WINDERMERE, LAKE DISTRICT – How much inflation can you tolerate?

What percentage of your savings are you willing to watch burn every year, “for the good of the economy?”

0%?

1%?

5%?

Perhaps I shouldn’t be asking. After all, that decision has already been made for you.

The government mandated in 2003 that 2% inflation every year is what’s good for you, and they weren’t interested in putting it to a vote.

(This was a reduction from the 2.5% inflation target that had been in place for the 11 years before that – no doubt there’s probably somebody out there who thinks we should be grateful for such monetary mercy.)

2% inflation is the sweet spot. The governments of America, Australia, New Zealand, Canada, and the technocrats of the eurozone all agree. Something about that number… that ever so marginal destruction of the everyman’s purchasing power… it’s just good for the soul.

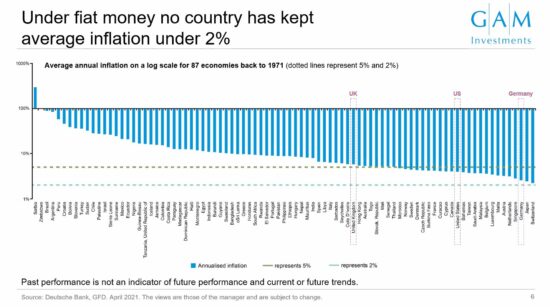

And yet, despite the broad consensus that 2% is “the right amount” of inflation, there’s an awkward fact to consider. Under the fiat money system we’ve been in since 1971, where in the absence of gold governments have had sole responsibility for managing their currencies… no government has been capable of achieving it.

This great chart from investment manager GAM shows the damage. No country has been able to keep average inflation as low as 2% over the period since the world went off the gold standard in ‘71. It always averages higher – even for nations that have experienced outright deflation like Japan, or governments that are desperately afraid of inflation, like Germany:

Click to enlarge

Click to enlarge

Source: gam.com

Inflation has averaged over 5% in the UK since ’71. The list of countries that have done a better job of protecting their citizens savings over that period is numerous indeed.

Amongst many others, the Aussies, the Moroccans, the French, the Canadians, and the Americans have all kept inflation lower… and the Saudi Arabians and Malaysians are better still.

I must say, I am very impressed to see Burkina Faso on that list – I suggest Her Majesty’s Treasury department send a delegation of their top economists to Ouagadougou (referred to as “Waga” for short by English-speaking visitors) for an extended stay, so they might learn something.

Of course, central bankers and their apologists would say that I am being unfair, as targeting 2% inflation only became popular many years after 1971. Perhaps “they just need more time”, and in a few more years the long-term averages will go down… but I doubt it.

Do you really think that they’ll be able to keep inflation at 2% in the 2020s, with the government spending cash as fast as the central banks can print it? And even if you were, are you really willing to let your savings burn at 2% a year anyway?

My answer to both questions is no. And that’s why I own gold.

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

PS I hadn’t spent much time in the Lake District before coming here a few weeks ago. What a damn pretty place – I can see why so many people like holidaying here.

It’s time for me to head off though – duty calls…

Category: Investing in Gold