Well that’s that dear reader – The Halvening has happened. Block 630,000 was mined yesterday just after 8pm. The long-awaited block of transactoions only took 20 seconds in the end. It’ll be another few years before we see the next halvening arrive.

What next? Well, I’ll leave Sam Volkering to give you his prediction, informed by years of experience in the crypto sector. He’s observed every halvening thus far, and while what happens next is never the same, there is one element to them all that rhymes – a recurring effect that you can profit from, which he’ll show you here. (link to CPE promo for nonbuyers, link to Crypto Eclipse report for buyers)

But that’s all from me for today – I’m about to see if Nickolai Hubble will give me the goods on what’s going on in the eurozone.

I’ll leave you with the following witty Coin Confidential that my colleague Harry Hamburg penned recently. You normally need to pay for Harry’s witty insights, but as it’s a special occasion – “Bitcoin Boxing Day” – this one’s for free.

Until tomorrow,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Bitcoin halves during the worst recession on record

Harry Hamburg, Coin Confidential

It’s time for some BIG MONEY NEWS!

Whenever I hear debates about BIG THINGS I can’t help but remember a comedy sketch from That Mitchell and Webb Look a few years back.

Basically, it was making fun of the very important panel shows and the very important things they talk about. And it was called BIG TALK.

If you never saw the BIG TALK sketch, you can watch it here on YouTube to get an idea of what I mean.

So, when I woke up to the big money news on Thursday, I couldn’t help but be reminded of that sketch.

And that big money news is…

Britain is facing its worst recession for over 300 years. Or basically, “since records began”… which is another classic BIG TALK-style phrase.

From The Times:

The UK recession will be the deepest since the Great Frost of 1709 and more than twice as bad as the 6 per cent crash in the financial crisis but the economy is projected to bounce back quickly with 15 per cent growth in 2021… In a slower rebound than the Office for Budget Responsibility’s recent forecast for the government, the lost ground will not be recovered entirely until the second half of next year.

The good news is everything is also predicted to get back to normal by the second half of next year. Make of that prediction what you will.

And it’s not just Britain.

The EU is also set to enter its worst recession on record – almost twice as bad as the after-effects of the financial crisis.

From The New York Times:

The European Commission released projections on Wednesday that Europe’s economy will shrink by 7.4 percent this year. A top official told residents of the European Union, first formed in the aftermath of the Second World War, to expect the “deepest economic recession in its history.”

While the US is borrowing another $3 trillion to try and keep its economy afloat. Bringing its total debt to more than $25 trillion.

A number so big, it is essentially impossible to imagine.

Or is it?

Using my £1 coins calculation from a few weeks ago, we can work out that 25 trillion £1 coins laid lengthways would reach 562.5 million km.

Which means it could wrap around the entire surface of the sun 128 times.

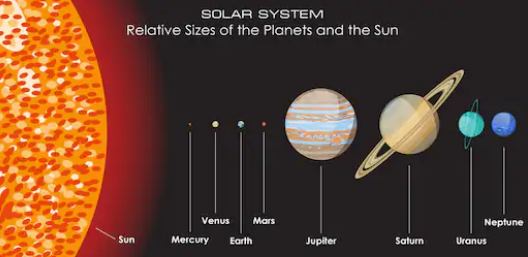

And this is how much bigger the sun is than the earth:

In short: $25 trillion is an impossibly large amount of money.

Then, causing/adding to all this, we have the whole coronapocalypse, which continues to wreak havoc all over the world.

Wow. If only BIG TALK was a real show. They would certainly have a lot to debate this week.

It all kind of feels like the start of a film or a sci-fi novel. The kind where a hero emerges and sets the world to rights.

And could that hero be… dare I say it… crypto?

Eventually the coronapocalypse will end. Even the most fervent doomers acknowledge that coronavirus burning itself out is inevitable.

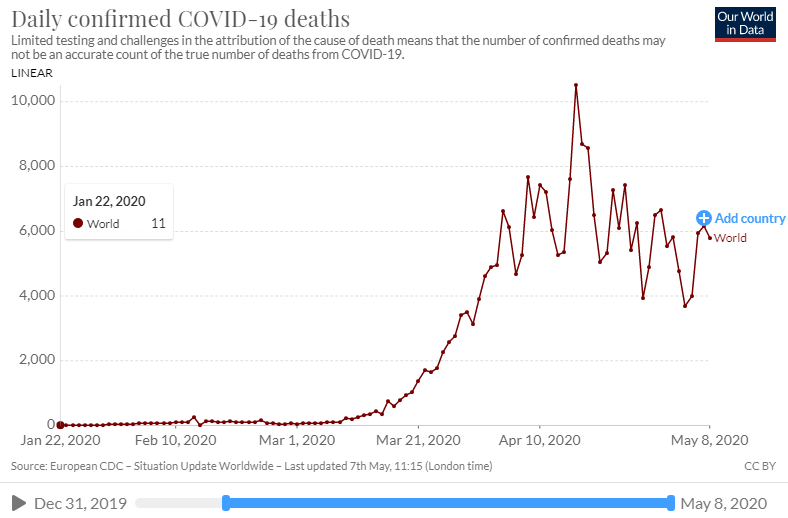

It’s clear from the daily death toll that “the worst is now over” and the world is on track for recovery.

Source: Our World in Data

Source: Our World in Data

And that’s why we’re seeing predictions for a swift financial recovery. The idea is that as people get back to work, things will bounce back. That’s the idea anyway.

However, just as with the last recession, there are going to be winners and losers. As I wrote about here, the recovery from the 2008 financial crisis enriched the wealthy and robbed the poor. Sort of like a malevolent Robin Hood.

And the fallout from that led to the creation of bitcoin.

Today, bitcoin is alive and well, and many of its proponents see now as its time to shine.

As more and more debt is racked up and more and more money is printed to speed the economic recovery, the real value of money will decrease.

While the real value of bitcoin – which has a limited supply – will increase against that money.

At least, that’s the theory.

And all of this just so happens to coincide with the bitcoin halving, which will take place on Monday [11 May].

As Forbes points out, the last three halvings have led to bitcoin’s price surging to never-before-seen prices.

From Forbes:

- First bitcoin halving: During 2012, the price of bitcoin increased from $11 to $1,000.

- Second bitcoin halving: From 2016-17, the price ballooned from $700 to $20,000.

- Third bitcoin halving: Scheduled on May 12, 2020 (the price impact is still yet to be seen).

However, those figures do simplify what actually happened. The ride to those prices was not smooth. As with all things in crypto, it was filled with huge drops along the way.

And there was a lot more going on than simply just the bitcoin halvings.

Most of the 2017 growth can be attributed to the explosion of other cryptocurrencies and an unprecedented interest in the possibilities they brought with them.

So now, as we enter into a new phase for the world, the economy and of course, for bitcoin, it will be interesting to see what the next 12 months bring.

Will we have another recovery which enriches the big financial institutions, while supressing wage growth and making people poorer in real terms? Another reverse Robin Hood recovery… or will this time be different?

Okay, that’s enough BIG TALK for today. Time to watch some comedy.

Thanks for reading.

This article originally appeared on coinconfidential.com.

Category: Market updates