ECCLESHALL, STAFFORDSHIRE – Back in Staffs – right on time for the pubs to start letting people inside again. I’ll see you at the pub later. In light of our 2021 Gold Summit, I think it’ll have to be a pint of Golden Ale for me…

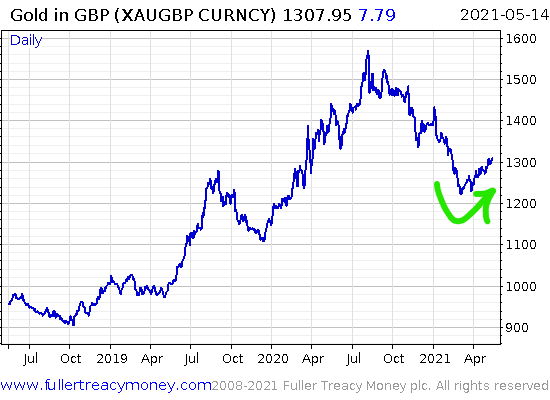

The Summit is almost over – and what an event it’s been. I’m very pleased with what we’ve created, and I hope it’s been of value to all who tuned in. I’m also pleased with the timing of our release. We managed to get the event produced and online right as the gold price has bottomed. It’s early days for this change in trend, but so far so good:

My good friend and colleague Nickolai Hubble gave the Summit’s keynote address – you can watch it here if you haven’t yet, while there’s still time.

Nickolai is very bullish not just on gold but on gold miners – as am I. I’ll let him make the case for the gold mining sector here, but in today’s note I’d like to tell you how much conviction I have in the gold mining sector – especially over the long term.

I haven’t shared this information publicly (or even with my colleagues) before, but I share a lot with you in these letters and see no reason why I shouldn’t tell you.

But before I go on, I want to make something very clear: what I’m about to write is neither personal financial advice, nor general financial advice.

The investment strategy I’m following here is very risky, and were I closer to retirement than I am (I’m still in my twenties) I’d probably be pursuing a less “gung-ho” strategy. I do not advise that you mimic my behaviour, but treat it instead as spectacle.

I’m referring specifically about the company pension I have here at Southbank Investment Research. Our business runs a defined contribution (DC) pension scheme, with generous employer contributions on top of employee contributions.

(It’s no defined benefit (DB) scheme, like the gold-plated final salary pensions from the days of yore. But – unless you work for the state in some capacity – good luck finding one of those that’s still open for new members and not trying to buy-out its existing ones.)

Anyhow, as is often the case with DC pension schemes, ours is administered by a large life insurance company, and offers a wide range of investment funds which members can invest their contributions.

While I started working here in 2017, I only actually got around to inspecting the options available in 2019 – as I say, I’m quite a long way off retirement and the pot was still small at that point.

But in June 2019 I got around to looking at the funds they had on offer. And I decided to move away from the default cookie cutter pension fund I’d been automatically rolled into for something more exotic. Of the funds I available, there was only one that I wanted.

It was a simple decision. Maybe a terrible one. Maybe a great one. I’ll flatter myself, and call it “brave”. But the line between bravery and stupidity can be nigh-on invisible, and only time will tell if this was actually a good idea.

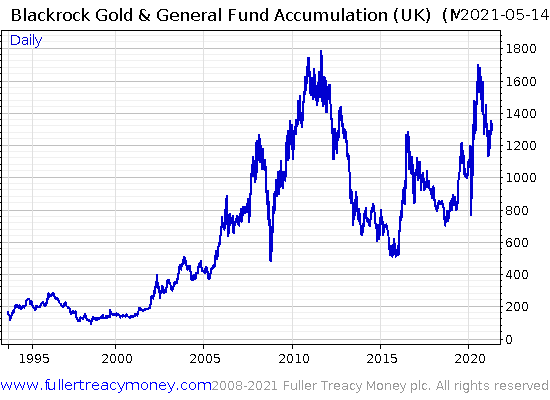

I dumped the whole pension (and all future contributions) into one fund, which only invests in one thing: companies which mine gold and precious metals.

The fund in question is the Blackrock Gold and General fund. If you’re into gold, you may well have heard of it. It found fame straddling the gold bull market of the 2000s, and I expect it to perform well again in the gold bull markets of the future.

It’s had a wild time over the last few years, but as retirement is decades away for me, I don’t mind having so much exposure to this sector. I can survive all manner of false dawns and market consolidations in the gold price – I have plenty of time to wait. I’ll be buying every month, for as long as I stay at Southbank – the longer this fund stays cheap, the better for me!

Maybe the decades to come will prove this is the dumbest financial decision I have ever made. But as far as I’m concerned, if I can’t even get this right then I don’t deserve to retire anyway.

Besides, my company pension forms only one part of my overall investment portfolio. Outside of the tax-advantaged structure that pensions provide, I have plenty of other investments elsewhere – several of which you’ll be familiar with if you’re reading this letter.

As I say, I don’t recommend you follow my lead here. But I would like to know if you think this is reckless, dumb, or otherwise misguided. Have I made a grave error? Send me your thoughts here.

See you at the pub,

Boaz Shoshan

Editor, Capital & Conflict

Category: Investing in Gold