It’s been five long years. But the American central bank can finally claim victory. After five years of undershooting, it’s hit its inflation target at last. America’s year-over-year PCE deflator hit 2.1% in February. That’s impressively close to its 2% goal.

Congratulations from us here at Capital & Conflict. This is great news for the members of the Federal Open Market Committee. But it’s bad news for everyone else.

2.1% inflation is bad for people with money in their bank account and it’s awful for bond investors. Especially while interest rates are still rock bottom. Inflation devalues the money Americans earn each day too, which hasn’t been growing much. For the world, it means the reserve currency is losing value against the commodities it’s used to pay for. And the value of dollars earned by companies in other countries is falling too.

We all accept central banks and their inflation targets blindly, as though they are a cog in the wheel of the economy. Tell someone that the world would be better off without central banks and they’ll look at you like you’re a total loony.

Of course people in North Korea probably think you’re a loony if you suggest privatising just about anything. “Who would tell us what to farm if the government doesn’t?” they’d ask. “We can’t let profit-seeking companies publish books, they’re too important!”

In the UK we used to control coal, electricity and many other prices. But that seems absurd now. The same should apply to central banks. Privatise money and get rid of monetary policy!

Can you imagine a private company whose job it is to lose 2% a year on its currency? No, a private for profit company would do a much better job. Just like they used to in the UK. We still have ten different note-issuing banks in the UK from those days. It took me hours to convince an Australian foreign exchange kiosk that £20 notes from Clydesdale Bank, the Bank of Scotland and the Royal Bank of Scotland are all the same as from the Bank of England.

Incidentally, the Federal Reserve actually is a private company, owned by banks. But so many laws govern it that this a moot point.

Of course money isn’t going to be privatised any time soon. Unless bitcoin destroys the government-run financial system. So the better question to spend your time on is this…

Is the Fed on the way up?

Now that the Fed has hit its target, what happens next? Normally an inflation rate above the target eventually means interest rate increases. And that’s just what the Fed has implied in its forecasts.

For now, it looks unlikely the rate increases will come soon. More time-sensitive indicators since February signalled inflation slowed again.

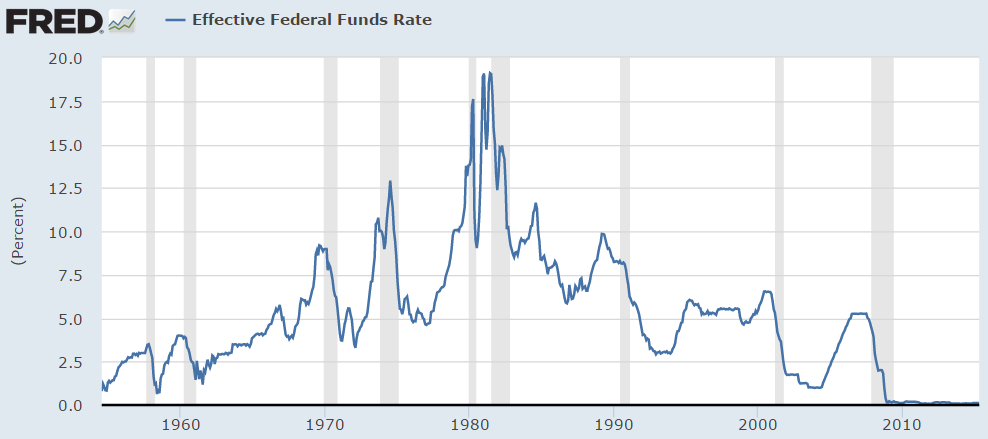

But eventually the Fed will manage to pull off the inflation it seeks. And more. And then it will have to reverse monetary policy. This could be the key to the next few decades of investing, just as falling interest rates were the key to the last few decades.

Rates fell from over 18% to 0% as stocks boomed. Will they boom as rates go back up?

Who can afford higher rates?

The problem with using interest rates to manipulate the economy is that the effect flows via debt. If the economy is too slow, you stimulate borrowing with lower interest rates. But that ignores the limit to how much people can borrow. If you rely on more and more borrowing to keep the economy afloat, you’re building up a mountain of debt. Eventually rates hit 0% and the borrowing binge has to end.

Debt is a wonderful thing, until it goes wrong. You can live so far ahead of your means it’s remarkable. But there’s a binary outcome. You’re either solvent and living the rich life, or you’re broke and in deep trouble.

Are we reaching the “broke and in deep trouble” phase? It’s hard to say. I’ll take a shot at answering that tomorrow.

Canadian contagion?

Last week we looked into a Canadian mortgage lender who had to access an emergency loan costing 20% interest. On Friday, Home Capital Group’s financial struggles hit the world news and the stock plunged. Regulators promptly told the media they’re standing at the ready.

The Canadians’ biggest non-bank lender only owns around 1% of the country’s mortgages. So why should you care? Because contagion is already spreading.

Home Capital Group’s competitor Equitable Group announced yesterday that its depositors are withdrawing their money.

Canada has an impressive housing bubble. Its own regulator is issuing warnings. If Home Capital Group is the canary in the coal mine, look out. The other lenders could be in similar strife.

For now the real worry is elsewhere, but with a similar problem. It’s much closer to home.

Until next time,

Nick Hubble

Capital & Conflict

Category: Central Banks