden outbreak of index investing leaves you as the responsible manager of all pensions by default, given your influence, or as they would say “control”, over the stockmarket. If you fail to pump stock prices, the concept of retirement in the Western world implodes. Thanks to academic research, the pension funds are banking on 7% gains or more per year. Good luck delivering on their promises.

Everyone now has their eyes on your so-called “exit strategy”. They burned effigies of Volcker the last time someone had to pull off a substantial exit of overly loose monetary policy.

The only good news is that inflation is nowhere to be seen. The age-old accountability mechanism for central bankers is in hibernation. Nobody is sure why.

How do you feel about ending central bank support for the economy and financial system now you’re the one responsible for the decision?

Do you think they will try it?

Even Greenspan was sucked in

All this explains why even the free marketeer and gold standard advocate Alan Greenspan was sucked into their web. He abandoned his principles and turned into a bubble-blower extraordinaire while chairman of the Federal Reserve.

His accomplishments during the so-called Great Moderation include financing a tech and housing bubble as well as rescuing anyone big enough who failed. The very opposite of his opinions before joining the Fed.

Running the economy’s main source of government interference based on a faith in free markets is a complete paradox. Greenspan believed that the free market would self correct while it was pumped full of funny money and low interest rates by him.

It’s absurd logically. But it all makes perfect sense when you put yourself in their shoes.

Would you raise interest rates? Would you reduce quantitative easing (QE) and sink the stockmarket, taking down the retirement living standards of everyone around you? Maybe you would stop financing your boss’ bonds in the treasury market?

Only an academic with no awareness of the real world could even handle the responsibility and pressure of central banking. (Or an investment banker formerly at Goldman Sachs.)

That’s why Yellen was chosen in the first place. Her blasé attitude to the sub-prime crisis right until the end was extraordinary. Her blasé attitude to the next crisis, which she is setting up, is just as impressive. How can she say “I don’t believe we will see another crisis in our lifetime” when she is the one financing the next crisis?

Unless, of course, she is right.

Prediction or self-fulfilling prophecy?

Nobody with the potential to become a leading central banker would weather a financial crisis for the sake of imposing sensible monetary policy. You and I probably wouldn’t do it either. We’d get sucked in like Greenspan.

And so sensible monetary policy is simply not going to happen.

What will happen is very simple. The moment markets wobble, lending declines, interest rates rise or anything else goes wrong, central bankers will return to QE. Or perhaps some new policy tool.

Watching the projected central bank balance sheet reduction with fear is like worrying your dog will chew off its tail if it ever catches the evasive little furball that seems to follow him everywhere. You’ve fundamentally misunderstood what’s going on.

Markets determine central bank policy, not vice versa.

You’ll discover the implications for your portfolio at our conference in October. And see my funny hat.

Until next time,

Nick Hubble

Capital & Conflict

Category: Central Banks