There are two types of governments in this world. Those who can print money and those who can’t. The distinction will define your investing success.

It already has, actually.

Stock markets in countries with a printing press are doing just fine. Stock markets in countries without a printing press are in trouble.

Spain, Greece and Italy’s stock markets are languishing. Greece’s had to be closed in 2015. Switzerland, America, Japan and Britain have had stock booms since their money printers got going.

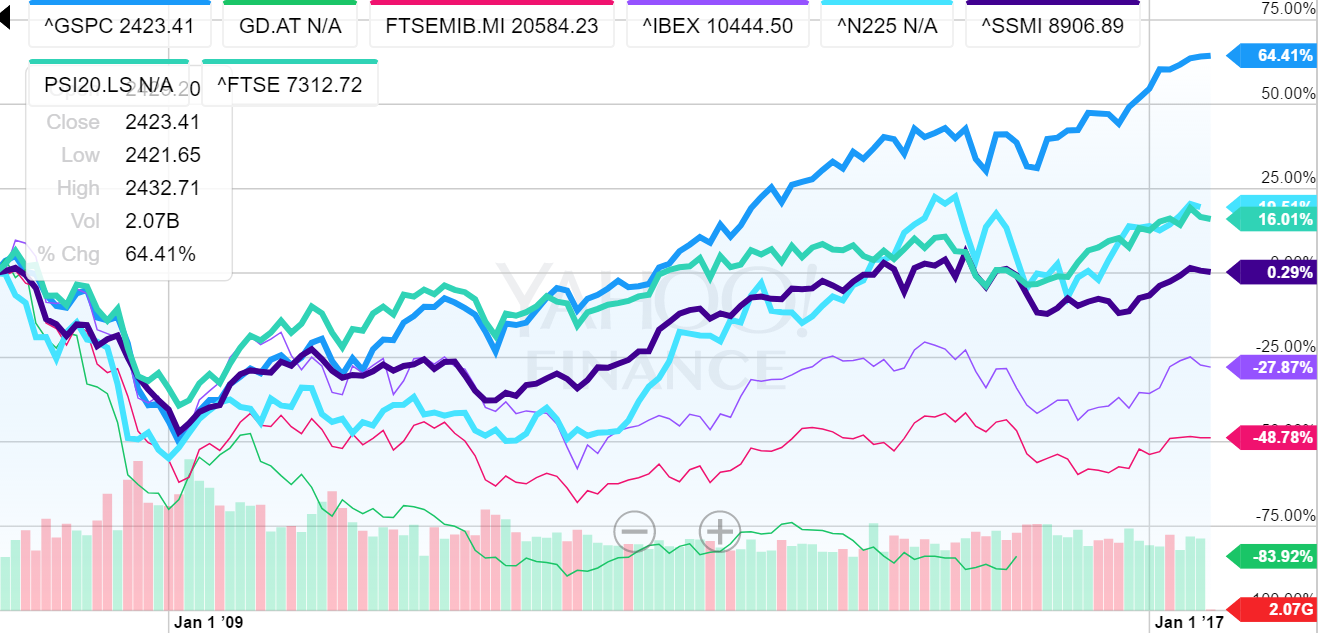

Let’s look at this on a chart

The money printers’ stock market indices are in bold, while those subject to the imposed policy of the eurozone’s ECB are the thin lines. The four outperformers are all money printers, while the three underperformers are not

Of course some countries in the Eurozone have done fine. Especially Ireland’s stock market. But that’s because the monetary policy of the ECB happens to have benefitted them. Greece, Spain and Italy would be printing money like mad if they had the power to.

And yes, no government technically has control of its central bank’s policy. But central banks are practically a government department by nature. They’re price fixers, bailout providers and regulators subject to government decree.

Some central banks have a domestic focus – one country. Others preside over several economies and their stock markets. That’s the key distinction.

It’s not just stocks, but the economy as a whole that follows this trend. Places with their own monetary policy can use that monetary policy to stimulate the economy. Places suffering under imposed monetary policy for a bigger area have no such control.

The EU is only one place where monetary policy is a one size fits all approach. The best illustration is the divide between America’s federal and state governments.

Illinois is looking more and more like Greece. It just passed its first budget in three years. The courts are forcing the state to pay bills it doesn’t have the money for. Pension obligations are an impossible amount. And ratings agencies are preparing to label the state’s bonds junk.

Other states are close behind Illinois’ demise. Basic government services are being shut down, and going unpaid.

How to profit from the two types of government

With the world’s financial markets moving in sync, and central bankers controlling them all, perhaps the best way to invest is pair trading. Bet in favour of one thing and against a related thing at the same time. The aim of pair trading is to be “market neutral”. An example explains it best.

If you bet against Italian shares while investing in Swiss ones, you are market neutral… in a way. European stocks tend to move in a similar direction. The bet is really that Swiss stocks will do better than Italian. Whether it’s a bull or bear market for stocks in Europe doesn’t matter. Your Swiss stocks might rise more, or fall less than the Italian ones you bet against, and you’d make a profit either way. You’d only lose money if Swiss stocks underperform Italian.

The tricky thing with pair trading is to get the balance of the size of the investment right. But let’s set that aside.

The aim of such a trade is to be long central bank intervention. The Swiss can print money and buy Swiss shares. They do to an extraordinary extent. The Italians are subject to the monetary policy of the Eurozone as a whole. And they just ignored the EU’s new bank rescue rules, so the Europeans rulers aren’t likely to be pleased.

While Swiss stocks get huge amounts of central bank support and Italian stocks far less, the pair trade bet should pay off. It has been so far.

If pair trading sounds too complex, look at it differently.

Imagine if you owned the printing presses. Not the papers, the money printing ones. Imagine if you could print your own pounds.

The thing is, you sort of can. You can invest in the people who do own the printing presses – the government.

Buying government bonds in places that can print money sounds like a rather safe bet. Inflation is your main risk. That takes time to emerge, so you’ll have plenty of warning. Investing in short term government bonds of countries that can print money is therefore not a bad strategy. At least it hasn’t been.

Meanwhile, governments that can’t print money may have to default. American state governments and EU governments are on top of this list. Their bonds will steadily fall in value because they don’t have central bankers looking after them specifically.

In America, the bailout situation for state governments isn’t quite clear. Will the Federal Government and/or its central bank come to the rescue?

There’s nothing like the austerity imposed by the free market. It will make the IMF, EU and ECB look kind.

The Eurozone is in Trouble

Imagine if the typical southern European voter figured all this out. That the monetary policy which is benefitting Germans and Irish is the same policy that is crushing them. With the monetary policy of the Swiss or Brits, the Italians, Portuguese, Spanish and Greeks might be faring far better.

Not only that, but monetary policy has begun its big shift from stimulus to tightening. Do you think Greece is ready for financial support from the ECB to end?

Do you think they’d rather have their own monetary policy again?

The divergence between governments that can print and those that can’t will have political consequences alongside the economic ones. I wonder which will come first?

Until next time,

Nick Hubble

Capital & Conflict

Category: Central Banks