Imagine being so concerned about the volatility in the stockmarket that you’d make an interest-free loan to the US government. You’d only do so because you’d prefer a liquid security—even a debt instrument—to a short-term money-market fund or stocks. You’d exchange liquidity for yield, in other words.

That’s what happened overnight in the US Treasury market. Uncle Sam sold three month T-bills with a yield of absolute smacko for the first time ever. Demand for the instruments was the highest since June. And just to repeat what happened, investors bought a supposedly interest bearing security they know won’t pay a yield.

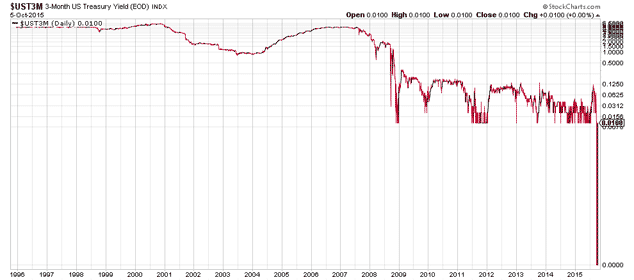

And you weren’t convinced we live in strange times. The markets are full of carnival mirrors these days. A low interest rate world distorts the way you see everything. You can see the distortion in the chart below. It’s a long-term chart of the yield on the three-month Treasury bill.

There was strong demand for the bills, as I mentioned. And in the secondary market, after the government has auctioned the new crack, the yields have actually been around and even below zero for a few weeks. According to the Wall Street Journal, “On Monday the yield on the one-month bill traded at negative-0.02% and the three-month yield was zero. An investor who holds the one-month bill through maturity will log a moderate capital loss, but that is the price the buyer has been willing to pay to obtain the bills.”

What price liquidity? Apparently no price is too high. At least not yet. “It is a bizarre outcome, but that is the world we are living in right now”, says Thomas Simons, a money-market economist in the Fixed Income Group at Jefferies LLC. “For many investors investing in short-term markets, bills are the only game in town.”

Why is it so hard to plan for the future and think long-term? Because the value of money is arbitrary and fleeting when interest rates are set by a committee. The inevitable result of rigging the price of money is inflation (in asset prices), and short-term thinking. Investors who think short-term aren’t investors. They’re asset renters. Or gamblers.

Recently beknownst to me is that the editors of MoneyWeek – John Stepek and Merryn Somerset Webb – have been trying to solve this problem for some time now. They call their solution Lifetime Wealth. The idea is simple in concept and in execution. Make a few investments that more or less track the market safely and forget about it and enjoy life. More on this later in the week.

In the meantime, please note the Dow Jones Industrials rallied 300 points and nearly 2% as three-month T-bill yields plummeted. Investors have decided: they don’t think the Fed can or will raise rates this year.

In the absence of higher yieldsm, investors are making two distinct choices. The first is to flee to liquidity and quiver in fear. The second is to buy stocks on the bet that the easy-money train will keep on rolling for 2016.

Keep your eyes open. That’s the move you could see now, the market ‘pricing in’ what it thinks will be an entire year of no change in US interest rates. Rally now in anticipation!

You can see that it’s all a mess. The whole market has been reduced to guessing whether Janet Yellen and Mark Carney’s intentions with your money are honourable. Let me save you the trouble of wondering: they are not. Sell the rallies.

You have no right to remain silent

This is one of those items I’ll probably regret publishing. But sometimes you have to bite the bullet and risk it. Here goes: your smartphone can be used to spy on you without your knowledge, according to US National Security Agency whistle-blower Edward Snowden.

Snowden told the BBC about the ‘Smurf Suite’ of surveillance capabilities developed by the NSA and Britain’s Government Communications Headquarters (GCHQ). He said it’s not you the surveillance agencies are after. It’s your phone.

Your phone has all the good stuff on it. Plus, they can turn your microphone and camera on without your knowledge by sending your phone an encrypted text message. It’s like a pocket-sized Big Brother. Or a crafty and malicious Little Brother, keeping you in their sights all the time.

Snowden says the suite of capabilities can turn your phone on and off without you knowing (Dreamy Smurf), turn the microphone in your phone on to listen in on you (Nosey Smurf), or determine where you are using your phone’s geo-location data (Tracker Smurf). This is an enhancement on using cell phone towers and triangulation to find you.

Someone with access to your handset can tell, “who you call, what you’ve texted, the things you’ve browsed, the list of your contacts, the places you’ve been, the wireless networks that your phone is associated with. And they can do much more. They can photograph you”.

Defenders of government intrusion into your private life generally have two things to say about this. The restrictions on its use are quite strict. It will only be used on terrorists, drug dealers, criminals and perverts. Or they say that “if you have nothing to hide, you have nothing to fear”.

