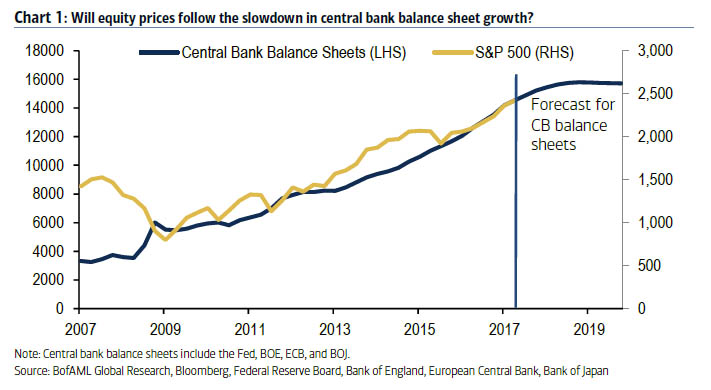

Fear is pulsing through the markets. Analyst after analyst at investment banks around the world are pointing out that only central bank money printing has kept the stockmarket afloat. And central bank money printing is set to decline in 2018. Therefore, the stockmarket is doomed.

This analysis has things precisely backwards. Central bankers printed money precisely to goose the stockmarket. It’s not a side-effect, it’s the intended “wealth effect”.

That theory says pumping up the stockmarket will make people feel richer and buy more, improving the economy. This is about as stupid as tricking people into borrowing and buying more with low interest rates. But with that method exhausted at 0% interest rates, central bankers came up with theory B to justify their hammer looking for a nail philosophy.

Anyway, if central bankers are printing money precisely to goose the stockmarket, then worrying about the effect of an end to quantitative easing (QE) on the stockmarket is missing the point. The moment the stockmarket dips, they print more money.

The stockmarket drives QE

Indeed, just forecasting central bank policy based on their predicted amounts of money printing is misguided. They will print the amount of money needed to float the stockmarket, regardless of what they publish as their estimated amounts.

Worrying about a crash in the stockmarket because of a lack of QE completely misses the reason QE comes into being – to prevent a falling stockmarket.

Economists join the stockmarket analysts with a slightly more enlightened question: how will the central banks “unwind” all their stimulus?

But nobody has answered the “why” yet. Why would central banks unwind their stimulus if it’s the only thing keeping things afloat? Why will they willingly call an end to the stability they’ve created? It may be false stability, but it still feels stable.

For central bankers to decrease QE and increase interest rates in the face of a stockmarket crash would mean a complete change of their position and belief set. They’d have to admit they’re clueless and declare they’re willing to allow a repeat of the 2008 crash.

Unlikely.

At the slightest sign of trouble, central bankers will return to their QE ways.

Until next time,

Nick Hubble

Capital & Conflict

Category: Central Banks