A legal and philosophical discussion of the right to privacy, or what a reasonable expectation of privacy is, is beyond the scope of today’s Capital and Conflict. But let me just make the point that in a free society – whether it’s a constitutional monarchy or a republic – there is a strong presumption always in favour of individual liberty over government power.

Or more plainly, you don’t have to prove to the government that you’re not doing anything wrong. It has to prove to you that your behaviour is so suspicious that it merits being charged with a crime. The British legal tradition recognises that it’s in the nature of government power to always encroach in personal liberty. The powerful prey on the weak because they can. The rule of law is there to prevent that.

A healthy respect for the rule of law and individual liberty would lead you to the conclusion that in a free society, you don’t want the government looking over your shoulder – or up at you from your pocket – just to be sure you’re not doing anything wrong. Your life is your life. And the pursuit if your happiness is unduly constrained by the fear that someone in a faceless bureaucracy may be watching and recording.

That’s the other important aspect to this discussion. What you do in your private life might not be a crime now. But if the majority changes the law, everything you say and do now could be used against you in a court of law. Or to blackmail you.

If you’re worried about this, there are two things you can do. First, drop out of technological society completely. It’s the only way to be sure.

If you’re not willing to do that, sign this petition to keep the government from taking your cash and instituting a digital currency . Control of digital money by the authorities is every bit as draconian and tyrannical as turning your phone on in your pocket to hear what you and your partner are talking about over dinner. It’s worse, in fact.

Political liberty and financial liberty are inextricably linked. If you’re not free to do as you want with your money, to trade with those whom you wish to trade with, or to count on the soundness of the money in your pocket, it’s hard (impossible) to live a free life pursuing your own happiness and improving the life of you and your family. If you agree, sign the petition.

Britain in Europe

Finally, you’ll hear from me next week on the proceedings of a conference to take place this weekend outside Naples. It’s called ‘Political and Economic Freedom and the Future of the European Union’. In preparing for the conference, I’ve been reading a great deal about the debates in this country about the European Union, the European Commission, and the events surrounding the birth of the European Central Bank and the common currency (the euro).

Several observations have already occurred to me as a result of what I’ve read so far. First is this: democracies can be just as dangerous to individual liberty as tyrannies. Majority rule is no guarantee of justice. That is why the great founding documents of the Western order have a respect for tradition (common law) and for laws which strictly define and limit the scope of government power.

Second, free trade and voluntary exchange between people is the best way to both improve the quality of life for the greatest number and to do so without the coercive violence of the state. Of course there is no such thing as free trade today. The world is rife with trading blocs and protectionism via tariffs. That will always be the case. But the greater the division of labour globally, the more people enjoy rising standards of living. If you’re for ending poverty, you have to be for free trade, otherwise you’re just a grandstanding moralist who likes to feel superior to people who have a better understanding of economics.

Thirdly, some people in Britain have known all along that the monetary union in Europe as always a back door for political union, centralisation and control from Brussels. Nigel Lawson knew. Margaret Thatcher knew. And Labour MP Nigel Spearing knew. He asked Mrs Thatcher the following question on 30 October, 1990 during question time [emphasis added is mine]:

“Despite what the prime minister has just said, is it not clear that it is the wish of our partners that there should be a loss of national identity on currency?”

“Is it not true that even the hard ecu, coupled with fixed exchange rates, would lead inexorably to economic and monetary union and to government either of bankers for bankers by bankers or to a strong political central government that would usher in a new Euro-state? If the prime minister is to save Britain as a self-governing nation, had she not better make that clear and galvanise the people of this country and all parties in Parliament to say a very polite no to economic and monetary union?”

Remember that’s a Labour MP speaking. Times have certainly changed. Reading the history of Britain’s discussion about its involvement in the European Union, it’s amazing how clear the debate was then. And how muddy it is now.

The European Union is about centralisation and the transfer of power from sovereign parliaments to Brussels. There may be tangible benefits to membership in the EU. But the loss of control to the European Commission and the European Parliament is certain not one of them.

Yet methodically, Brussels advances, driven primarily by the twin powers in Paris and Berlin. The French desire a rational and top-down Europe with rules made at the centre and distributed to every corner of a Federal Europe. The Germans—perhaps still afraid that left to their own devices they’ll try to take Europe over again—are going along with it.

Once a trans-national government authority gets going, like an avalanche, it’s hard to stop. Unable to foist political union on Britain, the EU and its agents have gone through the backdoor. Control the money, control the state. Control the state, control you.

What a challenge for people trying to preserve their own financial freedom and liberty. Your own government plots to come for your cash. An un-elected nest of vipers and thieves, meanwhile, plot to come for your Parliament. Time to get on the front foot, Britain.

Category: Brexit